- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9996

Why Investors Shouldn't Be Surprised By Peijia Medical Limited's (HKG:9996) 26% Share Price Surge

Peijia Medical Limited (HKG:9996) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 55% share price drop in the last twelve months.

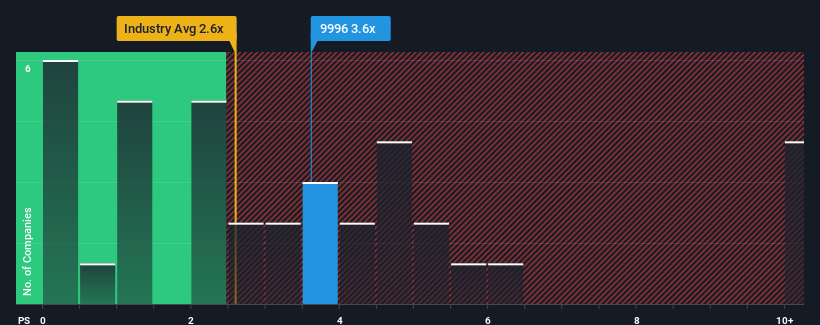

After such a large jump in price, given close to half the companies operating in Hong Kong's Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Peijia Medical as a stock to potentially avoid with its 3.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Peijia Medical

What Does Peijia Medical's P/S Mean For Shareholders?

Peijia Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Peijia Medical.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Peijia Medical would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 41% per year during the coming three years according to the four analysts following the company. With the industry only predicted to deliver 23% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Peijia Medical's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Peijia Medical's P/S

Peijia Medical shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Peijia Medical shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for Peijia Medical that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9996

Peijia Medical

Engages in the research, development, manufacturing, and sales of transcatheter valve therapeutic and neurointerventional procedural medical devices in the People’s Republic of China.

Undervalued with high growth potential.

Market Insights

Community Narratives