- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1208

MMG Limited (SEHK:1208): Evaluating Valuation Following Fresh Production Results and Updated Performance Metrics

Reviewed by Simply Wall St

MMG (SEHK:1208) has released its latest production results for the third quarter and year to date, giving investors an up-to-date look at output levels for copper, zinc, lead, and molybdenum. This fresh data can help gauge how the company is tracking against its operational goals and shapes expectations moving forward.

See our latest analysis for MMG.

The latest results come amid a surge in momentum for MMG, with a strong 79.4% 90-day share price return and an even more remarkable 187% gain year-to-date. Over the past year, total shareholder return has soared 144%, underscoring renewed growth optimism and investor confidence despite the recently announced plan to change auditors.

If this kind of sharp turnaround has you curious, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

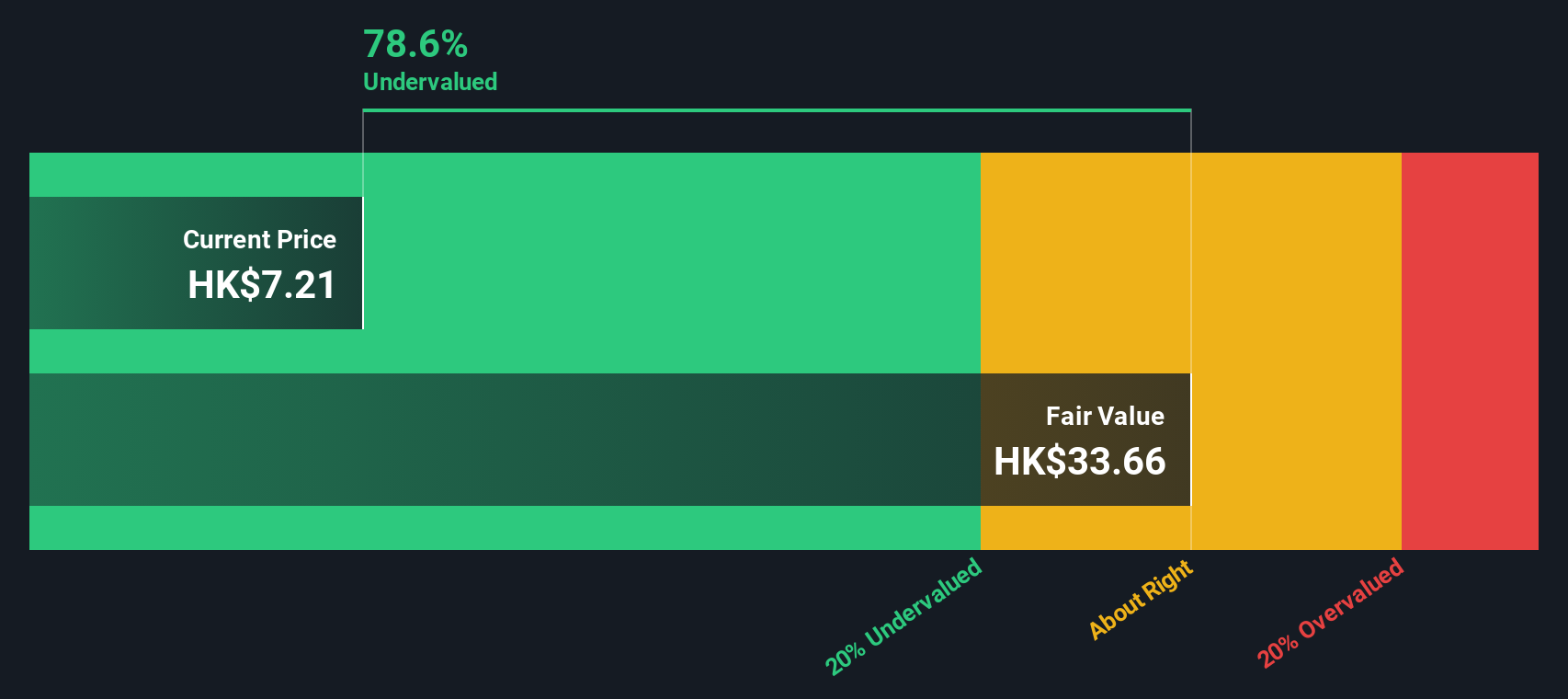

With shares surging and operational numbers on the rise, the pressing question is whether MMG is still trading below its true value, or if the current share price already reflects all of that future growth potential.

Most Popular Narrative: 23% Overvalued

According to the most widely followed narrative for MMG, the fair value estimate sits well below the last close of HK$7.21. This indicates the stock currently trades at a meaningfully higher price than the underlying fundamentals justify. This sets the tone for understanding what is driving MMG's ambitious valuation and how it connects to market optimism.

Ongoing production expansions, including Las Bambas optimization, the ramp-up at Kinsevere, and the multi-year capacity expansion at Khoemacau (targeting 130kt by 2028), should drive meaningful volume growth and operating leverage, contributing to sustained top-line gains and improved margins.

Curious about the math powering this outlook? The real intrigue is in bold production targets and margin leaps, mixed with future multiples that signal real conviction. What is fueling analysts’ confidence in this premium? The full narrative reveals the key assumptions that could change everything you expect about MMG’s valuation.

Result: Fair Value of $5.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, community unrest near Las Bambas and execution challenges at new projects could quickly shift the outlook if disruptions affect production or profits.

Find out about the key risks to this MMG narrative.

Another View: Contrasting With the SWS DCF Model

On the other hand, our SWS DCF model suggests MMG is actually trading well below its estimated fair value of HK$33.51. This is in sharp contrast to the multiples-based view, which flags the shares as overvalued. Could the market be missing some long-term advantages, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MMG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MMG Narrative

If you see things differently or want to analyze the numbers your own way, it takes just a few minutes to build your own perspective. Do it your way

A great starting point for your MMG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let all the opportunities pass you by. The smartest investors widen their horizons and spot trends before the crowd. Get ahead now by checking out:

- Start your hunt for tomorrow’s breakout names with these 3556 penny stocks with strong financials, where tiny companies punch above their weight and surprises are the norm.

- Jump on the front lines of technological innovation by tapping into these 27 AI penny stocks as artificial intelligence transforms entire industries and powers astonishing growth stories.

- Secure a stream of passive income and market resilience when you explore these 17 dividend stocks with yields > 3%, which features higher-than-average yields and steady fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1208

MMG

An investment holding company, engages in the exploration, development, and mining of mineral properties.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives