- Hong Kong

- /

- Commercial Services

- /

- SEHK:3316

SEHK AK Medical Holdings Among 3 Stocks Possibly Undervalued According to Estimates

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions and economic shifts, the Hong Kong stock market has shown resilience, with the Hang Seng Index climbing 10.2% recently. Amidst these fluctuations, investors are keen to identify stocks that may be undervalued, presenting potential opportunities for those looking to capitalize on market inefficiencies. In this context, understanding what makes a stock potentially undervalued—such as strong fundamentals or overlooked growth prospects—can be crucial in making informed investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$33.00 | HK$63.32 | 47.9% |

| Giant Biogene Holding (SEHK:2367) | HK$52.30 | HK$97.51 | 46.4% |

| Zhaojin Mining Industry (SEHK:1818) | HK$13.10 | HK$23.97 | 45.3% |

| Kuaishou Technology (SEHK:1024) | HK$50.85 | HK$89.18 | 43% |

| MicroPort NeuroScientific (SEHK:2172) | HK$10.50 | HK$18.87 | 44.4% |

| Yadea Group Holdings (SEHK:1585) | HK$13.28 | HK$23.07 | 42.4% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$30.00 | HK$56.11 | 46.5% |

| CSC Financial (SEHK:6066) | HK$9.75 | HK$17.79 | 45.2% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.02 | HK$19.71 | 44.1% |

| Digital China Holdings (SEHK:861) | HK$2.97 | HK$5.83 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

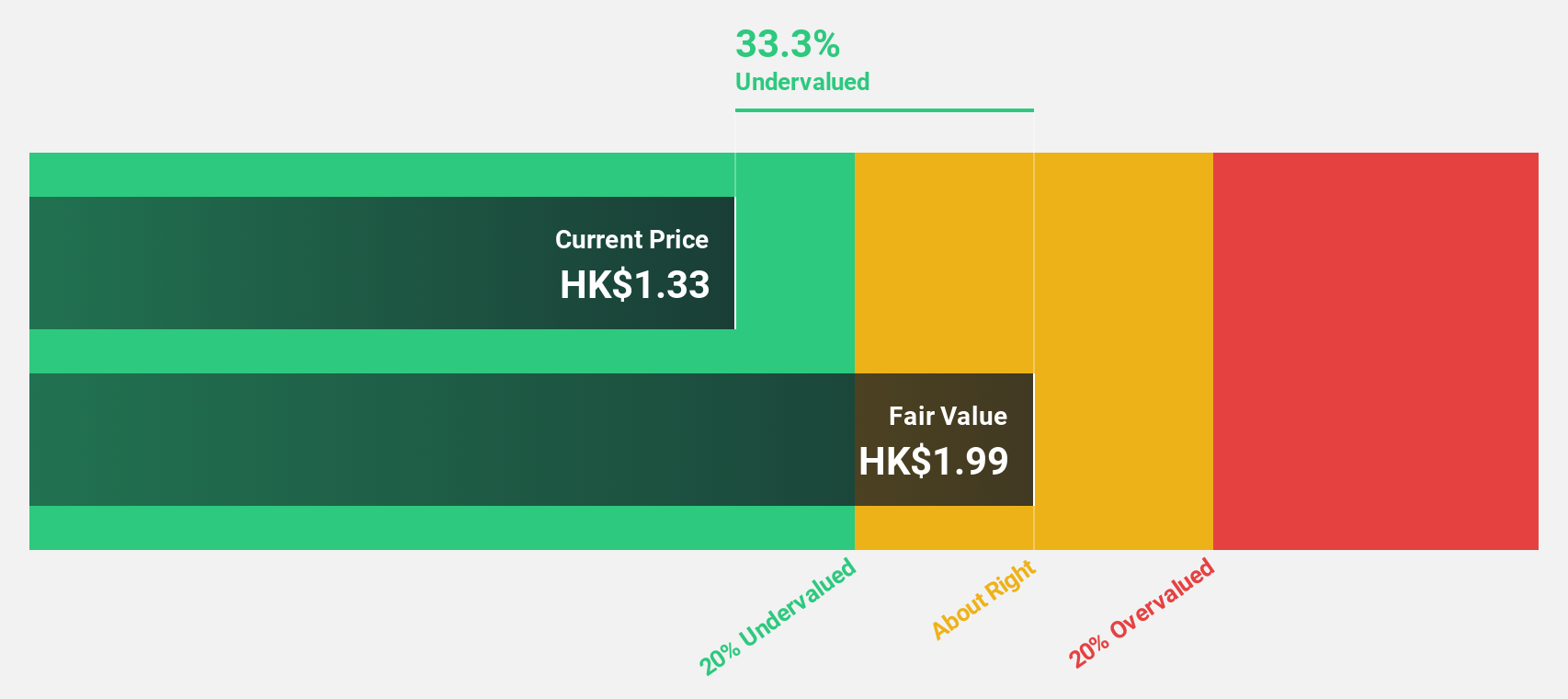

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited is an investment holding company that designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally, with a market cap of HK$5.32 billion.

Operations: The company's revenue segments include CN¥989.17 million from orthopedic implants in China and CN¥159.06 million from orthopedic implants in the United Kingdom.

Estimated Discount To Fair Value: 40.9%

AK Medical Holdings is trading at HK$4.95, significantly below its estimated fair value of HK$8.38, suggesting it is undervalued based on cash flows. Its earnings are projected to grow 28.7% annually over the next three years, outpacing the Hong Kong market's growth rate of 12.2%. Despite recent management changes and stable half-year earnings results, AK Medical shows potential for robust revenue growth at 24.7% per year compared to the market average of 7.4%.

- Insights from our recent growth report point to a promising forecast for AK Medical Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in AK Medical Holdings' balance sheet health report.

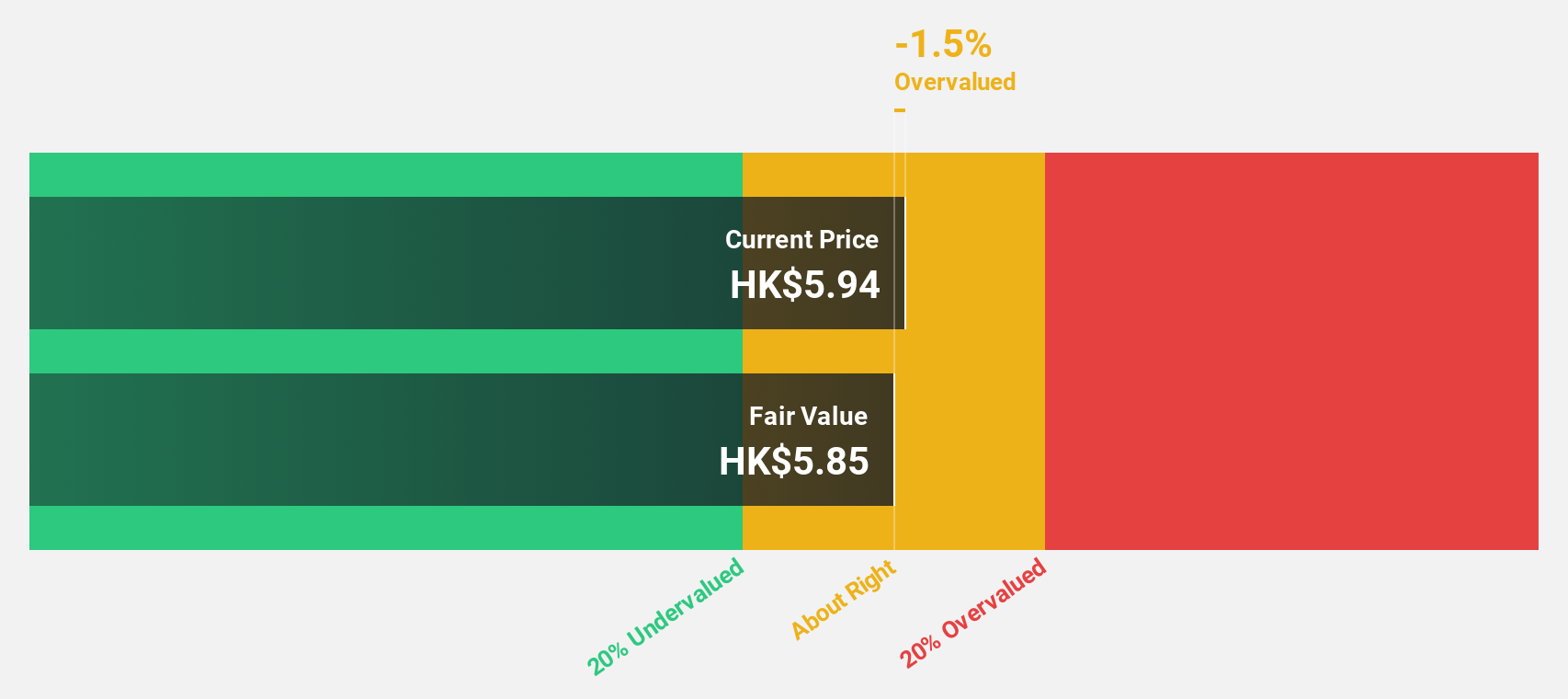

MicroPort CardioFlow Medtech (SEHK:2160)

Overview: MicroPort CardioFlow Medtech Corporation is a medical device company focused on developing and commercializing transcatheter and surgical solutions for structural heart diseases in China and internationally, with a market cap of HK$1.98 billion.

Operations: The company generates revenue from its Surgical & Medical Devices segment, totaling CN¥382.91 million.

Estimated Discount To Fair Value: 10.6%

MicroPort CardioFlow Medtech is trading at HK$0.82, slightly below its estimated fair value of HK$0.92, indicating a modest undervaluation based on cash flows. The company is expected to achieve profitability within three years, with revenue growth forecasted at 23.5% annually—surpassing the Hong Kong market's average growth rate of 7.4%. Recent earnings showed improved financial performance, with sales increasing to CNY 223.14 million and a reduced net loss compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in MicroPort CardioFlow Medtech's future results.

- Delve into the full analysis health report here for a deeper understanding of MicroPort CardioFlow Medtech.

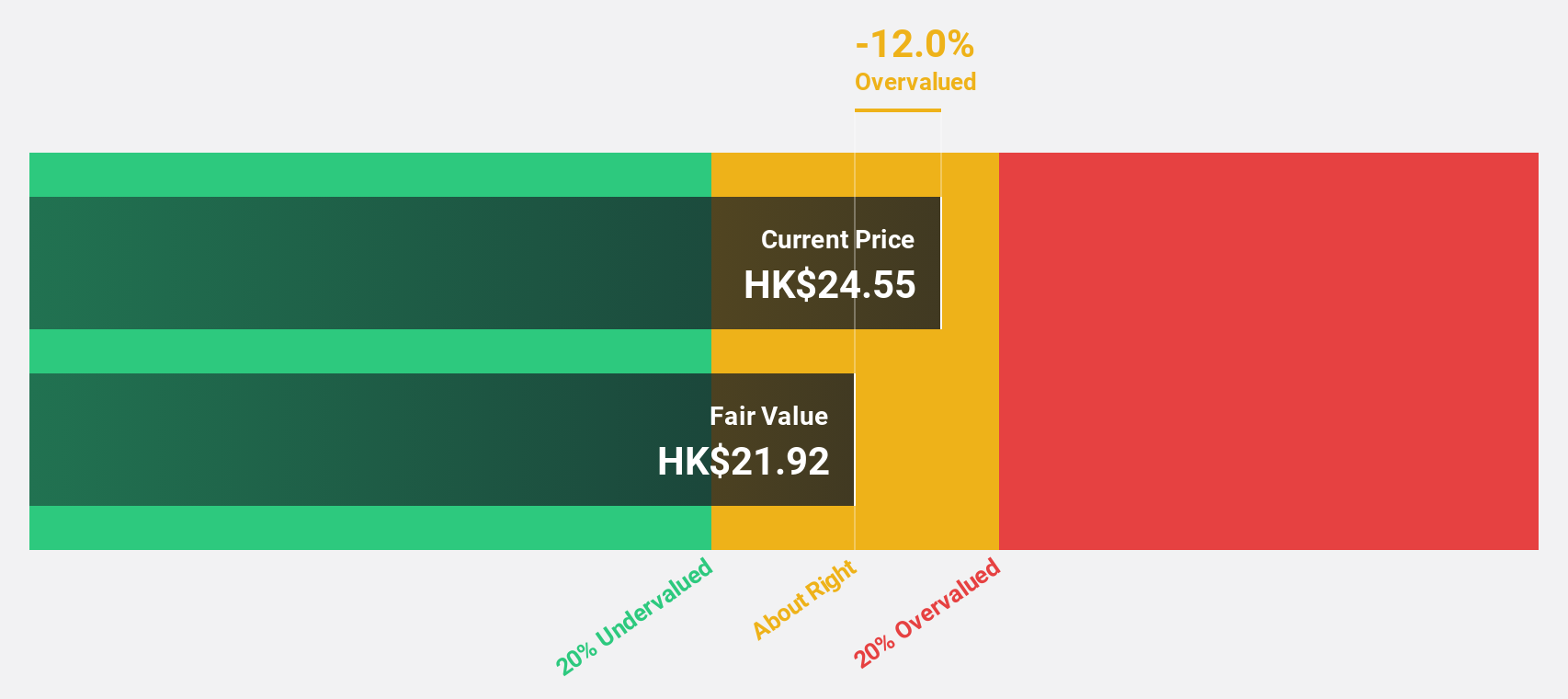

Binjiang Service Group (SEHK:3316)

Overview: Binjiang Service Group Co. Ltd. operates in the People's Republic of China, offering property management and related services, with a market cap of HK$5.23 billion.

Operations: The company generates revenue primarily through property management services and related offerings in China, with total earnings of CN¥1.91 billion.

Estimated Discount To Fair Value: 31.5%

Binjiang Service Group is trading at HK$18.92, significantly below its estimated fair value of HK$27.63, highlighting a notable undervaluation based on cash flows. The company's earnings and revenue are forecast to grow annually by 15% and 16.4%, respectively, outpacing the Hong Kong market averages. Recent financials show sales increased to CNY 1.65 billion with net income rising to CNY 265.32 million for the first half of 2024, though dividend stability remains an issue.

- Our expertly prepared growth report on Binjiang Service Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Binjiang Service Group with our detailed financial health report.

Key Takeaways

- Get an in-depth perspective on all 36 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binjiang Service Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3316

Binjiang Service Group

Provides property management and related services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.