AIA Group (SEHK:1299): Exploring the Valuation as Investor Optimism Rises

Reviewed by Simply Wall St

Most Popular Narrative: 18.3% Undervalued

Based on the most widely followed narrative, AIA Group is considered notably undervalued, with current market prices trailing the estimated fair value by a wide margin.

Rapid urbanization and wealth creation across Asia, coupled with demographic shifts such as a rising middle class and aging population, are boosting demand for private insurance and health solutions. AIA's strong regional brand and innovative product development are likely to support higher premium volumes and persistency, contributing to earnings growth and predictable, recurring cash flow.

Curious how this optimistic outlook translates into valuation? The narrative points to bold profit targets, margin improvements, and future earnings multiples that rival the highest in Asian financials. What are the crucial numbers and the real story fueling this sharp upside? Dive deeper and discover the assumptions that could set AIA apart from the rest.

Result: Fair Value of $91.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower economic growth in key markets or tighter regulations could undermine AIA Group's projected gains and challenge long-term growth assumptions.

Find out about the key risks to this AIA Group narrative.Another View: What Do Price Ratios Say?

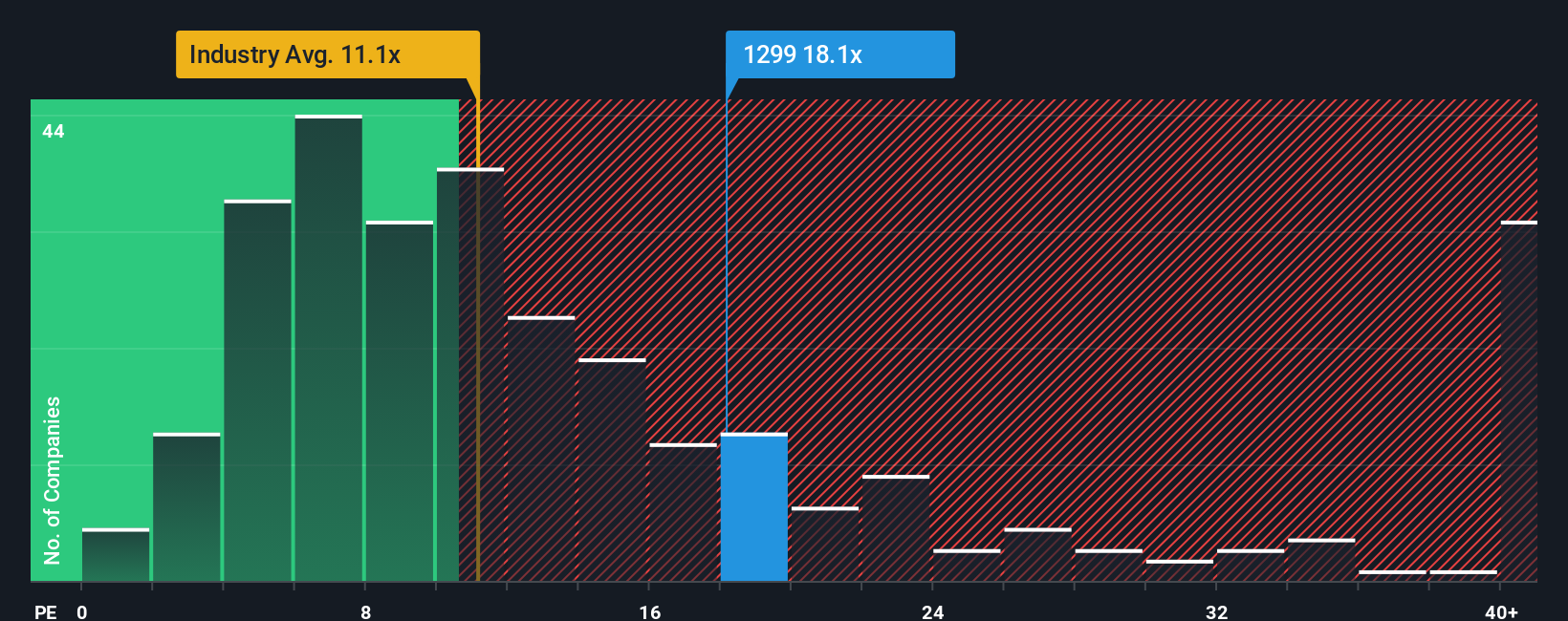

While the previous outlook shows AIA Group as undervalued, a different approach draws on price ratios compared to the rest of the industry. By this measure, AIA is starting to look more expensive than its Asian peers. This premium could signal hidden strengths, or it could set high expectations that might be challenging to meet.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding AIA Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own AIA Group Narrative

If you see the numbers differently or want to uncover your own insights, there is nothing stopping you from diving in and creating a story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AIA Group.

Looking for more investment ideas?

Unlock fresh opportunities by going beyond the headlines. Target the movers, innovators, and strong performers shaping tomorrow's markets using the Simply Wall Street Screener. Why settle for average when you can spot what's next?

- Capture growth potential by scanning penny stocks with strong financials using penny stocks with strong financials to uncover emerging companies poised for their breakthrough moment.

- Power up your watchlist by tapping into healthcare AI leaders with healthcare AI stocks, redefining diagnostics, patient care, and the future of medical technology.

- Boost your portfolio’s stability and returns by targeting dividend stocks with yields over 3 percent through dividend stocks with yields > 3% and secure income from proven performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:1299

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives