- Hong Kong

- /

- Healthcare Services

- /

- SEHK:9955

ClouDr Group Limited (HKG:9955) Soars 67% But It's A Story Of Risk Vs Reward

ClouDr Group Limited (HKG:9955) shareholders have had their patience rewarded with a 67% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

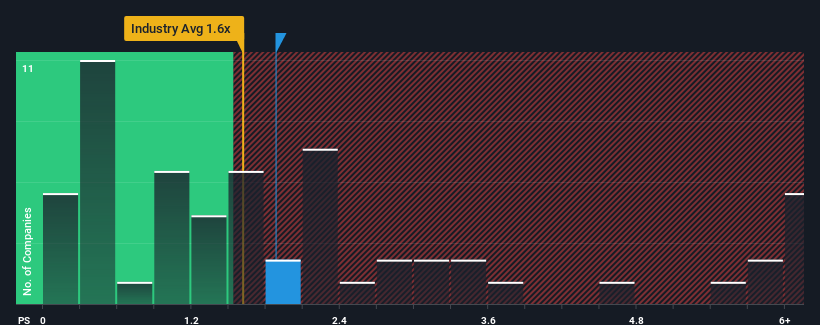

Although its price has surged higher, there still wouldn't be many who think ClouDr Group's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in Hong Kong's Healthcare industry is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for ClouDr Group

What Does ClouDr Group's P/S Mean For Shareholders?

ClouDr Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ClouDr Group.How Is ClouDr Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like ClouDr Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 70%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 36% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 20% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that ClouDr Group is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From ClouDr Group's P/S?

ClouDr Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at ClouDr Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for ClouDr Group you should be aware of.

If these risks are making you reconsider your opinion on ClouDr Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9955

ClouDr Group

Provides supplies and software as a service (SaaS) installation to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for patients with chronic condition management.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives