- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

3 SEHK Dividend Stocks Yielding Up To 9.9%

Reviewed by Simply Wall St

The Hong Kong market has shown resilience amid global economic uncertainties, with the Hang Seng Index gaining 0.85% recently despite broader concerns about deflationary pressures in China. This backdrop highlights the importance of stable income sources, making dividend stocks particularly appealing for investors seeking reliable returns. In this context, selecting dividend stocks that offer strong yields and consistent payouts can be a prudent strategy to navigate market volatility and secure steady income streams.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.31% | ★★★★★★ |

| Luk Fook Holdings (International) (SEHK:590) | 9.07% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.96% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.30% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.90% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.55% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.41% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.66% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.70% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.77% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of HK$6.60 billion.

Operations: Wasion Holdings Limited generates its revenue primarily from three segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

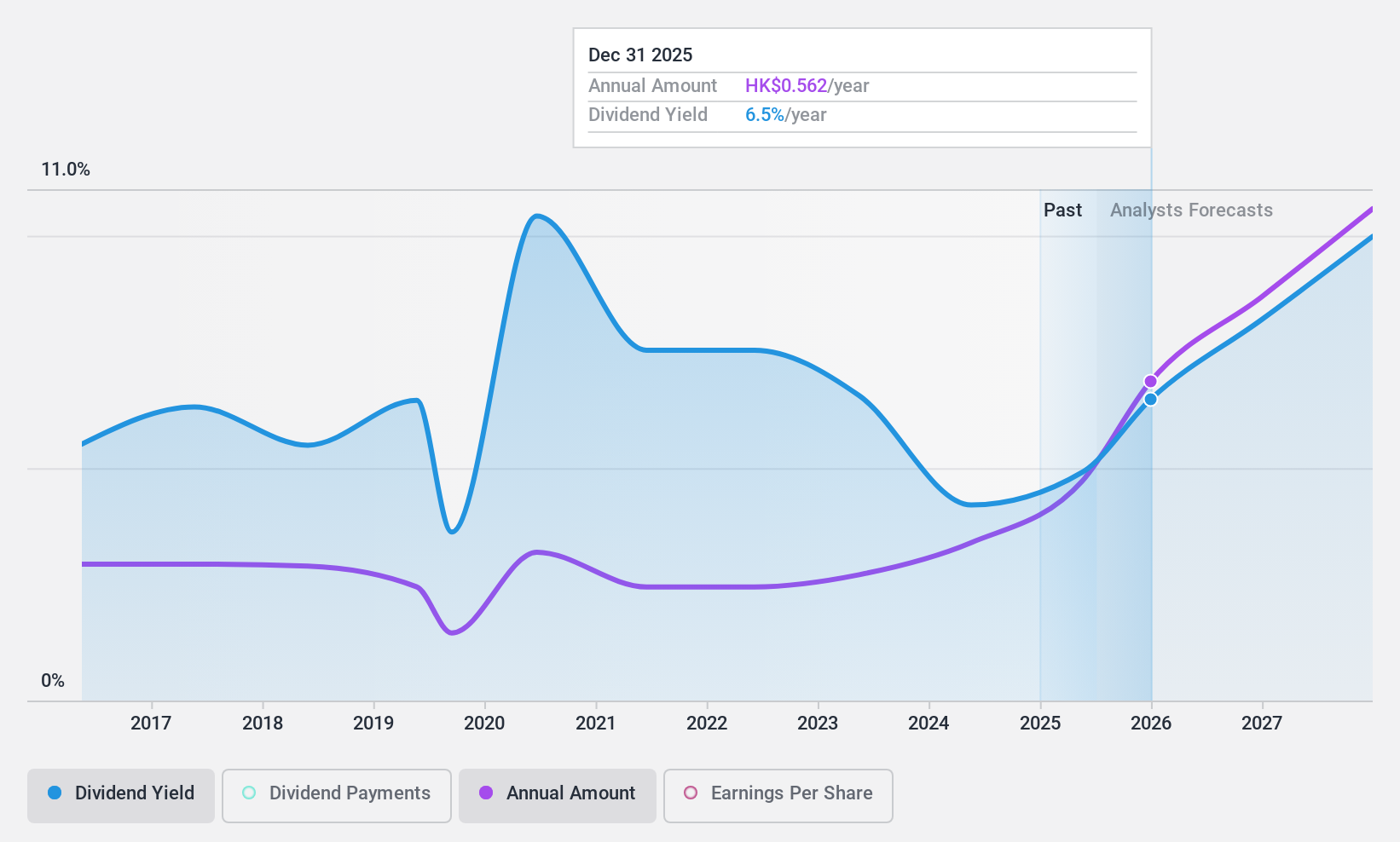

Dividend Yield: 4.2%

Wasion Holdings' dividend payments have been volatile over the past decade, despite recent growth in earnings and revenue. The company's dividends are well-covered by both earnings (48.9% payout ratio) and cash flows (27.6% cash payout ratio). While trading at 39.4% below its estimated fair value, Wasion's recent international smart meter contracts worth HKD 267.82 million, HKD 73.57 million, and HKD 44.83 million highlight its expanding global footprint and potential for future growth in dividend stability.

- Click to explore a detailed breakdown of our findings in Wasion Holdings' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Wasion Holdings shares in the market.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Limited, with a market cap of HK$5.73 billion, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Operations: China Overseas Grand Oceans Group Limited generates its revenue from property investment and development (CN¥56.08 billion) and property leasing (CN¥242.46 million).

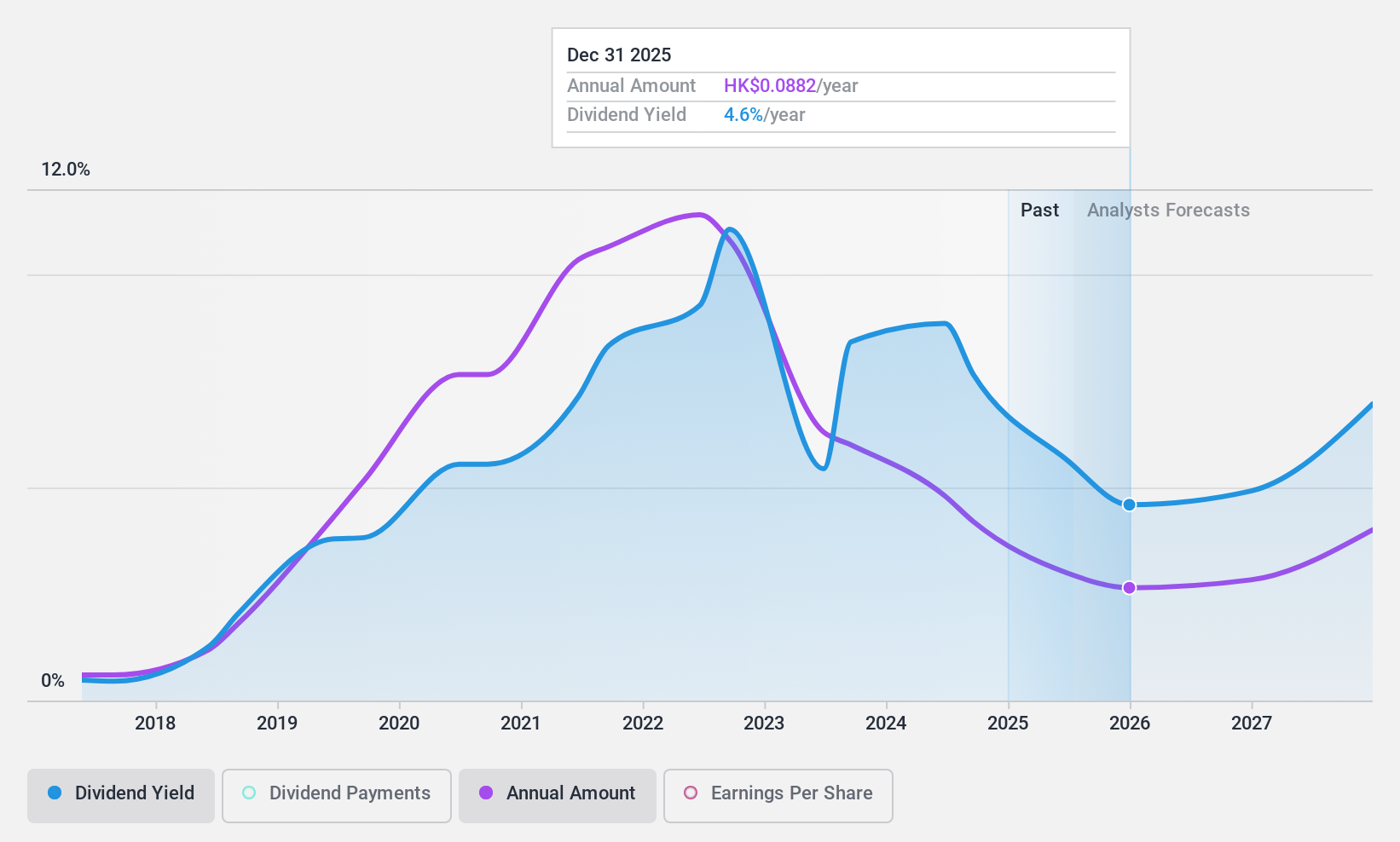

Dividend Yield: 9.9%

China Overseas Grand Oceans Group's dividend payments have been volatile over the past decade, despite a low payout ratio of 22.5%, indicating strong earnings coverage. Recent sales figures show a mixed performance, with July 2024 property contracted sales at RMB 2.23 billion and GFA at 214,800 square meters, reflecting varied year-on-year changes. The company's high debt level and forecasted earnings decline pose concerns for long-term dividend sustainability despite its top-tier yield of 9.9%.

- Click here to discover the nuances of China Overseas Grand Oceans Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that China Overseas Grand Oceans Group is trading behind its estimated value.

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market cap of approximately HK$124.29 billion.

Operations: Lenovo Group Limited's revenue segments include the Intelligent Devices Group (IDG) with $44.60 billion, Solutions and Services Group (SSG) at $7.47 billion, and Infrastructure Solutions Group (ISG) totaling $8.92 billion.

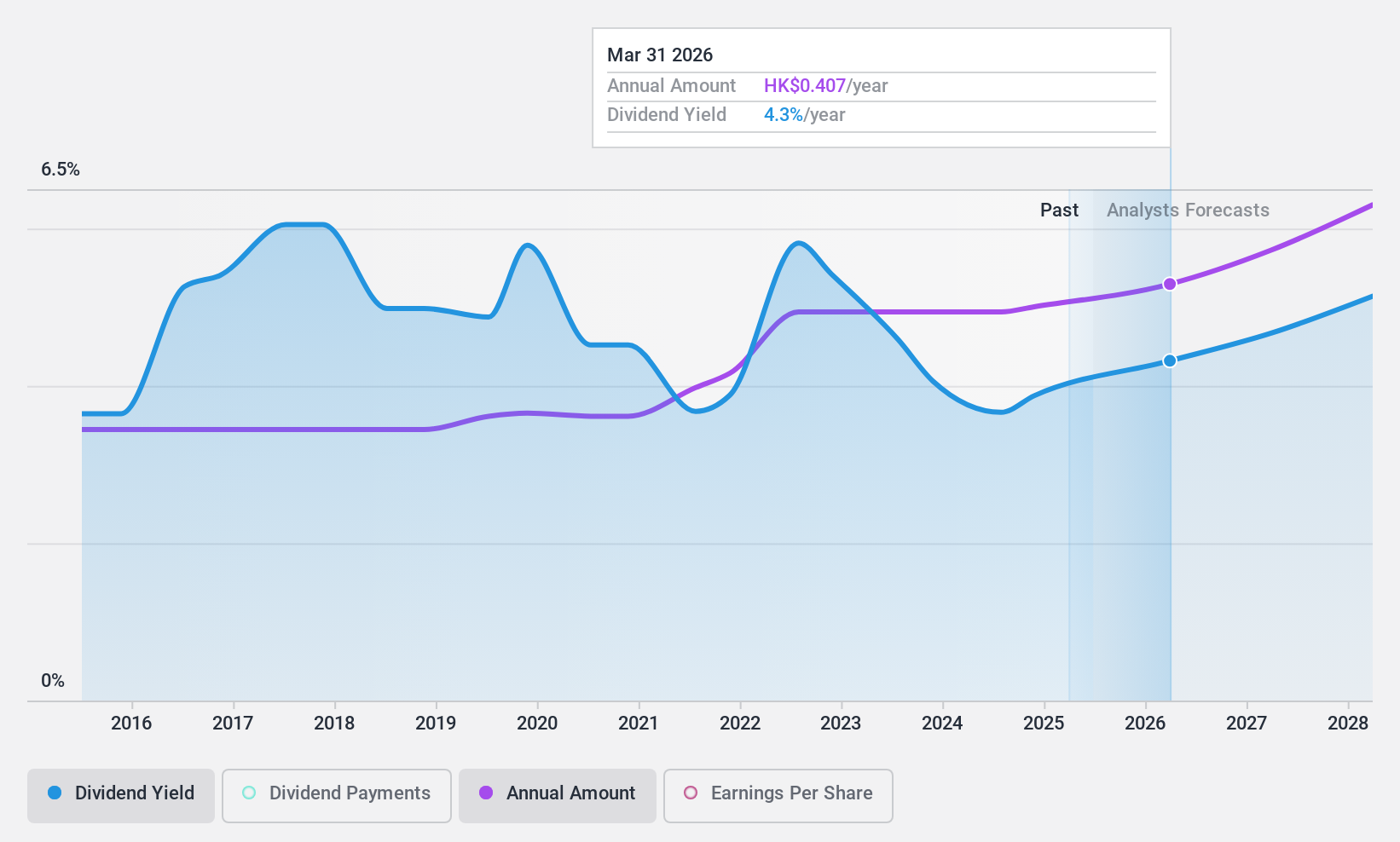

Dividend Yield: 3.8%

Lenovo Group’s dividend payments have been stable and growing over the past decade, supported by a reasonable payout ratio of 57.8% and cash flow coverage of 83.1%. Despite trading at 70.8% below its estimated fair value, Lenovo's profit margins have declined from last year. The company declared a final dividend of HK$0.30 per share for FY2024 amidst strategic partnerships and product advancements, including AI-focused collaborations with Databricks and automotive innovations with NVIDIA Drive Thor platform integration.

- Dive into the specifics of Lenovo Group here with our thorough dividend report.

- The analysis detailed in our Lenovo Group valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 86 Top SEHK Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

High growth potential with solid track record and pays a dividend.