Teamway International Group Holdings Limited (HKG:1239) Stock Catapults 52% Though Its Price And Business Still Lag The Industry

Teamway International Group Holdings Limited (HKG:1239) shares have had a really impressive month, gaining 52% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.1% isn't as impressive.

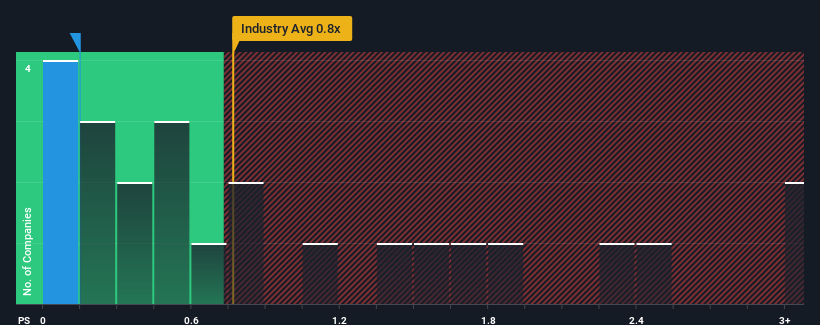

In spite of the firm bounce in price, it would still be understandable if you think Teamway International Group Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Hong Kong's Packaging industry have P/S ratios above 0.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Teamway International Group Holdings

How Has Teamway International Group Holdings Performed Recently?

It looks like revenue growth has deserted Teamway International Group Holdings recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Teamway International Group Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Teamway International Group Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Teamway International Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Teamway International Group Holdings' P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The latest share price surge wasn't enough to lift Teamway International Group Holdings' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Teamway International Group Holdings maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Teamway International Group Holdings you should be aware of, and 2 of them are significant.

If you're unsure about the strength of Teamway International Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Teamway International Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1239

Teamway International Group Holdings

An investment holding company, designs, manufactures, and sells packaging products and structural components in the Mainland China and Singapore.

Slight and slightly overvalued.

Market Insights

Community Narratives