China Treasures New Materials Group Ltd. (HKG:2439) Surges 31% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, China Treasures New Materials Group Ltd. (HKG:2439) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 100% following the latest surge, making investors sit up and take notice.

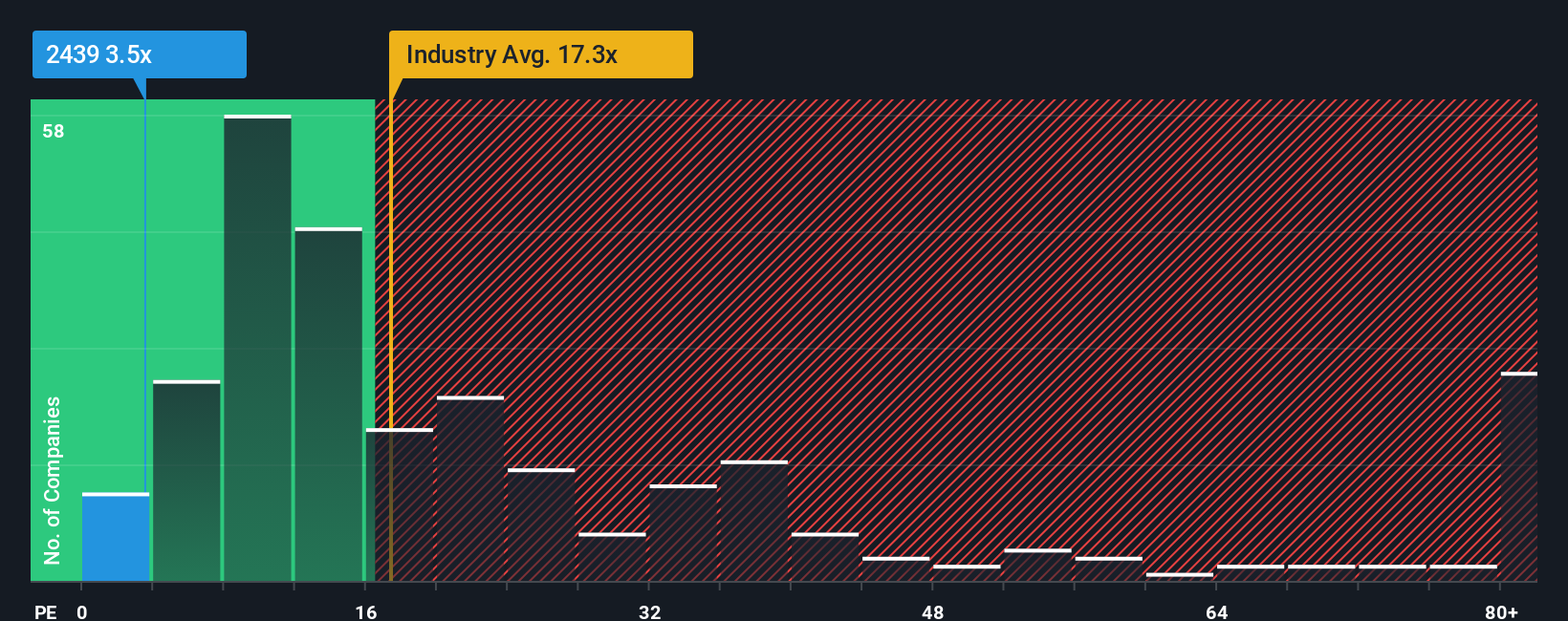

Although its price has surged higher, China Treasures New Materials Group's price-to-earnings (or "P/E") ratio of 3.5x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 27x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

China Treasures New Materials Group has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for China Treasures New Materials Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Treasures New Materials Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 26% gain to the company's bottom line. As a result, it also grew EPS by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that China Treasures New Materials Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Shares in China Treasures New Materials Group are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Treasures New Materials Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Treasures New Materials Group that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2439

China Treasures New Materials Group

An investment holding company, develops, manufactures, and sells biodegradable plastic product bags in the People's Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives