- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1258

China Nonferrous Mining (SEHK:1258): Assessing Valuation as USD 680 Million Luanshya Expansion Unveiled

Reviewed by Simply Wall St

China Nonferrous Mining (SEHK:1258) is making headlines with a major investment totaling around USD 680 million in two expansive new projects at its Luanshya operations. The move highlights the company’s focus on increasing production capacity and strengthening reserves.

See our latest analysis for China Nonferrous Mining.

China Nonferrous Mining’s bold expansion plans come on the heels of some rapid share price momentum. After a bit of profit-taking this month, with a 1-month share price return of -5.65 percent, the stock is still up an astonishing 168.10 percent year-to-date and has enjoyed a staggering 181.03 percent total shareholder return over the past year. These moves suggest investors are increasingly optimistic about the company’s growth prospects.

If this kind of growth story has you curious about other market standouts, now is the time to broaden your search and discover fast growing stocks with high insider ownership

But with shares already surging this year, the big question for investors is whether China Nonferrous Mining’s recent moves mean there is still value left to unlock, or if the market is already pricing in this future growth.

Price-to-Earnings of 15.5x: Is it justified?

China Nonferrous Mining trades at a price-to-earnings (P/E) ratio of 15.5x. This stands out as notably lower than both its peer average and the wider Hong Kong market, pointing to apparent value in the company's shares relative to comparable firms.

The P/E ratio reflects the price investors are willing to pay for each dollar of the company's earnings. For established resource companies in sectors like metals and mining, the P/E is a crucial indicator since earnings quality, sector cyclicality, and growth trajectory can all impact investor appetite and relative valuation.

With the company's P/E ratio of 15.5x well below the peer group average of 46.3x, the market seems to be pricing in more conservative future growth than its rivals. Compared to the Hong Kong Metals and Mining industry average of 15.8x, its valuation also looks attractive. However, relative to its fair P/E ratio of 13.7x, the market might adjust higher or lower as the company's new projects start to deliver results.

Explore the SWS fair ratio for China Nonferrous Mining

Result: Price-to-Earnings of 15.5x (UNDERVALUED)

However, slowing revenue and profit growth or a shift in investor sentiment could quickly put pressure on the current valuation and outlook.

Find out about the key risks to this China Nonferrous Mining narrative.

Another View: What Does the DCF Model Say?

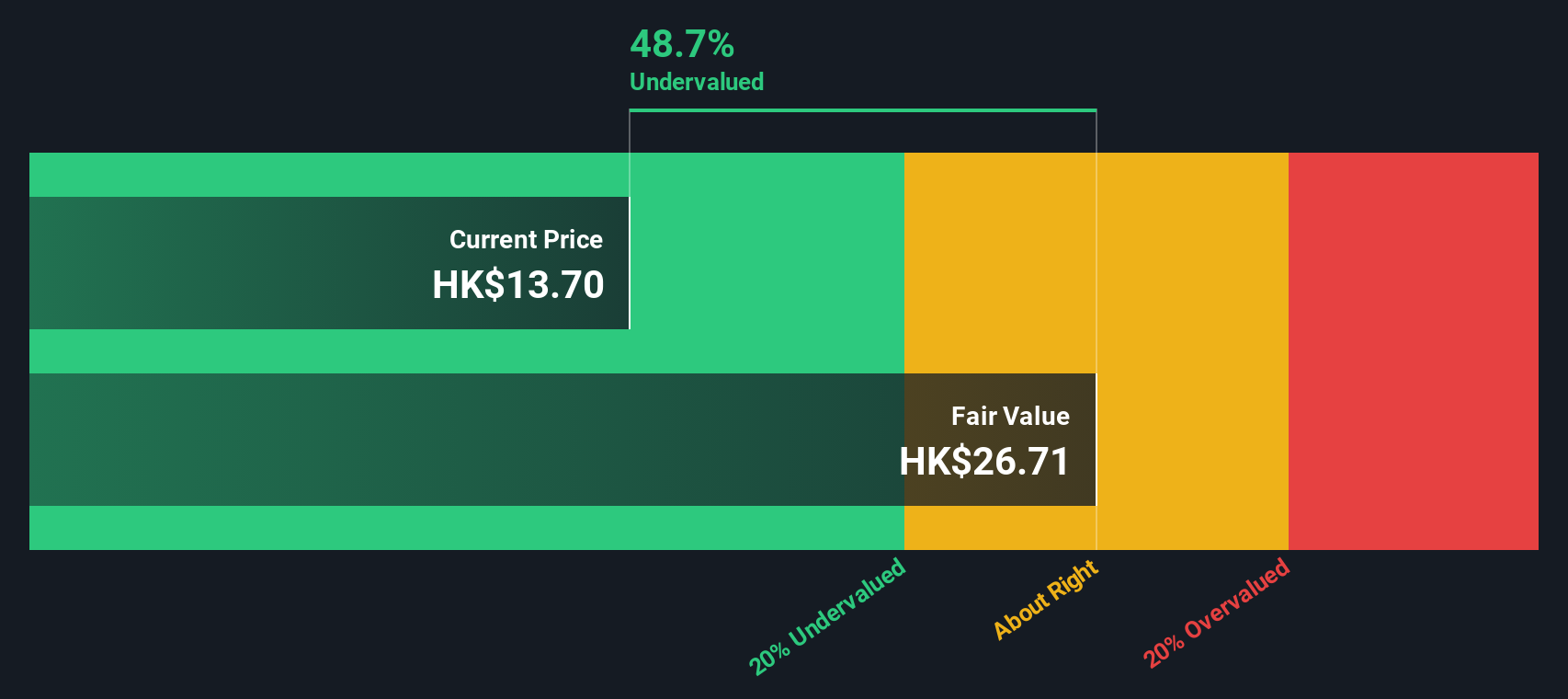

While the P/E ratio paints China Nonferrous Mining as undervalued against its peers and industry, our SWS DCF model suggests an even greater disconnect. According to this method, the shares are trading 48.7% below their estimated fair value, which signals substantial upside potential if the model's assumptions play out. Could this gap represent an opportunity, or does it highlight risks that the market is already pricing in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Nonferrous Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Nonferrous Mining Narrative

If you want a different perspective or like to dive into the numbers yourself, you can build your own view in just a few minutes, so why not Do it your way

A great starting point for your China Nonferrous Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to one opportunity when you could be ahead of the curve with other market leaders. Search smarter right now using these targeted stock ideas for your next move:

- Capture serious potential by seizing opportunities among stocks that have strong cash flows and appealing valuations with these 932 undervalued stocks based on cash flows.

- Capitalize on hot sectors by targeting the latest advancements and growth in artificial intelligence with these 26 AI penny stocks.

- Accelerate your passive income game and lock in attractive yields by seeking out these 14 dividend stocks with yields > 3% that consistently reward shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1258

China Nonferrous Mining

An investment holding company, engages in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt in Zambia and the Democratic Republic of Congo.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success