- China

- /

- Electrical

- /

- SZSE:002518

Asian Market Value Picks Including WEILONG Delicious Global Holdings And Two More

Reviewed by Simply Wall St

As global markets experience a rally driven by easing trade tensions and positive economic developments, Asian stock markets are also witnessing upward momentum, particularly in China where recent trade agreements have bolstered investor confidence. In this environment, identifying undervalued stocks can present opportunities for investors looking to capitalize on market optimism; companies like WEILONG Delicious Global Holdings exemplify potential value picks amid these conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.53 | CN¥75.96 | 49.3% |

| T'Way Air (KOSE:A091810) | ₩2040.00 | ₩3980.07 | 48.7% |

| Strike CompanyLimited (TSE:6196) | ¥3660.00 | ¥7291.10 | 49.8% |

| Polaris Holdings (TSE:3010) | ¥210.00 | ¥415.69 | 49.5% |

| Peijia Medical (SEHK:9996) | HK$6.39 | HK$12.66 | 49.5% |

| Livero (TSE:9245) | ¥1705.00 | ¥3379.75 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥842.00 | ¥1680.16 | 49.9% |

| GCH Technology (SHSE:688625) | CN¥30.38 | CN¥60.22 | 49.6% |

| Forum Engineering (TSE:7088) | ¥1218.00 | ¥2377.47 | 48.8% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥31.51 | CN¥62.42 | 49.5% |

Underneath we present a selection of stocks filtered out by our screen.

WEILONG Delicious Global Holdings (SEHK:9985)

Overview: WEILONG Delicious Global Holdings Ltd, with a market cap of HK$32.97 billion, produces and sells spicy snack food in the People’s Republic of China and internationally.

Operations: The company's revenue is primarily derived from its vegetable products segment, which generated CN¥3.37 billion, followed by seasoned flour products at CN¥2.67 billion, and bean-based and other products contributing CN¥228.69 million.

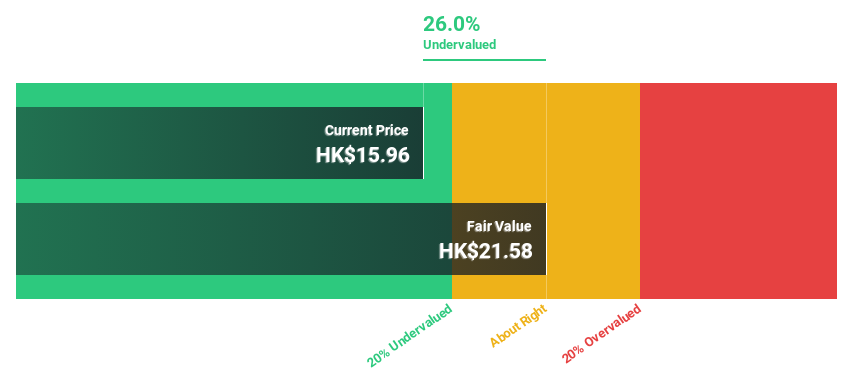

Estimated Discount To Fair Value: 36.4%

WEILONG Delicious Global Holdings is trading at HK$13.56, significantly below its estimated fair value of HK$21.31, indicating potential undervaluation based on discounted cash flow analysis. Despite a recent follow-on equity offering raising HK$1.18 billion, the stock remains 36.4% under fair value estimates with earnings anticipated to grow 17.3% annually, outpacing the Hong Kong market's growth rate of 10.4%. However, insider selling and dividend sustainability concerns persist amidst expansion plans in Nanning.

- The analysis detailed in our WEILONG Delicious Global Holdings growth report hints at robust future financial performance.

- Navigate through the intricacies of WEILONG Delicious Global Holdings with our comprehensive financial health report here.

Shenzhen KSTAR Science and Technology (SZSE:002518)

Overview: Shenzhen KSTAR Science and Technology Co., Ltd. operates in the power electronics industry, focusing on providing solutions such as UPS systems and solar inverters, with a market cap of approximately CN¥13.02 billion.

Operations: Shenzhen KSTAR Science and Technology Co., Ltd. generates its revenue primarily from the power electronics sector, specializing in solutions like UPS systems and solar inverters.

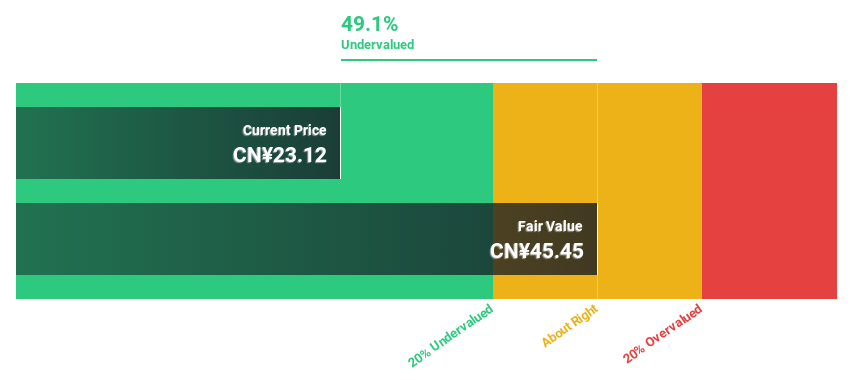

Estimated Discount To Fair Value: 48.4%

Shenzhen KSTAR Science and Technology is trading at CN¥22.37, well below its estimated fair value of CN¥43.33, suggesting it may be undervalued based on cash flow analysis. Despite a decrease in profit margins from 15.1% to 8.9%, revenue is projected to grow 22.3% annually, surpassing the Chinese market's growth rate of 12.4%. However, dividend sustainability remains uncertain following recent decreases in payouts for the year 2024 amidst declining net income figures.

- In light of our recent growth report, it seems possible that Shenzhen KSTAR Science and Technology's financial performance will exceed current levels.

- Dive into the specifics of Shenzhen KSTAR Science and Technology here with our thorough financial health report.

Zhejiang Garden BiopharmaceuticalLtd (SZSE:300401)

Overview: Zhejiang Garden Biopharmaceutical Co., Ltd. operates in the biopharmaceutical industry and has a market cap of CN¥8.10 billion.

Operations: Zhejiang Garden Biopharmaceutical Co., Ltd. operates in the biopharmaceutical industry with a market cap of CN¥8.10 billion, but specific revenue segments are not provided in the available data.

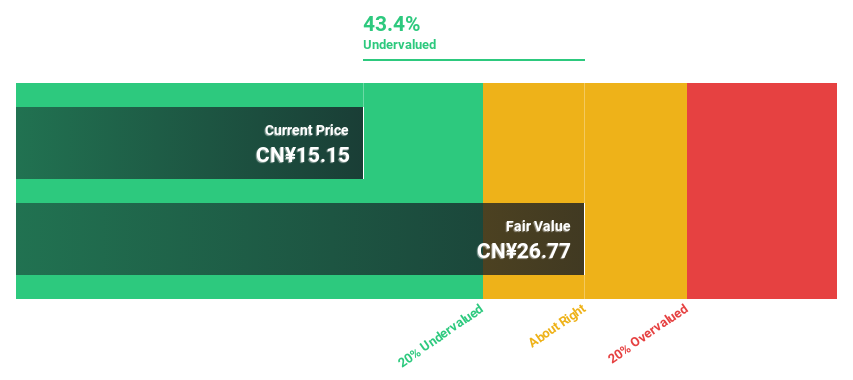

Estimated Discount To Fair Value: 43.5%

Zhejiang Garden Biopharmaceutical Ltd. is trading at CN¥14.9, significantly below its estimated fair value of CN¥26.36, highlighting potential undervaluation based on cash flow analysis. With earnings projected to grow 35.9% annually, surpassing the Chinese market's growth rate of 23.4%, the company shows strong profit growth prospects despite a modest revenue decline in Q1 2025 compared to last year. However, its dividend coverage by free cash flows remains weak at present levels.

- Our expertly prepared growth report on Zhejiang Garden BiopharmaceuticalLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Zhejiang Garden BiopharmaceuticalLtd's balance sheet by reading our health report here.

Where To Now?

- Embark on your investment journey to our 284 Undervalued Asian Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002518

Shenzhen KSTAR Science and Technology

Shenzhen KSTAR Science and Technology Co., Ltd.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives