- Hong Kong

- /

- Healthcare Services

- /

- SEHK:9955

Cautious Investors Not Rewarding ClouDr Group Limited's (HKG:9955) Performance Completely

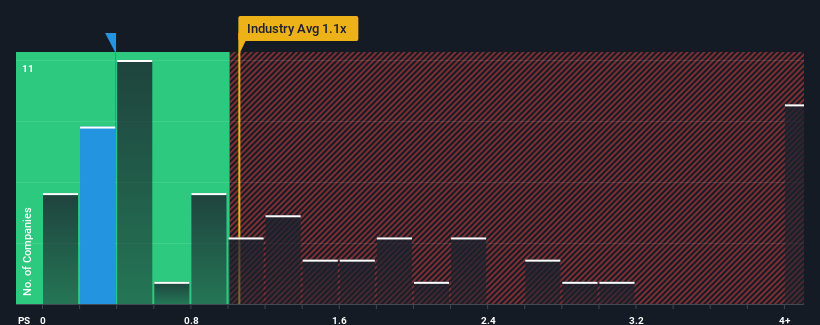

When close to half the companies operating in the Healthcare industry in Hong Kong have price-to-sales ratios (or "P/S") above 1.1x, you may consider ClouDr Group Limited (HKG:9955) as an attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for ClouDr Group

What Does ClouDr Group's Recent Performance Look Like?

Recent times have been advantageous for ClouDr Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think ClouDr Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is ClouDr Group's Revenue Growth Trending?

In order to justify its P/S ratio, ClouDr Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 19% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 14% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that ClouDr Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems ClouDr Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for ClouDr Group with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9955

ClouDr Group

Provides supplies and software as a service (SaaS) installation to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for patients with chronic condition management.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives