- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1696

Increases to CEO Compensation Might Be Put On Hold For Now at Sisram Medical Ltd (HKG:1696)

Key Insights

- Sisram Medical to hold its Annual General Meeting on 24th of June

- Salary of US$863.0k is part of CEO Lior Dayan's total remuneration

- The overall pay is 330% above the industry average

- Sisram Medical's EPS grew by 31% over the past three years while total shareholder loss over the past three years was 76%

In the past three years, the share price of Sisram Medical Ltd (HKG:1696) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 24th of June. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Sisram Medical

How Does Total Compensation For Lior Dayan Compare With Other Companies In The Industry?

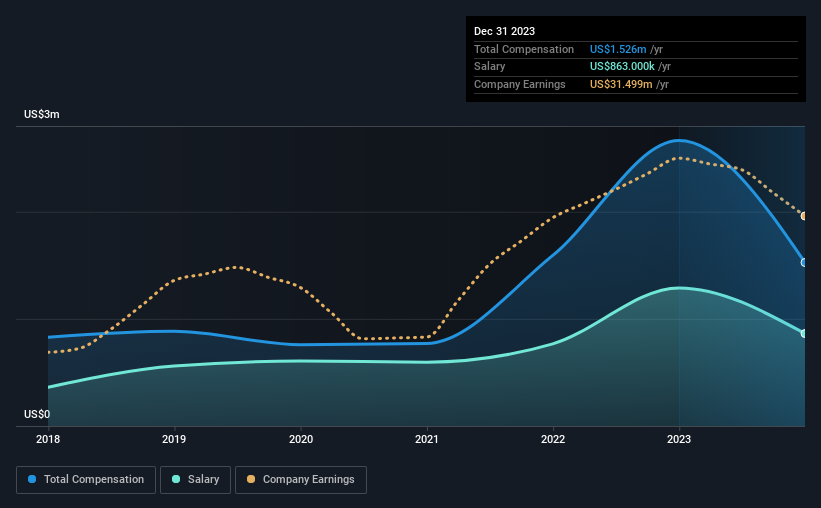

Our data indicates that Sisram Medical Ltd has a market capitalization of HK$1.8b, and total annual CEO compensation was reported as US$1.5m for the year to December 2023. We note that's a decrease of 43% compared to last year. In particular, the salary of US$863.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the Hong Kong Medical Equipment industry with market caps ranging from HK$781m to HK$3.1b, we found that the median CEO total compensation was US$355k. Hence, we can conclude that Lior Dayan is remunerated higher than the industry median. Furthermore, Lior Dayan directly owns HK$3.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$863k | US$1.3m | 57% |

| Other | US$663k | US$1.4m | 43% |

| Total Compensation | US$1.5m | US$2.7m | 100% |

On an industry level, roughly 64% of total compensation represents salary and 36% is other remuneration. Sisram Medical pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Sisram Medical Ltd's Growth

Sisram Medical Ltd has seen its earnings per share (EPS) increase by 31% a year over the past three years. Its revenue is up 1.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sisram Medical Ltd Been A Good Investment?

With a total shareholder return of -76% over three years, Sisram Medical Ltd shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Sisram Medical that investors should think about before committing capital to this stock.

Important note: Sisram Medical is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1696

Sisram Medical

Engages in the research, design, development, manufacture, sale, and marketing of medical aesthetics and dental equipment, home use devices, injectables, and cosmeceuticals products in the Asia Pacific, Europe, North America, Latin America, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success