Lacklustre Performance Is Driving China Feihe Limited's (HKG:6186) Low P/E

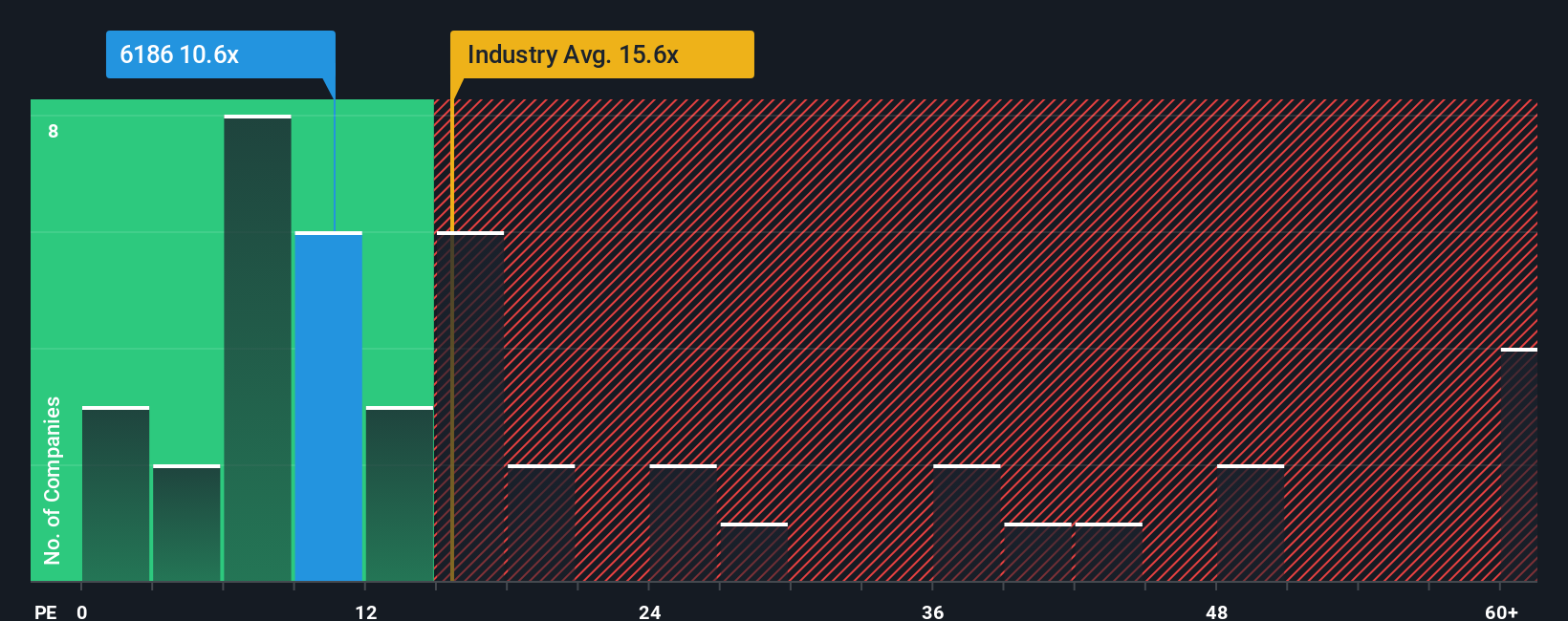

With a price-to-earnings (or "P/E") ratio of 10.6x China Feihe Limited (HKG:6186) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 13x and even P/E's higher than 29x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, China Feihe has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for China Feihe

How Is China Feihe's Growth Trending?

China Feihe's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 5.4% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 49% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 6.2% per annum during the coming three years according to the analysts following the company. With the market predicted to deliver 15% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that China Feihe's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From China Feihe's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Feihe's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - China Feihe has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6186

China Feihe

An investment holding company, produces and sells dairy products and raw milk in Mainland China, Canada, and the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives