- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1789

We Think Shareholders May Consider Being More Generous With AK Medical Holdings Limited's (HKG:1789) CEO Compensation Package

Key Insights

- AK Medical Holdings will host its Annual General Meeting on 18th of June

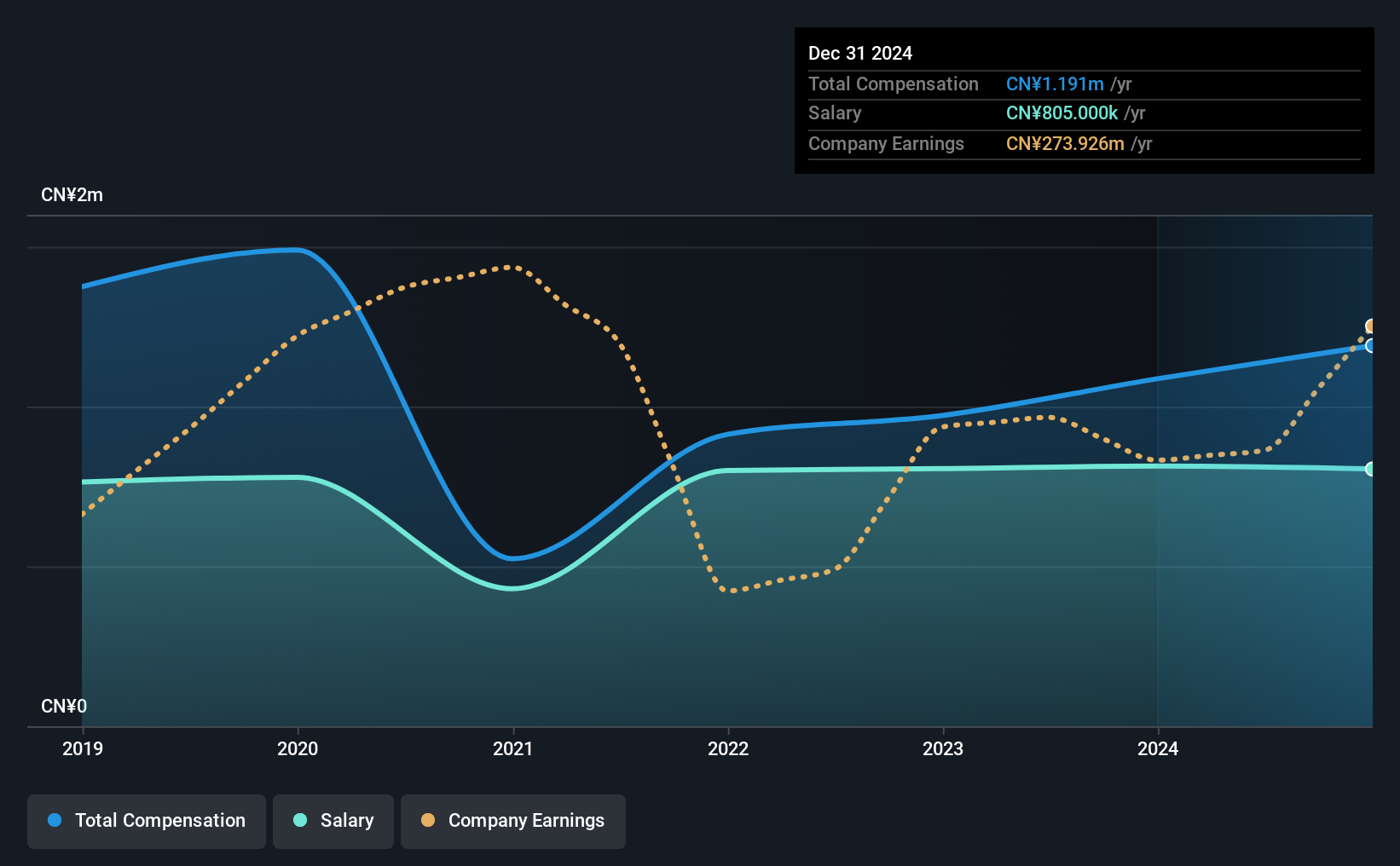

- Total pay for CEO Zhijiang Li includes CN¥805.0k salary

- The total compensation is 65% less than the average for the industry

- AK Medical Holdings' EPS grew by 43% over the past three years while total shareholder return over the past three years was 30%

Shareholders will be pleased by the robust performance of AK Medical Holdings Limited (HKG:1789) recently and this will be kept in mind in the upcoming AGM on 18th of June. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for AK Medical Holdings

Comparing AK Medical Holdings Limited's CEO Compensation With The Industry

Our data indicates that AK Medical Holdings Limited has a market capitalization of HK$6.9b, and total annual CEO compensation was reported as CN¥1.2m for the year to December 2024. Notably, that's an increase of 9.6% over the year before. In particular, the salary of CN¥805.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Hong Kong Medical Equipment industry with market capitalizations between HK$3.1b and HK$13b, we discovered that the median CEO total compensation of that group was CN¥3.4m. Accordingly, AK Medical Holdings pays its CEO under the industry median. Furthermore, Zhijiang Li directly owns HK$3.1b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥805k | CN¥814k | 68% |

| Other | CN¥386k | CN¥273k | 32% |

| Total Compensation | CN¥1.2m | CN¥1.1m | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. Our data reveals that AK Medical Holdings allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at AK Medical Holdings Limited's Growth Numbers

Over the past three years, AK Medical Holdings Limited has seen its earnings per share (EPS) grow by 43% per year. Its revenue is up 23% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has AK Medical Holdings Limited Been A Good Investment?

AK Medical Holdings Limited has generated a total shareholder return of 30% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at AK Medical Holdings.

Switching gears from AK Medical Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1789

AK Medical Holdings

An investment holding company, designs, develops, produces, and markets orthopedic joint implants and related products in the People’s Republic of China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives