- Hong Kong

- /

- Metals and Mining

- /

- SEHK:103

If You Like EPS Growth Then Check Out Shougang Concord Century Holdings (HKG:103) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Shougang Concord Century Holdings (HKG:103). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Shougang Concord Century Holdings

Shougang Concord Century Holdings's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Shougang Concord Century Holdings has grown EPS by 11% per year. That's a good rate of growth, if it can be sustained.

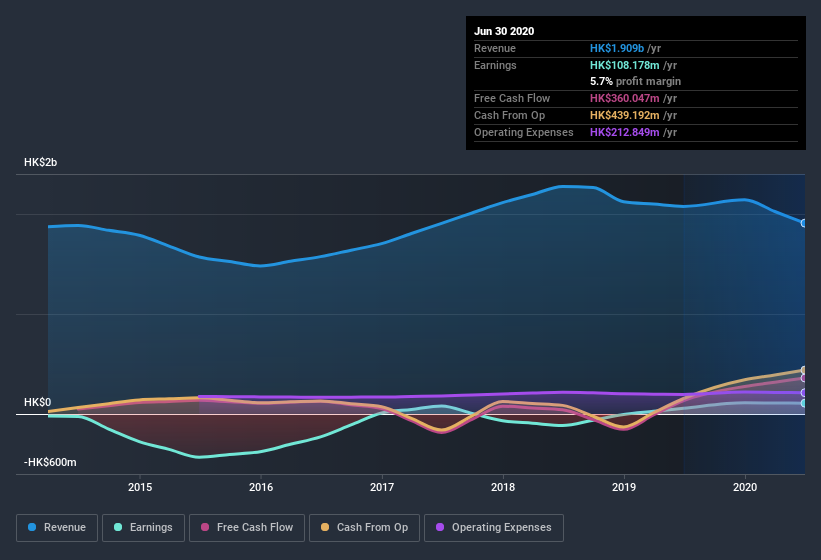

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Shougang Concord Century Holdings's EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Shougang Concord Century Holdings is no giant, with a market capitalization of HK$541m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Shougang Concord Century Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Shougang Concord Century Holdings shares, in the last year. With that in mind, it's heartening that Kwok Kau Tang, the of the company, paid HK$104k for shares at around HK$0.20 each.

Should You Add Shougang Concord Century Holdings To Your Watchlist?

One important encouraging feature of Shougang Concord Century Holdings is that it is growing profits. Not every business can grow its EPS, but Shougang Concord Century Holdings certainly can. The cherry on top is that we have an insider buying shares. That encourages me further to keep an eye on this stock. We should say that we've discovered 5 warning signs for Shougang Concord Century Holdings that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Shougang Concord Century Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Shougang Concord Century Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:103

Shougang Century Holdings

An investment holding company, engages in the manufacture and sale of steel cords for radial tyres in the People’s Republic of China.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives