Unveiling Three Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets demonstrate resilience, with the S&P 500 reaching new highs and value stocks showing strength, investors may find opportunities in stocks that appear undervalued relative to their intrinsic worth. In this context, identifying stocks trading below their estimated intrinsic value could be particularly timely, offering potential for appreciation as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK34.52 | SEK68.64 | 49.7% |

| Arcoma (OM:ARCOMA) | SEK17.90 | SEK35.75 | 49.9% |

| PostNL (ENXTAM:PNL) | €1.277 | €2.54 | 49.8% |

| Count (ASX:CUP) | A$0.555 | A$1.10 | 49.7% |

| Fodelia Oyj (HLSE:FODELIA) | €5.88 | €11.71 | 49.8% |

| EdiliziAcrobatica (BIT:EDAC) | €8.76 | €17.43 | 49.7% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49502.89 | 49.7% |

| HeartCore Enterprises (NasdaqCM:HTCR) | US$0.70415 | US$1.41 | 49.9% |

| SMRT Holdings Berhad (KLSE:SMRT) | MYR0.945 | MYR1.89 | 49.9% |

| Innovent Biologics (SEHK:1801) | HK$36.80 | HK$73.14 | 49.7% |

Here's a peek at a few of the choices from the screener

Rede D'Or São Luiz (BOVESPA:RDOR3)

Overview: Rede D'Or São Luiz S.A. is a healthcare provider operating a network of hospitals in Brazil, with a market capitalization of approximately R$59.51 billion.

Operations: The company generates its revenue primarily from three segments: Health (R$26.36 billion), Hospital (R$25.80 billion), and People (R$0.84 billion).

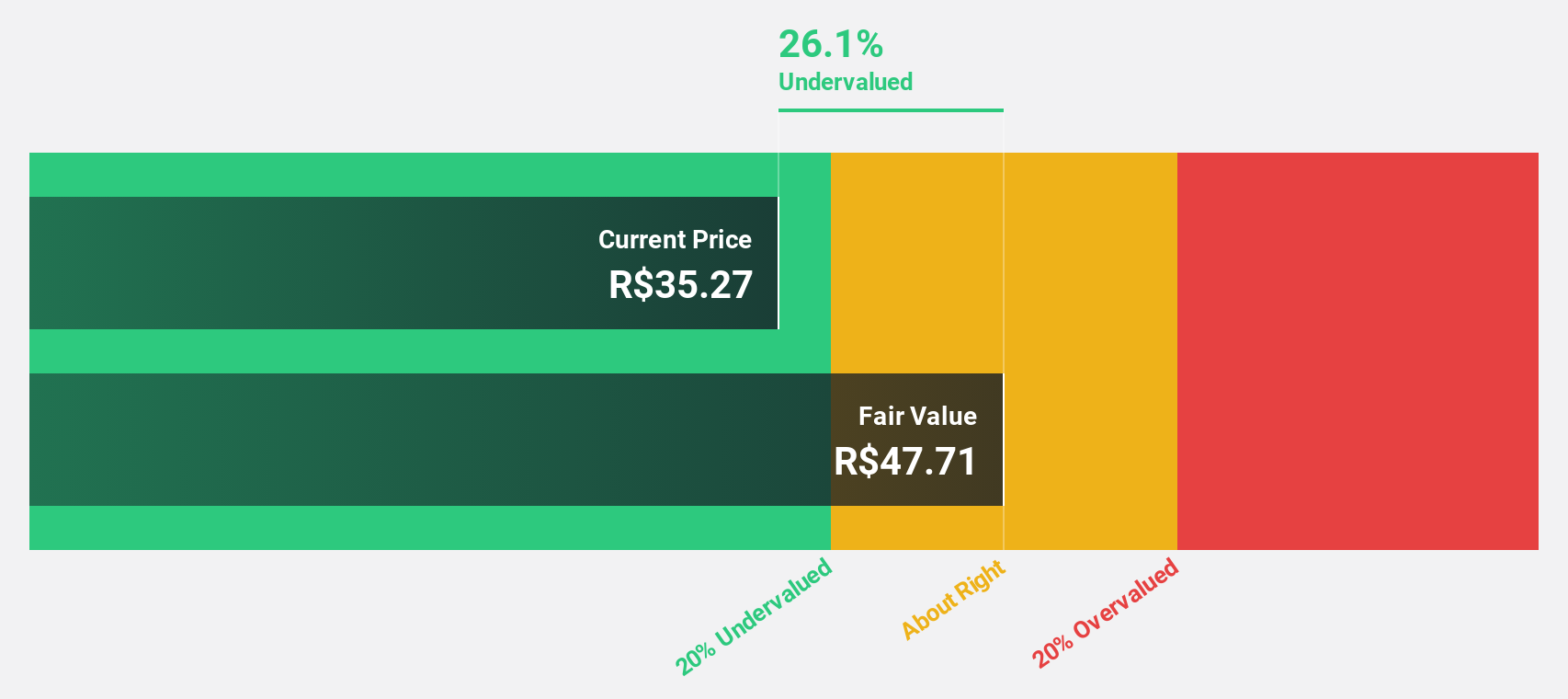

Estimated Discount To Fair Value: 28.5%

Rede D'Or São Luiz S.A. has shown a robust performance with net income rising to BRL 804.59 million in Q1 2024 from BRL 298.69 million in the previous year, reflecting a significant increase. The company is trading at R$27.39, which is 28.5% below the estimated fair value of R$38.33, indicating it may be undervalued based on discounted cash flow reasoning and recent earnings growth of 98.5%. Additionally, it has announced a share buyback plan worth BRL 1 billion to enhance shareholder value, signaling confidence from management in the stock's potential despite its forecasted low return on equity of 18.1% in three years and slower revenue growth compared to market expectations.

- The growth report we've compiled suggests that Rede D'Or São Luiz's future prospects could be on the up.

- Navigate through the intricacies of Rede D'Or São Luiz with our comprehensive financial health report here.

Repligen (NasdaqGS:RGEN)

Overview: Repligen Corporation specializes in developing and commercializing bioprocessing technologies and systems for biological drug manufacturing across North America, Europe, the Asia Pacific, and internationally, with a market capitalization of approximately $7.10 billion.

Operations: The company generates its revenue primarily from the medical products segment, totaling approximately $607.45 million.

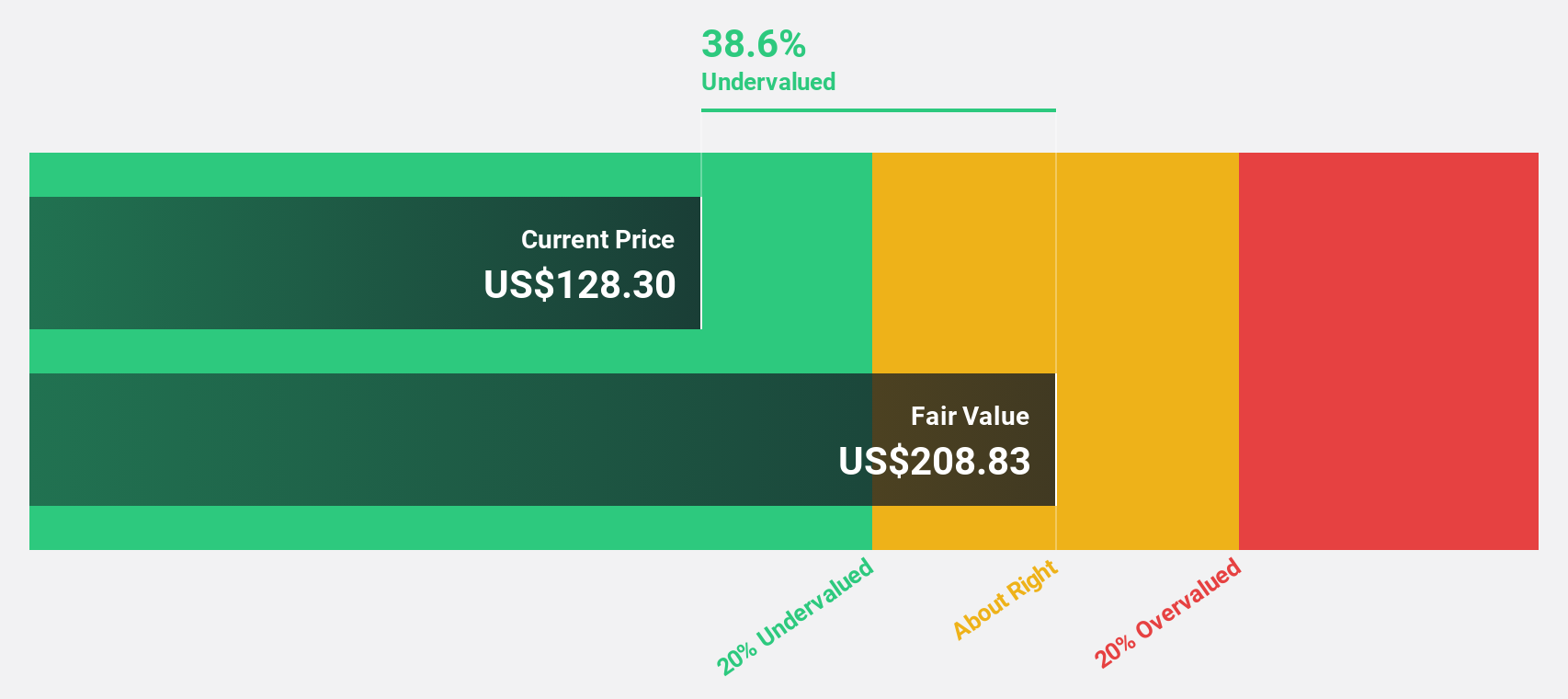

Estimated Discount To Fair Value: 20.1%

Repligen Corporation, with a revenue surge from US$63 million in 2014 to US$639 million in 2023, demonstrates robust growth under CEO Tony J. Hunt's leadership. Despite recent dips in quarterly earnings and net margins—US$151.35 million revenue and 2.4% profit margin respectively—the company is considered undervalued based on discounted cash flow analysis, trading over 20% below estimated fair value at US$126.59. Forecasted earnings growth is strong at an annual rate of 38.3%, outpacing the market prediction of 14.8%.

- The analysis detailed in our Repligen growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Repligen stock in this financial health report.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the People’s Republic of China, focusing on the research, design, development, manufacturing, marketing, and distribution of branded down apparel and non-down products as well as OEM services; it has a market capitalization of approximately HK$49.74 billion.

Operations: The company generates revenue from three primary segments: branded down apparel, non-down apparel, and OEM services.

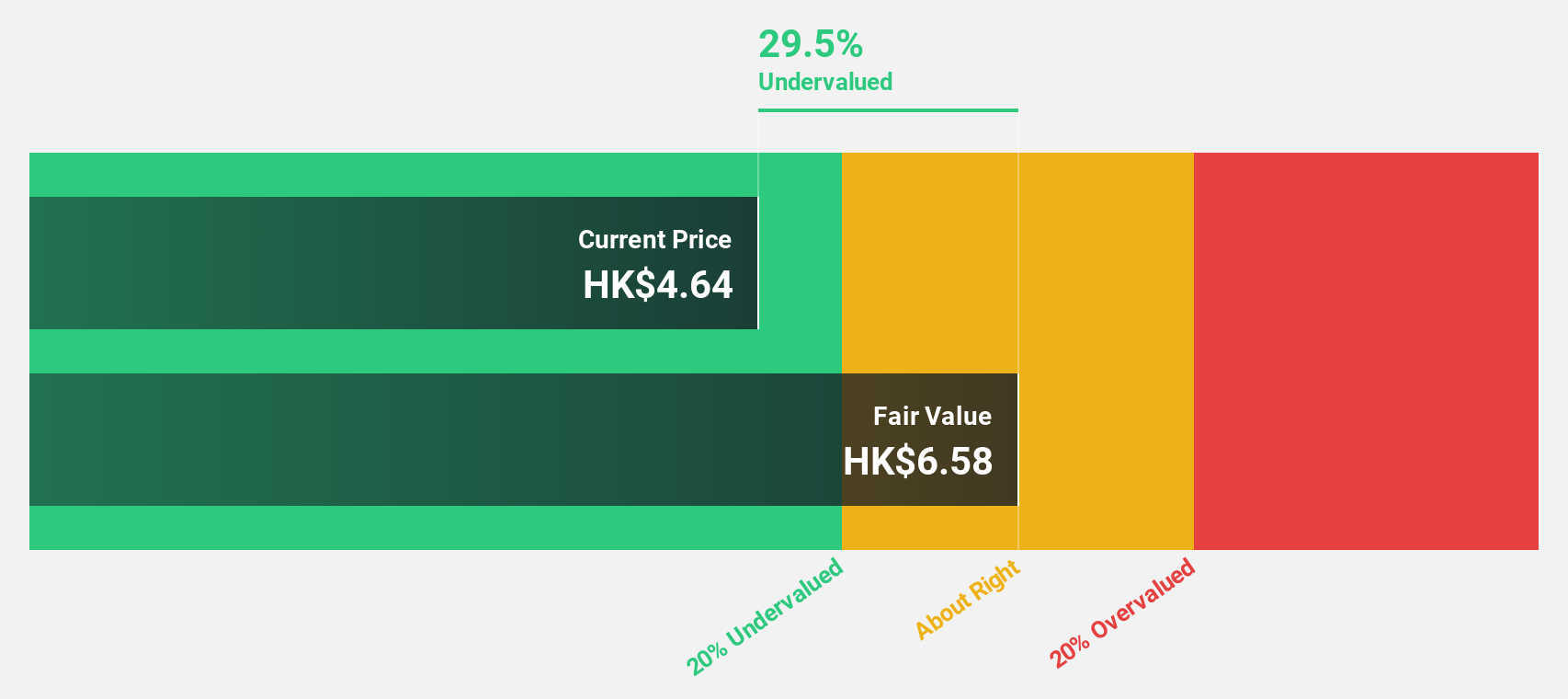

Estimated Discount To Fair Value: 29.8%

Bosideng International Holdings, priced at HK$4.87, is considered undervalued by over 20%, with a fair value estimate of HK$6.94 based on discounted cash flow analysis. The company recently reported a significant increase in annual sales to CNY 23.21 billion and net income to CNY 3.07 billion, reflecting earnings growth of 43.7% over the past year. Despite this performance and a forecasted earnings growth rate of 12.74% per annum, Bosideng has experienced substantial insider selling and maintains an unstable dividend track record.

- In light of our recent growth report, it seems possible that Bosideng International Holdings' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Bosideng International Holdings.

Summing It All Up

- Get an in-depth perspective on all 955 Undervalued Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Outstanding track record with excellent balance sheet and pays a dividend.