Stock Analysis

Amidst a backdrop of fluctuating global markets and heightened trade tensions, the Hong Kong stock market presents unique opportunities for investors focused on growth companies with high insider ownership. Such stocks often suggest a commitment from those who know the company best, aligning closely with investor interests especially in challenging economic climates.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 30.6% | 43% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Here's a peek at a few of the choices from the screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. is involved in the research, development, production, and marketing of edible bird’s nest products in China, with a market capitalization of approximately HK$6.07 billion.

Operations: The company generates revenue through multiple channels, including CN¥824.40 million from direct sales to online customers, CN¥509.04 million from sales to offline distributors, CN¥351.17 million from direct sales to offline customers, CN¥262.89 million from direct sales to e-commerce platforms, and CN¥16.75 million from sales to online distributors.

Insider Ownership: 26.7%

Earnings Growth Forecast: 14.8% p.a.

Xiamen Yan Palace Bird's Nest Industry, a growth company in Hong Kong, shows promising financial trends with earnings forecasted to grow by 14.84% per year, outpacing the Hong Kong market average of 11.4%. Despite this, its revenue growth at 12.5% annually is below the high-growth benchmark of 20% but still exceeds the local market's 7.8%. The company maintains a robust projected Return on Equity at 27.3%, indicating efficient management and profitability. Recent activities include affirming dividends and amending corporate bylaws, reflecting stable governance and shareholder returns.

- Take a closer look at Xiamen Yan Palace Bird's Nest Industry's potential here in our earnings growth report.

- According our valuation report, there's an indication that Xiamen Yan Palace Bird's Nest Industry's share price might be on the expensive side.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited, with a market cap of HK$177.57 billion, operates globally in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products primarily in North America and Europe.

Operations: The company's revenue is primarily generated from its power equipment segment, which brought in $12.79 billion, and its floorcare and cleaning products segment, which contributed $0.97 billion.

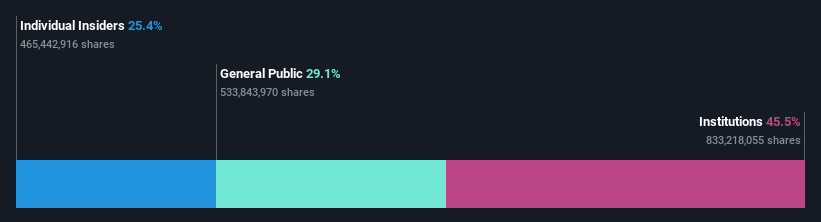

Insider Ownership: 25.4%

Earnings Growth Forecast: 14.9% p.a.

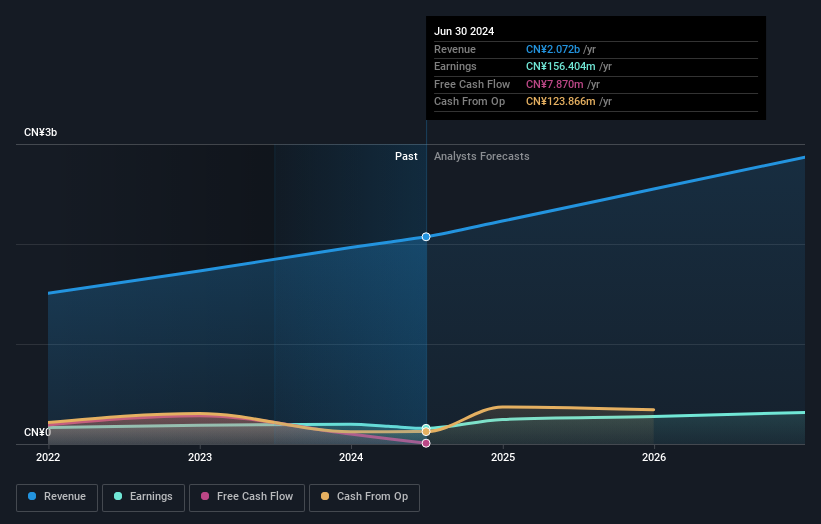

Techtronic Industries, a key player in Hong Kong's high insider ownership segment, recently initiated a share repurchase program to boost shareholder value, reflecting strong internal confidence. Despite leadership changes with CEO Joseph Galli Jr.'s resignation and Steven Richman's appointment, the company maintains robust growth forecasts. Expected earnings growth at 14.9% per year surpasses the local market’s 11.4%, though revenue growth projections of 8.1% annually are modest compared to high-growth benchmarks but still outpace the market average of 7.8%.

- Unlock comprehensive insights into our analysis of Techtronic Industries stock in this growth report.

- Our valuation report unveils the possibility Techtronic Industries' shares may be trading at a premium.

Adicon Holdings (SEHK:9860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited, with a market cap of HK$6.78 billion, operates medical laboratories across the People’s Republic of China.

Operations: The company generates CN¥3.30 billion from its healthcare facilities and services segment.

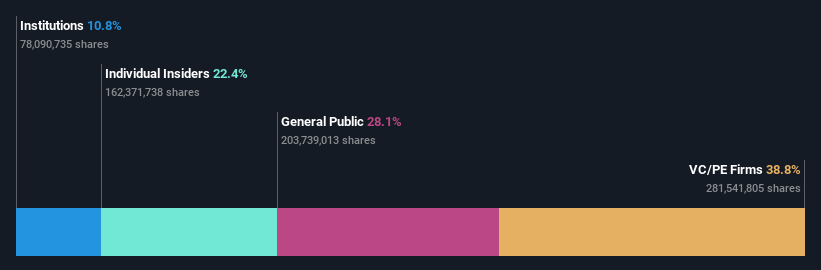

Insider Ownership: 22.4%

Earnings Growth Forecast: 28.3% p.a.

Adicon Holdings, a growth-oriented firm in Hong Kong with substantial insider ownership, is poised for significant earnings expansion at 28.33% annually, outpacing the local market's forecast of 11.4%. However, its profit margins have declined to 7.1% from last year's 14%. Recently, Adicon initiated a share repurchase program authorized by shareholders, signaling strong internal confidence and potential enhancement of shareholder value through increased net asset value or earnings per share.

- Click here to discover the nuances of Adicon Holdings with our detailed analytical future growth report.

- The analysis detailed in our Adicon Holdings valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Click this link to deep-dive into the 54 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Techtronic Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:669

Techtronic Industries

Engages in the design, manufacture, and marketing of power tools, outdoor power equipment, and floorcare and cleaning products in the North America, Europe, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.