- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1733

With EPS Growth And More, E-Commodities Holdings (HKG:1733) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like E-Commodities Holdings (HKG:1733). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for E-Commodities Holdings

E-Commodities Holdings's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that E-Commodities Holdings's EPS went from HK$0.15 to HK$1.32 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

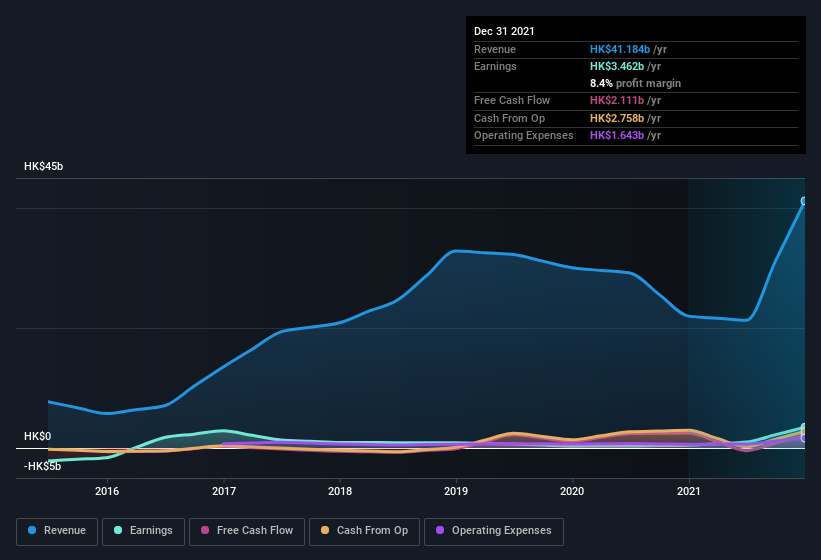

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. E-Commodities Holdings shareholders can take confidence from the fact that EBIT margins are up from 3.3% to 11%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check E-Commodities Holdings's balance sheet strength, before getting too excited.

Are E-Commodities Holdings Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that E-Commodities Holdings insiders have a significant amount of capital invested in the stock. Indeed, they hold HK$117m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 2.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add E-Commodities Holdings To Your Watchlist?

E-Commodities Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind E-Commodities Holdings is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. However, before you get too excited we've discovered 4 warning signs for E-Commodities Holdings (2 are potentially serious!) that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if E-Commodities Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1733

E-Commodities Holdings

Engages in the processing and trading of coal and other products.

Flawless balance sheet and good value.

Market Insights

Community Narratives