- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2500

Asian Market Insights: Venus Medtech (Hangzhou) Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets react to new trade agreements and economic data, the Asian market remains a focal point for investors seeking growth opportunities amidst evolving geopolitical landscapes. Penny stocks, often associated with smaller or newer companies, continue to attract attention for their potential to offer significant returns at lower entry points. Despite being considered a niche investment area today, these stocks can present compelling opportunities when backed by robust financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.00 | THB3.95B | ✅ 4 ⚠️ 0 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.105 | SGD44.62M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$933.81M | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.49 | SGD198.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.725 | SGD691.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.53 | SGD9.96B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.25 | SGD51.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.50 | SGD960.23M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 971 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Venus Medtech (Hangzhou) (SEHK:2500)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Venus Medtech (Hangzhou) Inc. focuses on the research, development, manufacturing, and sale of bioprosthetic heart valves both in Mainland China and internationally, with a market cap of HK$1.32 billion.

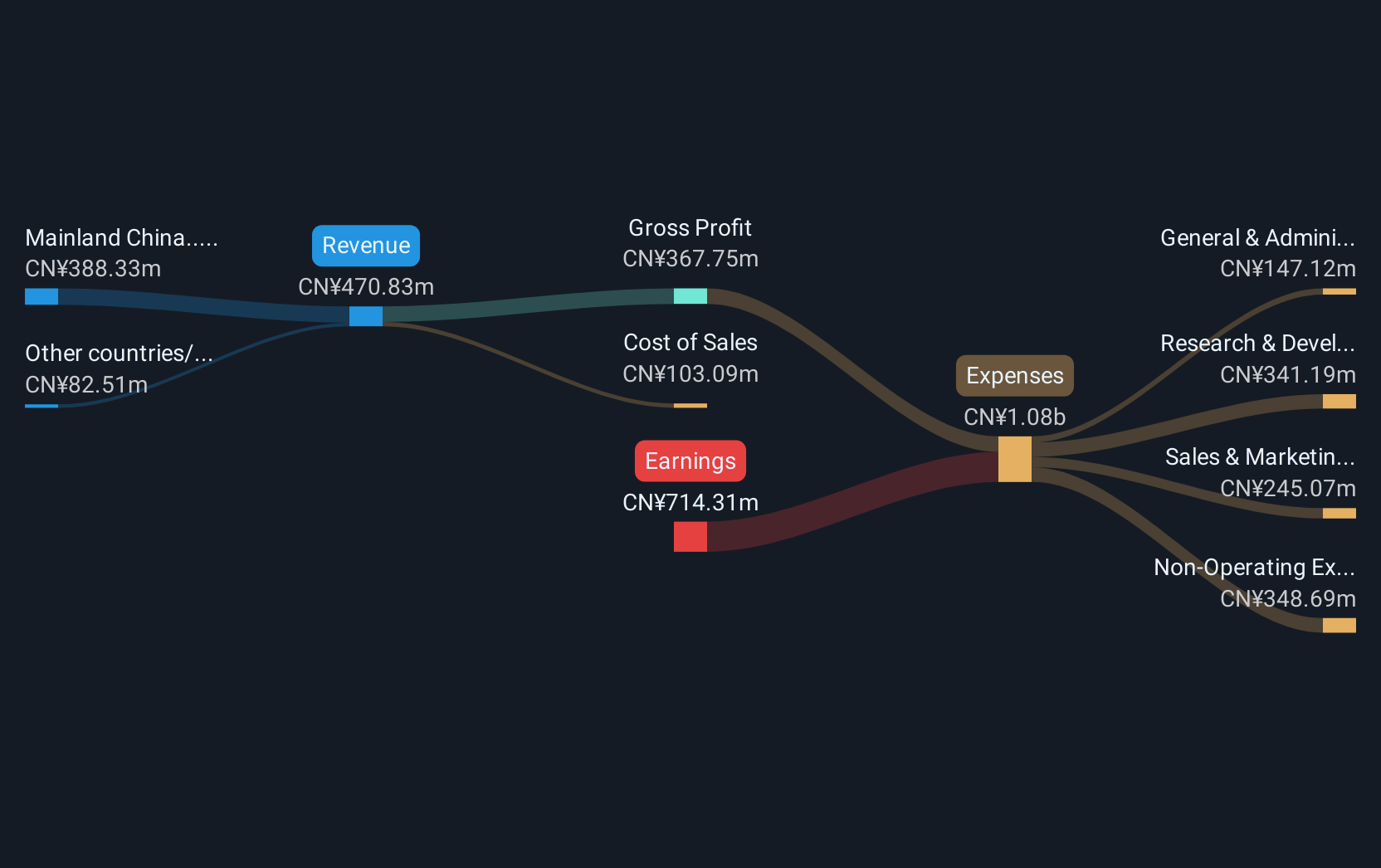

Operations: The company generates revenue primarily from its medical products segment, amounting to CN¥470.83 million.

Market Cap: HK$1.32B

Venus Medtech (Hangzhou) Inc. has a market cap of HK$1.32 billion and generates revenue of CN¥470.83 million from its medical products segment, but remains unprofitable with losses growing at 24.8% annually over five years. Despite this, the company maintains a strong cash position, covering both short and long-term liabilities with sufficient runway for more than three years based on current free cash flow levels. Recent board changes include the appointment of Mr. Ting Yuk Anthony Wu as chairman, reflecting potential strategic shifts as the company navigates its financial challenges amidst industry competition and growth opportunities in bioprosthetic heart valves.

- Get an in-depth perspective on Venus Medtech (Hangzhou)'s performance by reading our balance sheet health report here.

- Explore historical data to track Venus Medtech (Hangzhou)'s performance over time in our past results report.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited is an investment holding company offering healthcare and related services in the People’s Republic of China and Hong Kong, with a market cap of HK$1.79 billion.

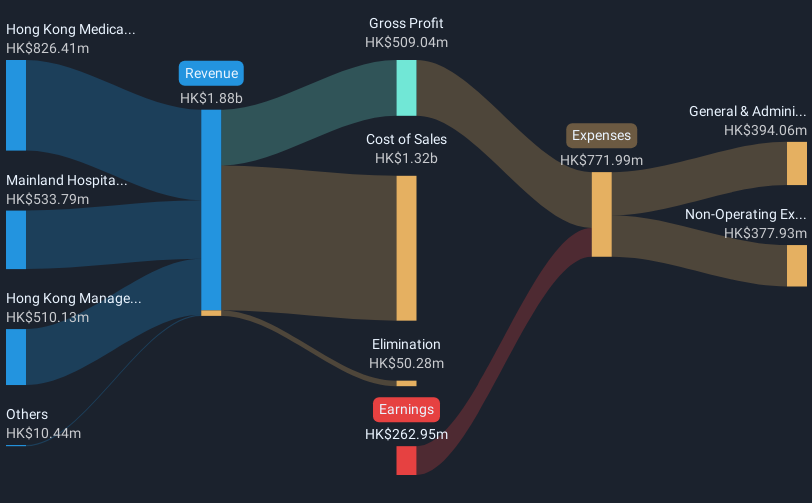

Operations: The company's revenue primarily comes from Hong Kong Medical Services (HK$829.68 million), the Hong Kong Managed Medical Network Business (HK$489.35 million), and Mainland Hospital Management and Medical Services (HK$546.62 million).

Market Cap: HK$1.79B

Town Health International Medical Group, with a market cap of HK$1.79 billion, derives significant revenue from its Hong Kong Medical Services (HK$829.68 million) and other healthcare segments, yet remains unprofitable. The company benefits from a stable cash position exceeding its total debt and short-term liabilities of HK$594.2 million, offering a cash runway exceeding three years due to positive free cash flow growth. Despite trading significantly below estimated fair value and having stable weekly volatility at 4%, challenges include increased debt-to-equity ratio over five years and an inexperienced management team averaging 1.3 years in tenure amidst ongoing financial losses.

- Click to explore a detailed breakdown of our findings in Town Health International Medical Group's financial health report.

- Assess Town Health International Medical Group's previous results with our detailed historical performance reports.

Ratchthani Leasing (SET:THANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market cap of THB10.47 billion.

Operations: The company's revenue is primarily derived from its Financial Service Business, generating THB1.82 billion, and its Insurance Brokerage Business, contributing THB154.43 million.

Market Cap: THB10.47B

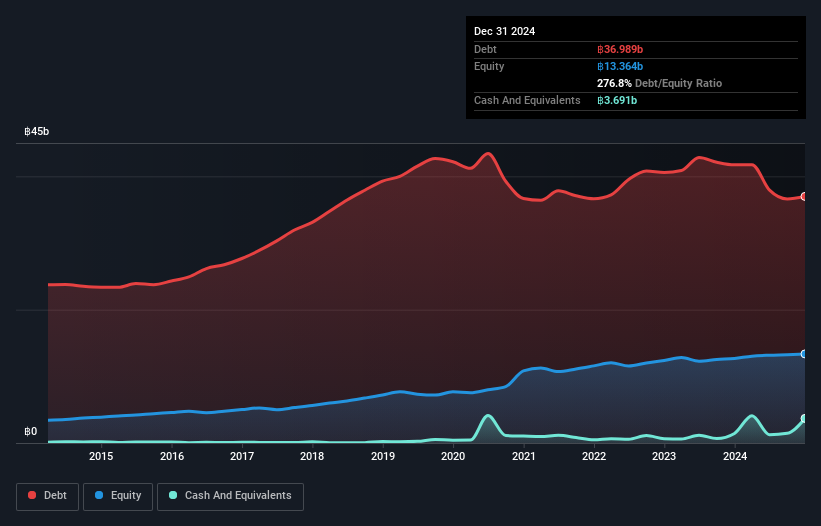

Ratchthani Leasing, with a market cap of THB10.47 billion, faces challenges as its earnings have declined by 14.6% annually over the past five years and experienced negative growth recently. Despite high net debt to equity at 222.9%, short-term assets comfortably cover both short- and long-term liabilities, indicating solid liquidity management. The company's operating cash flow effectively covers its debt obligations, though profitability remains pressured with a low return on equity of 5.2%. Recent board changes include Mr. Varavudh Varaporn's resignation due to health issues, impacting governance continuity amidst declining revenue and net income in early 2025 results.

- Click here and access our complete financial health analysis report to understand the dynamics of Ratchthani Leasing.

- Learn about Ratchthani Leasing's future growth trajectory here.

Seize The Opportunity

- Reveal the 971 hidden gems among our Asian Penny Stocks screener with a single click here.

- Interested In Other Possibilities? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2500

Venus Medtech (Hangzhou)

Engages in the research, development, manufacturing, and sale of bioprosthetic heart valves in Mainland China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives