Vitasoy (SEHK:345) Net Margin Jumps to 3.9%, Reinforcing Optimistic Profitability Narratives

Reviewed by Simply Wall St

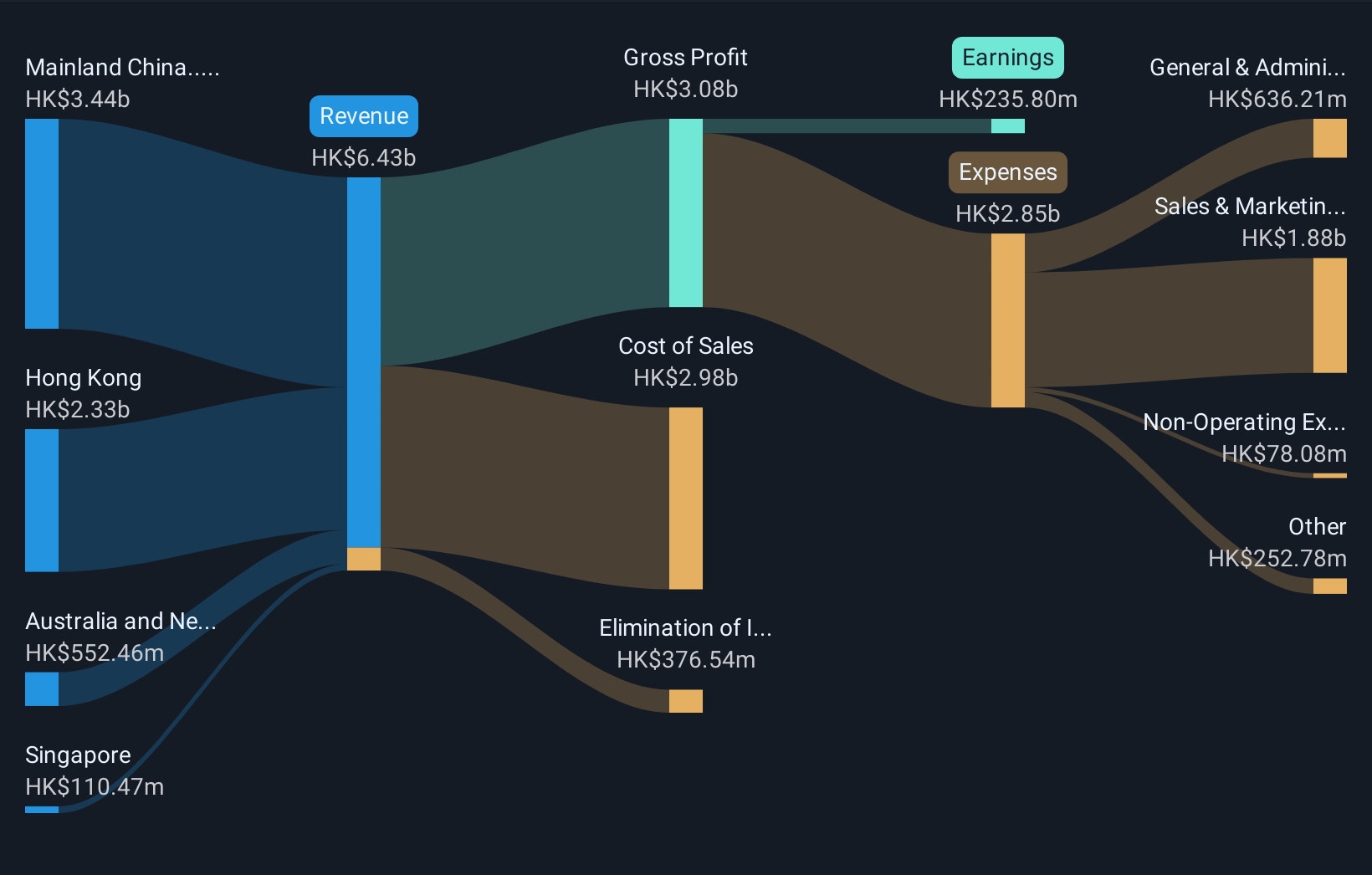

Vitasoy International Holdings (SEHK:345) has just released its H1 2026 earnings, reporting revenue of $6.1 billion HKD and basic EPS of 0.22 HKD for the trailing twelve months, while net income came in at 236 million HKD. Looking back, the company has seen revenue hold steady over recent periods, with $6.3 billion HKD in H2 2025 and $6.3 billion HKD in H1 2025. EPS moved from 0.22 HKD to 0.12 HKD through these intervals. Margins have become a bigger part of the story for investors, with profitability metrics now in sharper focus as the company navigates its next stage.

See our full analysis for Vitasoy International Holdings.Next up, we will see how these numbers hold up against the widely discussed narratives in the market and whether expectations are shifting in light of the latest earnings release.

See what the community is saying about Vitasoy International Holdings

Margin Expansion Outpaces Market Average

- Net profit margins grew from 2% last year to 3.9% for the trailing twelve months, while the overall Hong Kong market expects earnings growth of 11.6% per year and Vitasoy is forecast at a slower 9.4% rate.

- The analysts' consensus view highlights that ongoing margin gains are tied to product innovation and operational stability, especially as profit margins are expected to rise from 3.7% to 4.2% over the next three years.

- The consensus narrative notes stable commercial execution in Mainland China and recovery from manufacturing headwinds in Australia as key drivers.

- At the same time, analysts caution that closely managing supply chain transitions, such as in Singapore, will be essential to preserve these gains.

Consensus sees Vitasoy’s margin recovery as central to valuation, but ongoing execution is under close watch for confirmation. 📊 Read the full Vitasoy International Holdings Consensus Narrative.

Valuation Gap Versus Sector Peers Widens

- With shares trading at a 21.2% discount to the DCF fair value of 8.51 HKD, the current price-to-earnings ratio of 29.7x stands above the Hong Kong Food industry’s 12.9x average, though below the peer average of 54.9x.

- The consensus narrative points out that while the discount to estimated fair value appeals to some, the relatively high P/E may spark debate over future upside, since analysts expect only modest annual revenue growth of 1.6%.

- Supporters of the consensus emphasize the potential for strong profitability to justify a premium valuation if new innovations drive growth.

- Critics focus on whether subdued top-line momentum and digital headwinds will limit further rerating, especially if revenue fails to gain traction.

Earnings Recovery Consistency Supported by Mainland China

- Earnings in the past year rebounded by 89.9%, compared with a 16.3% annual decline over the last five years, bolstered by improved performance and new product launches in Mainland China.

- Consensus narrative underscores that, although stability is returning, with trailing annual net income reaching $235.8 million HKD, future gains will rely heavily on sustained growth in Mainland China, export channels, and e-commerce recalibration.

- The turnaround in Australia and new flavor launches are noted as catalysts for diversifying profit sources.

- Still, consensus flags the risk that any new operational issues or competition in China could disrupt these positive earnings trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vitasoy International Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest figures? Share your perspective and shape your own story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vitasoy International Holdings.

See What Else Is Out There

With Vitasoy’s modest revenue growth and ongoing debates over premium valuation, concerns linger about its ability to deliver consistent returns at current multiples.

If you want to target companies with stronger upside for the price you pay, our these 926 undervalued stocks based on cash flows gives you a smarter way to capture value opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:345

Vitasoy International Holdings

An investment holding company, manufactures and sells food and beverages in Mainland China, Hong Kong, Australia, New Zealand, and Singapore.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success