- China

- /

- Metals and Mining

- /

- SHSE:600459

Undiscovered Gems in Asia with Strong Potential May 2025

Reviewed by Simply Wall St

As global markets grapple with volatility fueled by U.S. Treasury market fluctuations and renewed tariff threats, small-cap stocks have been particularly impacted, with indices like the S&P MidCap 400 and Russell 2000 experiencing notable declines. In this environment, identifying promising opportunities in Asia requires a keen eye for companies that demonstrate resilience and potential for growth amid broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AzureWave Technologies | NA | 0.15% | 17.60% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Hefei Gocom Information TechnologyLtd | NA | 9.11% | -12.23% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.03% | -13.23% | -30.14% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Saison Technology | NA | 1.17% | -9.03% | ★★★★★★ |

| Creative & Innovative System | 0.65% | 57.93% | 84.89% | ★★★★★★ |

| Nikko | 38.24% | 6.43% | -3.15% | ★★★★★☆ |

| Firich Enterprises | 32.65% | -1.31% | 35.54% | ★★★★★☆ |

| Anhui Wanyi Science and TechnologyLtd | 12.18% | 14.33% | -20.41% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Persistence Resources Group (SEHK:2489)

Simply Wall St Value Rating: ★★★★★★

Overview: Persistence Resources Group Ltd is an investment holding company focused on the exploration, mining, processing, and sale of gold bullion in the People’s Republic of China with a market capitalization of HK$3.38 billion.

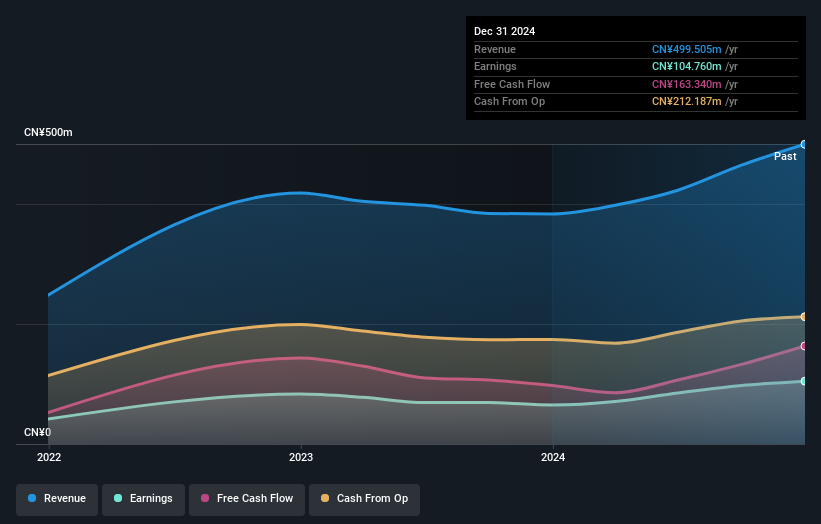

Operations: Persistence Resources Group generates revenue primarily from its gold mining and processing operations, amounting to CN¥499.51 million. The company's financial performance is reflected in its net profit margin, which stands at 12.5%.

Persistence Resources Group, a nimble player in the metals and mining sector, has shown impressive financial strides. With earnings growth of 61% last year, it outpaced the industry average of 43%. The company is debt-free, highlighting its robust financial health. Recent earnings reported for 2024 show sales at CNY 499.51 million and net income climbing to CNY 104.76 million from CNY 65.03 million in the previous year. Despite a volatile share price recently, Persistence remains profitable with high-quality earnings and positive free cash flow, indicating strong operational performance amidst industry challenges.

Sino-Platinum MetalsLtd (SHSE:600459)

Simply Wall St Value Rating: ★★★★★★

Overview: Sino-Platinum Metals Co., Ltd focuses on the research, development, production, sales, and technical services of metal and non-metal materials in China with a market capitalization of approximately CN¥10.96 billion.

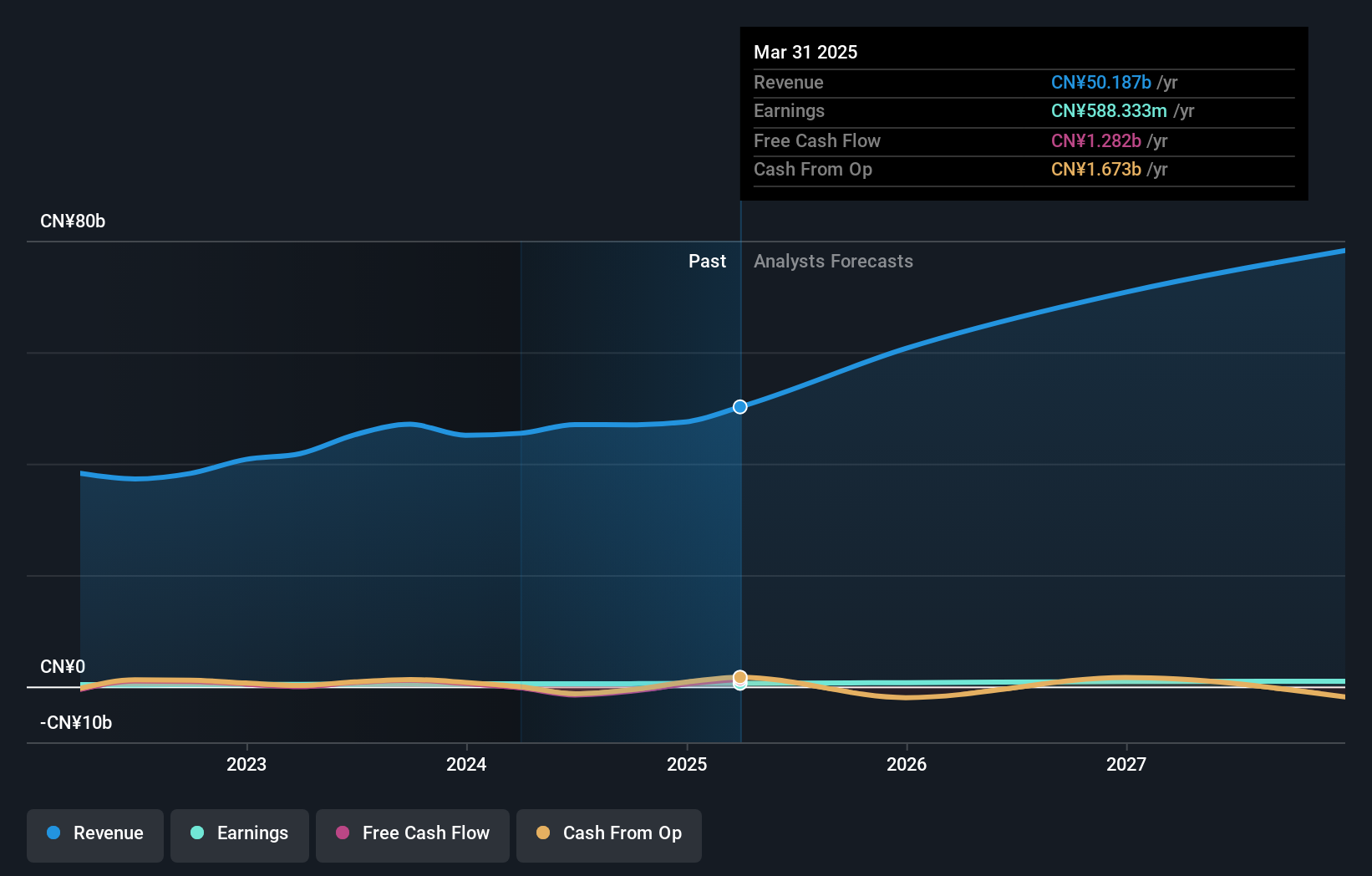

Operations: Sino-Platinum Metals Co., Ltd generates its revenue primarily from the Metal Processors and Fabrication segment, which accounted for CN¥50.19 billion.

Sino-Platinum Metals, a smaller player in the metals and mining sector, has shown impressive earnings growth of 16.4% over the past year, outpacing the industry average of -3.9%. The company reported a net income of CNY 579.49 million for 2024, up from CNY 468.31 million in the previous year, with basic earnings per share rising to CNY 0.77 from CNY 0.62. Its net debt to equity ratio stands at a satisfactory 16.4%, reflecting prudent financial management as it reduced this ratio from 89.5% over five years while maintaining high-quality earnings and strong interest coverage at 13.8 times EBIT.

Sunway (SHSE:603333)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sunway Co., Ltd. is a company that focuses on the research, development, production, sale, and service of cable products in China with a market capitalization of approximately CN¥4.11 billion.

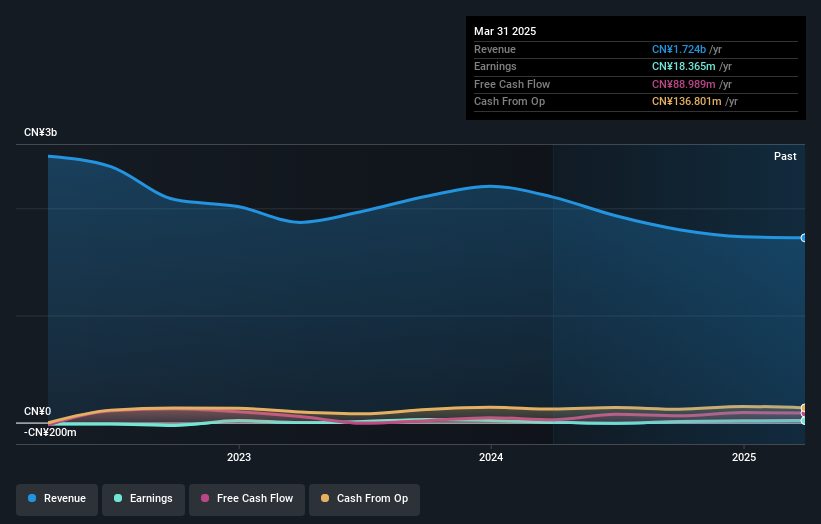

Operations: Sunway generates revenue primarily through its manufacturing segment, which contributed CN¥1.72 billion. The company's financial data highlights a focus on this core segment for revenue generation.

Sunway, a smaller player in the Asian market, has seen its earnings surge by 741.5% over the past year, outpacing the Electrical industry average of -1.4%. The company's debt to equity ratio improved significantly from 54.4% to 26.6% over five years, indicating prudent financial management. Despite recording a net loss of CNY 14.49 million for Q1 2025 compared to CNY 16.52 million in the previous year, Sunway's basic and diluted losses per share narrowed to CNY 0.02 from CNY 0.03 a year ago, reflecting some operational resilience amidst challenging conditions and ongoing strategic investments by stakeholders like Fuhua Tongda Chemical Co., Ltd., which recently increased its stake in Sunway through an auction acquisition process for approximately CNY 300 million.

- Unlock comprehensive insights into our analysis of Sunway stock in this health report.

Evaluate Sunway's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2604 more companies for you to explore.Click here to unveil our expertly curated list of 2607 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600459

Sino-Platinum MetalsLtd

Engages in the precious metal industrial materials manufacturing industry in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion