- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2160

MicroPort CardioFlow Medtech Corporation (HKG:2160) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

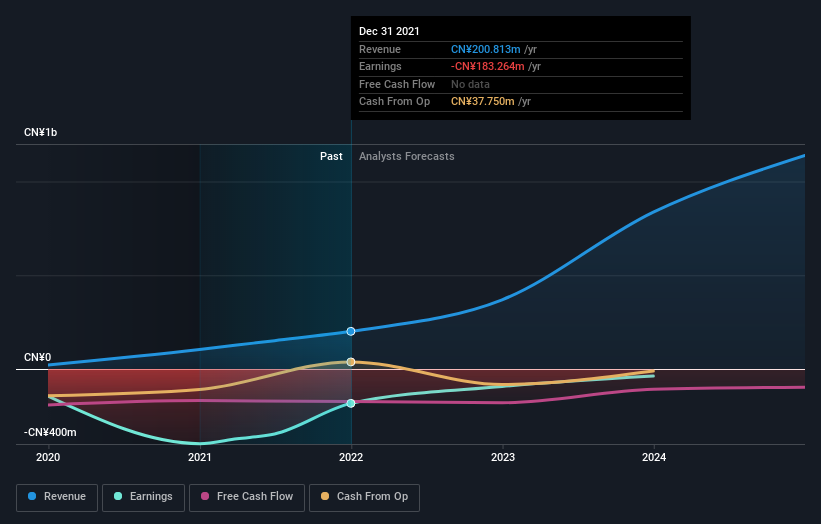

As you might know, MicroPort CardioFlow Medtech Corporation (HKG:2160) last week released its latest full-year, and things did not turn out so great for shareholders. Unfortunately, MicroPort CardioFlow Medtech delivered a serious earnings miss. Revenues of CN¥201m were 19% below expectations, and statutory losses ballooned 36% to CN¥0.08 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for MicroPort CardioFlow Medtech

After the latest results, the five analysts covering MicroPort CardioFlow Medtech are now predicting revenues of CN¥369.0m in 2022. If met, this would reflect a sizeable 84% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 50% to CN¥0.038. Yet prior to the latest earnings, the analysts had been forecasting revenues of CN¥501.4m and losses of CN¥0.038 per share in 2022. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to next year's revenue estimates, while at the same time holding losses per share steady.

The analysts lifted their price target 18% to HK$13.10per share, with reduced revenue estimates seemingly not expected to have a long-term impact on the intrinsic value of the business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values MicroPort CardioFlow Medtech at HK$21.83 per share, while the most bearish prices it at HK$6.48. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that MicroPort CardioFlow Medtech's rate of growth is expected to accelerate meaningfully, with the forecast 84% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 68% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 38% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that MicroPort CardioFlow Medtech is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. They also downgraded their revenue estimates, although industry data suggests that MicroPort CardioFlow Medtech's revenues are expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that in mind, we wouldn't be too quick to come to a conclusion on MicroPort CardioFlow Medtech. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for MicroPort CardioFlow Medtech going out to 2024, and you can see them free on our platform here..

And what about risks? Every company has them, and we've spotted 2 warning signs for MicroPort CardioFlow Medtech you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2160

MicroPort CardioFlow Medtech

A medical device company, engages in the research, development, and commercialization of transcatheter and surgical solutions for structural heart diseases in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives