Besunyen Holdings (HKG:926 investor five-year losses grow to 40% as the stock sheds HK$48m this past week

While it may not be enough for some shareholders, we think it is good to see the Besunyen Holdings Company Limited (HKG:926) share price up 17% in a single quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 74% in that time, significantly under-performing the market.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Besunyen Holdings

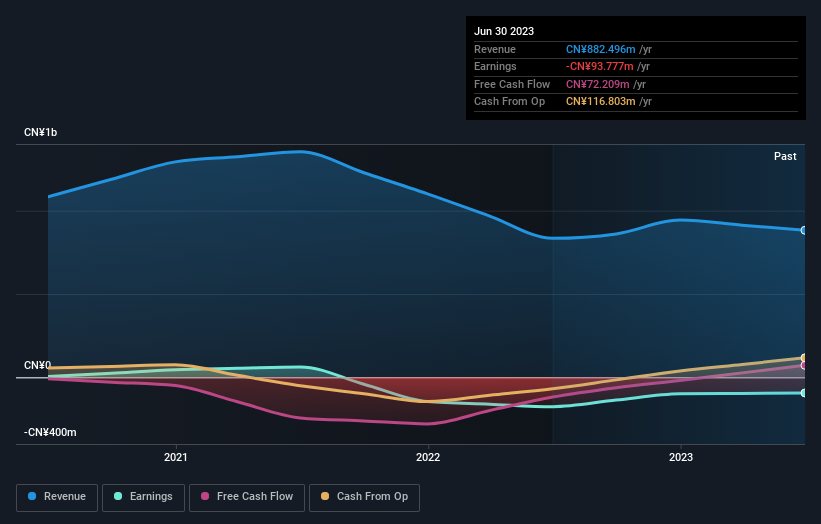

Given that Besunyen Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Besunyen Holdings saw its revenue increase by 13% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 12% per year in the last five years. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Besunyen Holdings' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Besunyen Holdings' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Besunyen Holdings' TSR, at -40% is higher than its share price return of -74%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Besunyen Holdings has rewarded shareholders with a total shareholder return of 42% in the last twelve months. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Besunyen Holdings better, we need to consider many other factors. Take risks, for example - Besunyen Holdings has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Besunyen Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:926

Besunyen Holdings

Engages in the research and development, production, promotion, and sale of therapeutic tea products and pharmaceuticals in the People's Republic of China and internationally.

Flawless balance sheet very low.