China Sanjiang Fine Chemicals' (HKG:2198 three-year decrease in earnings delivers investors with a 45% loss

It is doubtless a positive to see that the China Sanjiang Fine Chemicals Company Limited (HKG:2198) share price has gained some 61% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 49% in the last three years, significantly under-performing the market.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for China Sanjiang Fine Chemicals

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, China Sanjiang Fine Chemicals moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 7.4% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching China Sanjiang Fine Chemicals more closely, as sometimes stocks fall unfairly. This could present an opportunity.

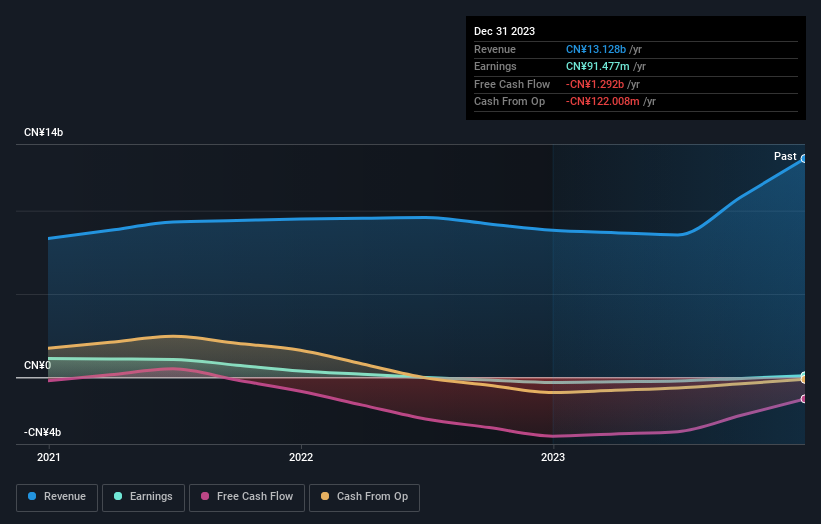

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on China Sanjiang Fine Chemicals' earnings, revenue and cash flow.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. In some ways, TSR is a better measure of how well an investment has performed. Over the last 3 years, China Sanjiang Fine Chemicals generated a TSR of -45%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

China Sanjiang Fine Chemicals provided a TSR of 0.6% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 6% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with China Sanjiang Fine Chemicals (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

China Sanjiang Fine Chemicals is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2198

China Sanjiang Fine Chemicals

An investment holding company, manufactures and supplies ethylene oxide and glycol, propylene, polypropylene, methyl tert-butyl ether (MTBE), surfactants, and ethanolamine in the People’s Republic of China, Japan, and Singapore.

Low with imperfect balance sheet.