Is Tingyi (SEHK:322) Undervalued? A Fresh Look at Valuation After Mixed Share Price Movements

Reviewed by Simply Wall St

Tingyi (Cayman Islands) Holding (SEHK:322) Stock Movement: Is it Signaling Opportunity?

If you are keeping an eye on Tingyi (Cayman Islands) Holding (SEHK:322), the recent share price action might have caught your attention. The stock has shown mixed movements, with a slight dip over the past week but healthy returns over the past year. While there is no single material event driving this shift, the stock’s recent momentum, albeit modest, may have investors questioning whether the market is repositioning itself ahead of any underlying changes at the company.

Over the past year, Tingyi (Cayman Islands) Holding’s shares have gained 13%, showing stronger growth recently compared to earlier months. Its return for the year to date stands at 12%, supported by improving fundamentals such as annual revenue and net income growth. While there have been ups and downs over shorter periods, including a slight slip in the past three months, the stock’s longer-term trend appears relatively resilient compared to broader market peers in the consumer staples space.

That raises the obvious question: are shares trading at a bargain now, or is the market already factoring in Tingyi’s future growth story?

Price-to-Earnings of 14x: Is it justified?

Based on the price-to-earnings (P/E) multiple, Tingyi (Cayman Islands) Holding is trading at 14 times its earnings. This is slightly above the average P/E multiple of its industry peers, which stands at 13x. However, it is below both the Hong Kong Food industry average of 15.1x and its estimated fair P/E value of 15.5x.

The price-to-earnings ratio offers investors a snapshot of how much the market is willing to pay per dollar of company earnings. For consumer staples businesses like Tingyi, which operate in a mature industry, P/E ratios provide a useful benchmark for gauging relative value and market expectations.

Although Tingyi’s multiple is somewhat higher than that of direct peers, it appears reasonable when compared to the broader sector. This suggests the market may be factoring in expectations of stable, though not necessarily exceptional, earnings growth as well as confidence in the firm's recent improvements in profitability.

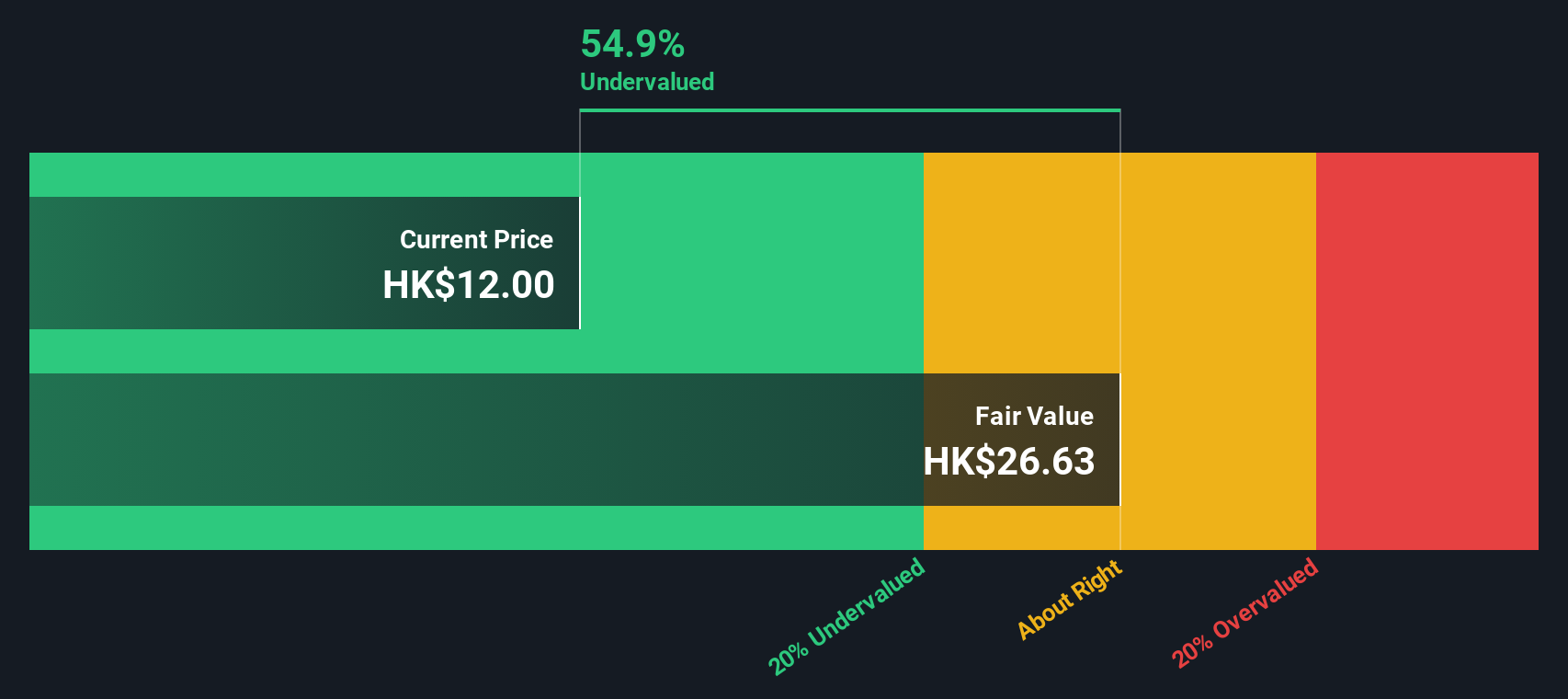

Result: Fair Value of $26.68 (UNDERVALUED)

See our latest analysis for Tingyi (Cayman Islands) Holding.However, risks such as fluctuating consumer demand or potential margin pressures remain, and these factors could quickly challenge the company's current valuation outlook.

Find out about the key risks to this Tingyi (Cayman Islands) Holding narrative.Another View: What Does the SWS DCF Model Say?

While P/E multiples suggest Tingyi could be decent value, the SWS DCF model takes a deeper look at future cash flows and finds the shares are still trading below what these fundamentals might justify. This could indicate more upside than the market currently expects.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tingyi (Cayman Islands) Holding Narrative

If you would like a fresh perspective or think your own research could lead to different conclusions, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your Tingyi (Cayman Islands) Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge as an investor by scanning the market for unique opportunities. There are always smart ways to put your money to work.

- Uncover undervalued gems and get ahead of the crowd by using our undervalued stocks based on cash flows to spot companies with hidden potential.

- Capture tomorrow’s tech breakthroughs when you harness AI penny stocks, which features businesses innovating in artificial intelligence and machine learning.

- Grow your income stream by checking out dividend stocks with yields > 3%, focused on stocks with attractive yields and stable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tingyi (Cayman Islands) Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:322

Tingyi (Cayman Islands) Holding

An investment holding company, manufactures and sells instant noodles, beverages, and instant food products in the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives