- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2160

Take Care Before Jumping Onto MicroPort CardioFlow Medtech Corporation (HKG:2160) Even Though It's 37% Cheaper

MicroPort CardioFlow Medtech Corporation (HKG:2160) shares have retraced a considerable 37% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

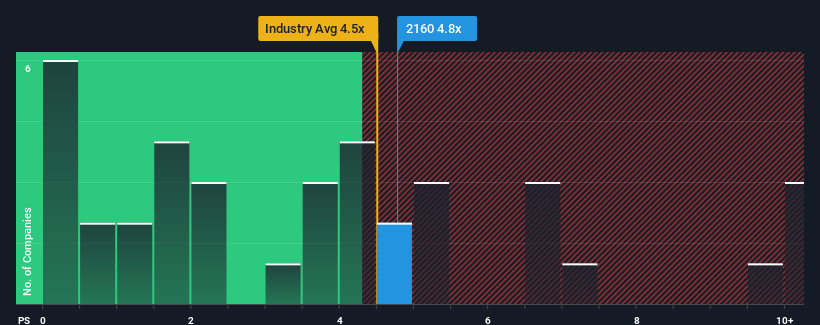

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about MicroPort CardioFlow Medtech's P/S ratio of 4.8x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in Hong Kong is also close to 4.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for MicroPort CardioFlow Medtech

How Has MicroPort CardioFlow Medtech Performed Recently?

MicroPort CardioFlow Medtech could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on MicroPort CardioFlow Medtech will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For MicroPort CardioFlow Medtech?

In order to justify its P/S ratio, MicroPort CardioFlow Medtech would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 7.5% gain to the company's revenues. The latest three year period has also seen an excellent 80% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 25% per annum over the next three years. With the industry only predicted to deliver 15% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that MicroPort CardioFlow Medtech's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On MicroPort CardioFlow Medtech's P/S

MicroPort CardioFlow Medtech's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, MicroPort CardioFlow Medtech's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 1 warning sign for MicroPort CardioFlow Medtech that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2160

MicroPort CardioFlow Medtech

A medical device company, engages in the research, development, and commercialization of transcatheter and surgical solutions for structural heart diseases in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives