- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1053

Chongqing Iron & Steel (SEHK:1053) Losses Deepen 65% Annually, Challenging Turnaround Optimism

Reviewed by Simply Wall St

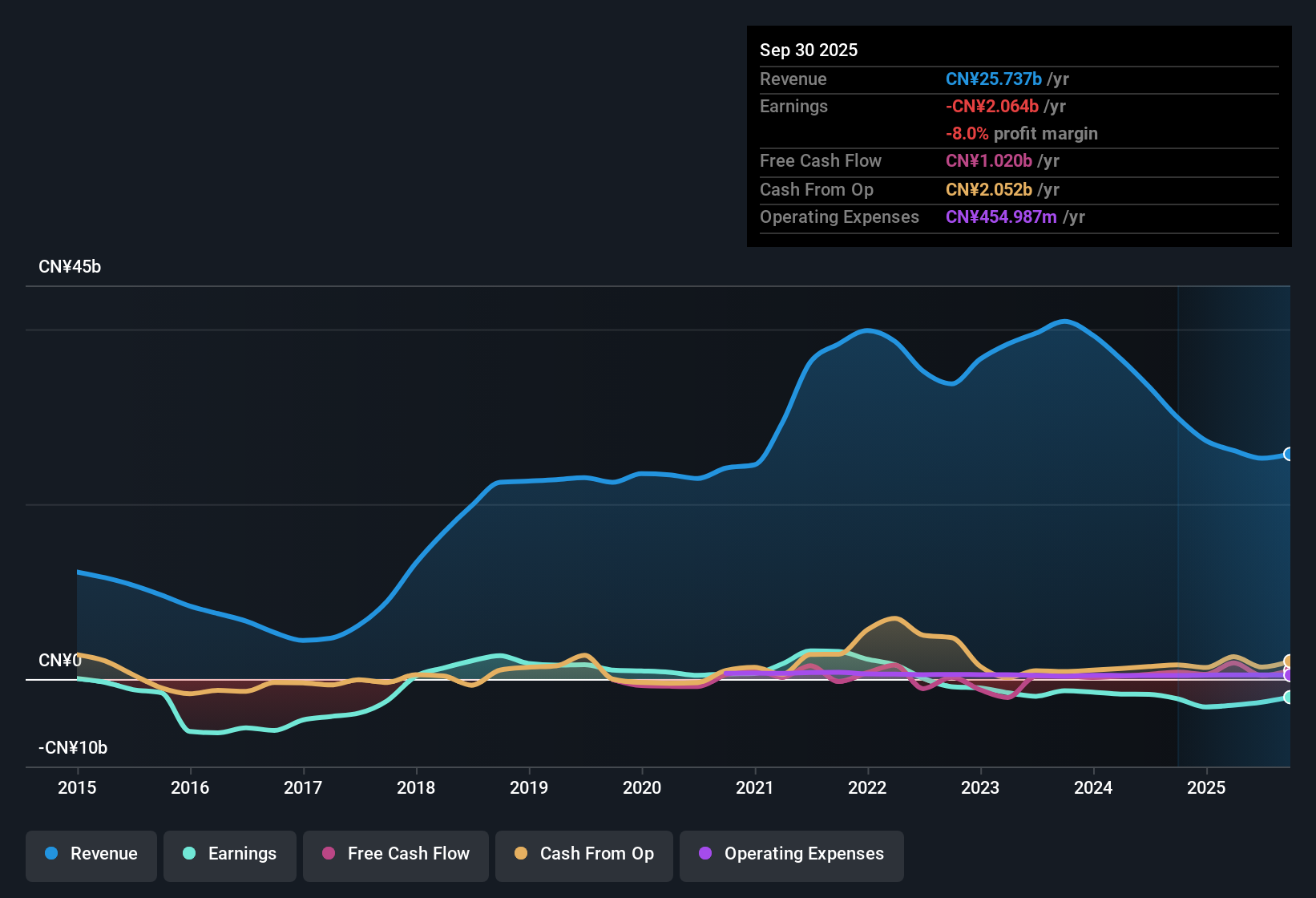

Chongqing Iron & Steel (SEHK:1053) remains in the red, with losses deepening at an average annual rate of 65% over the past five years. Revenue is forecast to grow by 1.6% per year, trailing the broader Hong Kong market’s 8.7% average. Earnings are expected to rebound sharply and grow 65.21% annually, potentially turning the company profitable within three years. Investors may be eyeing this shift, as the company’s margin picture hasn’t improved yet. Forecasts and valuation have started to shape a more optimistic backdrop.

See our full analysis for Chongqing Iron & Steel.Now, let’s see how these earnings results measure up against the prevailing narratives. Where do the numbers confirm consensus, and where might they push back on commonly held views?

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-To-Sales Ratio Far Below Peers

- Chongqing Iron & Steel’s Price-To-Sales Ratio stands at just 0.4x, which is less than a quarter of the wider Hong Kong Metals and Mining industry average of 1x, and significantly below the peer average of 1.7x.

- While the prevailing market view focuses on the company’s value story,

- The 0.4x ratio implies investors expect continued underperformance or are cautious about slower forecasted revenue growth of 1.6% per year.

- This hefty discount compared to peers could set the stage for a re-rating if margin improvement or profitability gains materialize.

- Chongqing Iron & Steel is currently trading at HK$1.36, putting it below both its estimated fair value of HK$1.66 and DCF fair value figures. This further reinforces the valuation gap narrative.

Losses Accelerate Despite Growth Forecasts

- Losses have deepened at an average annual rate of 65% over the past five years, even as earnings are forecast to rebound sharply at 65.21% per year in the future.

- The prevailing market view spotlights strong profit recovery potential,

- The fact that margins show no immediate signs of improvement highlights how a return to profitability is still a forecast rather than a current turnaround.

- This makes it critical to watch for execution on growth promises versus ongoing operating challenges.

No Material Risks Flagged Against Attractive Valuation

- The latest analysis reports no newly identified major risks, while highlighting relative value, attractive valuation, and the forecast for renewed profit growth or revenue expansion as core rewards.

- The prevailing market view underscores optimism for a turnaround,

- But with the company’s revenue growth trailing the broader market at just 1.6% and no improvement yet in net profit margins,

- The shares’ discount to fair value appears more rooted in ongoing near-term headwinds than in risk events flagged by formal disclosures.

See what the community is saying about Chongqing Iron & Steel

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Chongqing Iron & Steel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Persistently deepening losses and sluggish revenue growth highlight Chongqing Iron & Steel’s ongoing struggle to deliver consistent financial performance and profitability improvements.

If you prefer stocks with steadier track records, use our stable growth stocks screener (2101 results) to compare companies demonstrating reliable revenue and earnings growth across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1053

Chongqing Iron & Steel

Engages in the production and sale of steel plates in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives