Reassessing Shiyue Daotian Group (SEHK:9676) Valuation After Sweeping Governance Reshuffle

Reviewed by Simply Wall St

Shiyue Daotian Group (SEHK:9676) just pushed through a sweeping governance reshuffle, adding new executive and independent directors, abolishing its Board of Supervisors and revising its Articles of Association. These are changes that the market is now pricing in.

See our latest analysis for Shiyue Daotian Group.

At around HK$7.10, the stock has seen a choppy near term pattern, with a negative 3 month share price return but a positive year to date share price return and a stronger 1 year total shareholder return, suggesting governance driven momentum is cautiously rebuilding.

If these governance changes have you rethinking where the next opportunity might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With the shares trading on a sizeable intrinsic value discount, yet already delivering double digit gains over the past year, the key question now is whether Shiyue Daotian is still mispriced or if investors are correctly anticipating future growth.

Price-to-Earnings of 35.2x: Is it justified?

On a last close of HK$7.10, Shiyue Daotian trades on a 35.2x price to earnings multiple, which screens as expensive against the Hong Kong Food industry.

The price to earnings ratio compares what investors pay today for each unit of current earnings. This makes it a useful lens for a consumer staples group that is already profitable. A higher multiple usually reflects expectations of stronger or more reliable profit growth, while a lower multiple can point to weaker prospects or higher perceived risk.

In Shiyue Daotian's case, the 35.2x price to earnings ratio looks rich versus the broader Hong Kong Food industry average of 12.7x. This implies the market is assigning a substantial premium to its earnings outlook. However, compared with a closer peer group where the average multiple is 48.2x, the shares actually sit at a discount. This suggests investors are still reluctant to price the company in line with faster growing or better known rivals despite its recent 157.1% earnings growth and improving margins.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 35.2x (OVERVALUED)

However, Shiyue Daotian still faces risks, including its rich valuation versus slower industry growth and potential margin pressure in a competitive staple foods market.

Find out about the key risks to this Shiyue Daotian Group narrative.

Another view on value

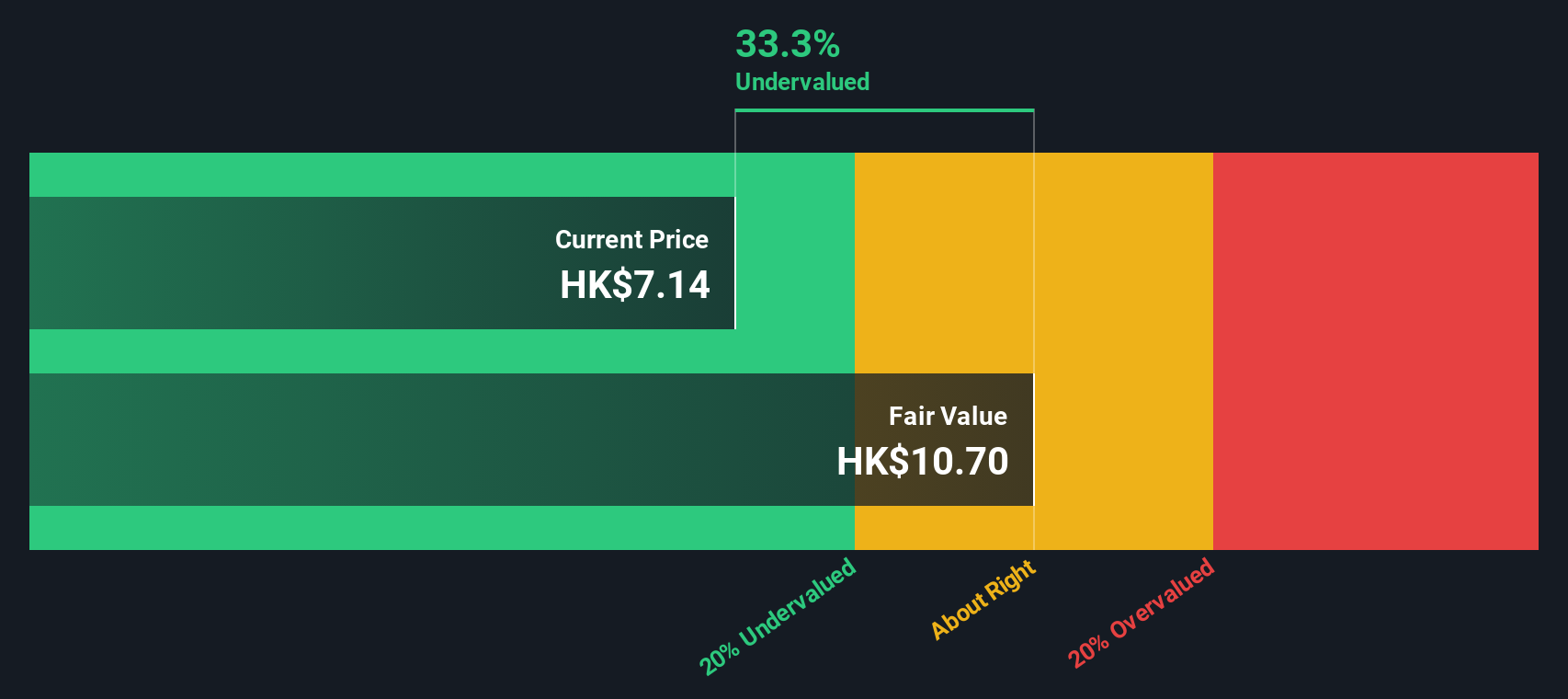

While the 35.2x earnings multiple looks stretched, our DCF model paints a different picture and suggests Shiyue Daotian trades about 33.6% below its estimated fair value of HK$10.69 per share. If cash flows are closer to the truth than today’s sentiment, is the downside already limited?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shiyue Daotian Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shiyue Daotian Group Narrative

If you want to dig into the numbers yourself or challenge this view, you can quickly build a personalised narrative in just a few minutes: Do it your way.

A great starting point for your Shiyue Daotian Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next step with targeted screens that can help you identify opportunities you might otherwise overlook in today’s fast moving market.

- Explore potential multi baggers early by scanning these 3633 penny stocks with strong financials that pair small market caps with business strength and momentum.

- Review these 24 AI penny stocks that are advancing practical AI in everyday products and services.

- Evaluate these 12 dividend stocks with yields > 3% that combine ongoing dividend payments with balance sheet resilience and earnings support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9676

Shiyue Daotian Group

Manufactures and sells pantry staple food in the People's Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion