Stock Analysis

- Hong Kong

- /

- Healthcare Services

- /

- SEHK:9860

SEHK Growth Leaders With High Insider Ownership In June 2024

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals from global markets, the Hong Kong stock market has shown resilience, with the Hang Seng Index posting modest gains. This environment underscores the potential value of focusing on growth companies within this market, particularly those with high insider ownership which often signals strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

| Fenbi (SEHK:2469) | 32.5% | 43% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

| Tian Tu Capital (SEHK:1973) | 33.9% | 70.5% |

| DPC Dash (SEHK:1405) | 38.2% | 89.7% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

| Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's review some notable picks from our screened stocks.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$756.48 billion.

Operations: The company generates revenue primarily from its automobile and battery sectors.

Insider Ownership: 30.1%

Revenue Growth Forecast: 13.9% p.a.

BYD, a prominent player in the electric vehicle market, demonstrates robust growth with significant insider ownership, aligning interests with shareholders. Recent amendments to company bylaws and a consistent dividend payout (RMB 3.096 per share) reflect stable governance and shareholder reward mechanisms. Notably, BYD's aggressive expansion is evidenced by substantial year-over-year increases in production and sales volumes. However, its revenue growth forecast of 13.9% per year trails behind some high-growth benchmarks but outpaces the broader Hong Kong market average of 7.8%.

- Click to explore a detailed breakdown of our findings in BYD's earnings growth report.

- The valuation report we've compiled suggests that BYD's current price could be inflated.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

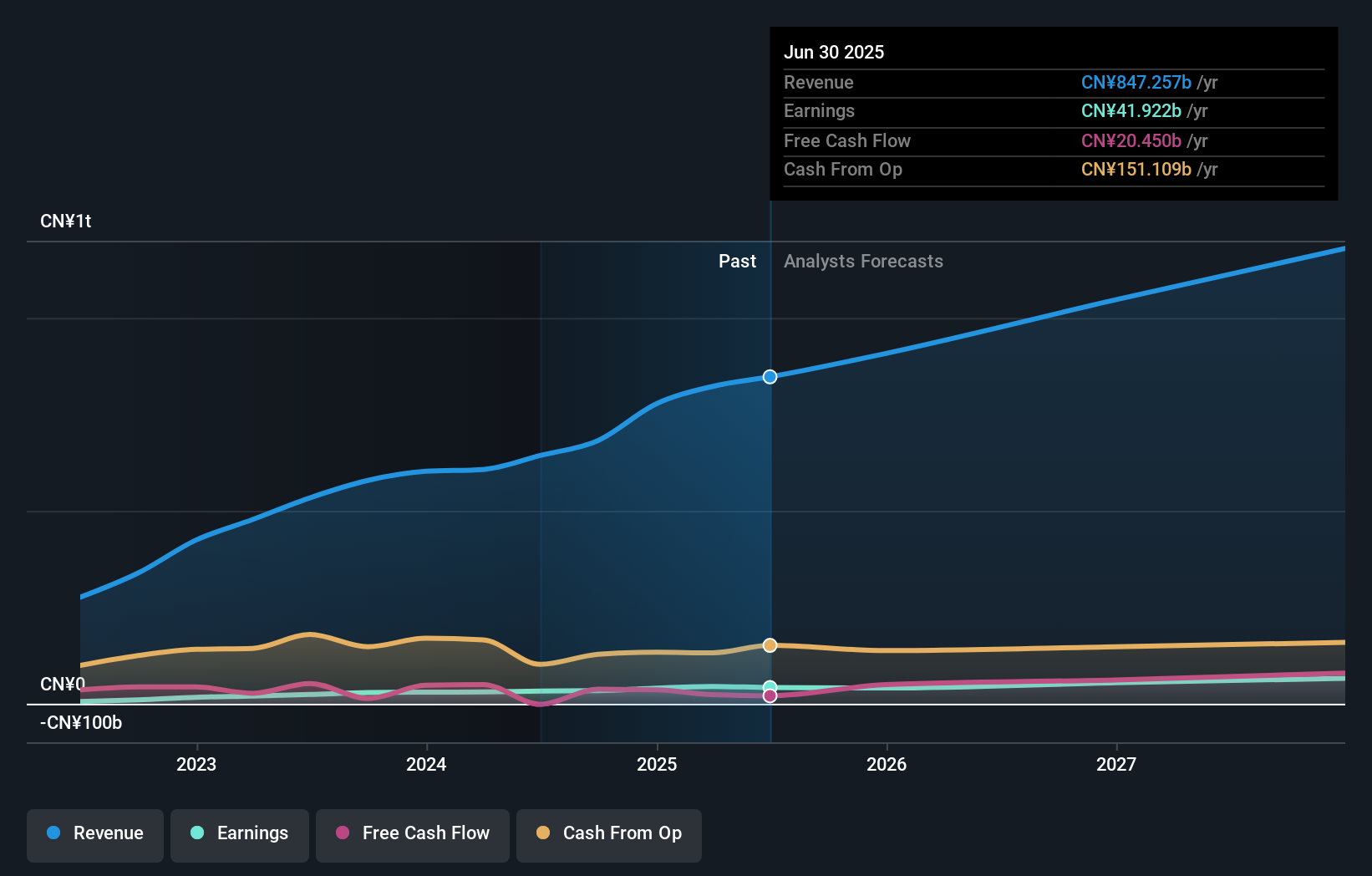

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$721.27 billion.

Operations: The company's revenue is derived from various technology retail operations within China.

Insider Ownership: 11.4%

Revenue Growth Forecast: 12.8% p.a.

Meituan, a growth-oriented company in Hong Kong, exhibits high insider ownership with insiders buying more shares than selling over the past three months. Recently, Meituan announced a substantial share repurchase program valued at US$2 billion, underscoring confidence in its financial health. The company reported a significant increase in quarterly sales and net income, with revenues rising to CNY 73.28 billion and profits to CNY 5.37 billion. Despite trading below its estimated fair value, Meituan is poised for robust future earnings growth forecasted at 31.4% annually, outpacing the Hong Kong market's average.

- Unlock comprehensive insights into our analysis of Meituan stock in this growth report.

- Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

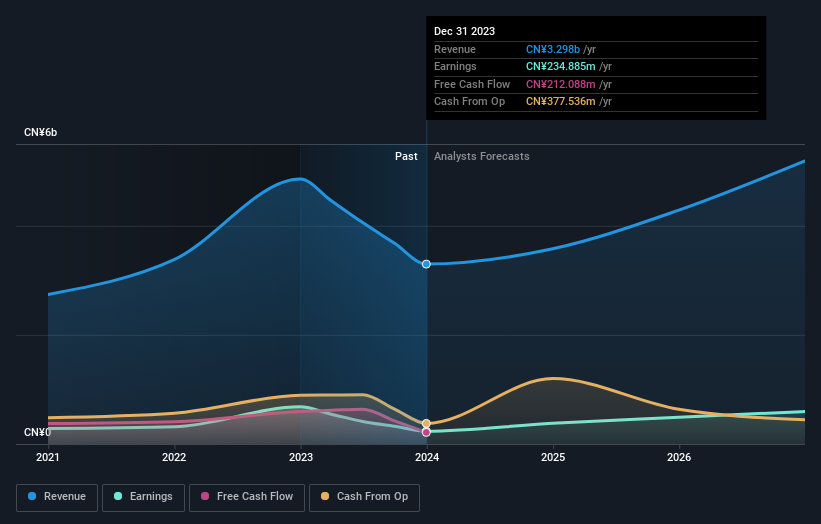

Adicon Holdings (SEHK:9860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited is a company that operates medical laboratories in the People's Republic of China, with a market capitalization of approximately HK$7.12 billion.

Operations: The company generates its revenue primarily from healthcare facilities and services, totaling CN¥3.30 billion.

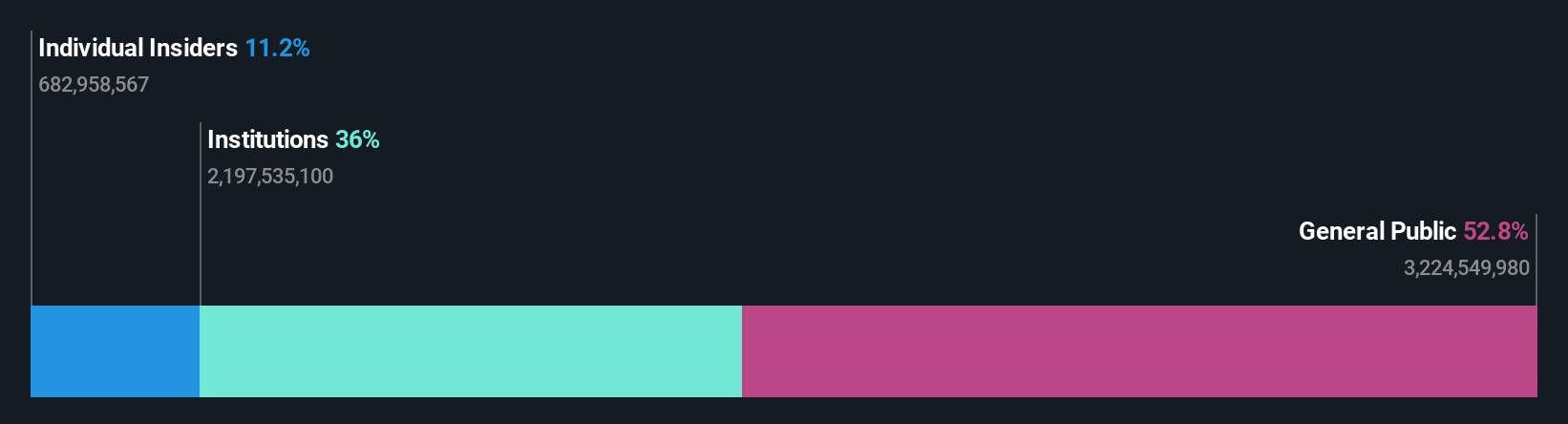

Insider Ownership: 22.3%

Revenue Growth Forecast: 15.2% p.a.

Adicon Holdings, a growth-focused firm in Hong Kong, is seeing robust earnings projections with an expected annual increase of 29.6%, outperforming the local market's average. Despite a recent dip in profit margins from 14% to 7.1%, insider ownership remains high, aligning interests with shareholders. Additionally, Adicon has initiated a share repurchase program, signaling confidence in its valuation and future prospects by planning to buy back up to 10% of its issued share capital.

- Take a closer look at Adicon Holdings' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Adicon Holdings is priced higher than what may be justified by its financials.

Where To Now?

- Click through to start exploring the rest of the 50 Fast Growing SEHK Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Adicon Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9860

Adicon Holdings

Operates medical laboratories in the People’s Republic of China.

High growth potential with excellent balance sheet.