Is There Opportunity in Tingyi After 12% Share Price Climb and Partnership With Mengniu?

Reviewed by Simply Wall St

If you are weighing your next move on Tingyi (Cayman Islands) Holding, you are definitely not alone. With so many updates and shifts in the broader consumer staples sector, plenty of investors are revisiting this stock to decide if now is the right time to buy, sell, or simply hold on. Let us look at what has been happening: after a solid rise of 18.0% over the past five years, Tingyi's stock has climbed 12.2% year-to-date and 12.7% over the last year. The past month was a little quieter with a 0.9% gain, and last week saw a slight dip of 0.4%. These numbers show a pattern of steady, if sometimes modest, progress—a trend that has attracted more attention as the market environment evolves.

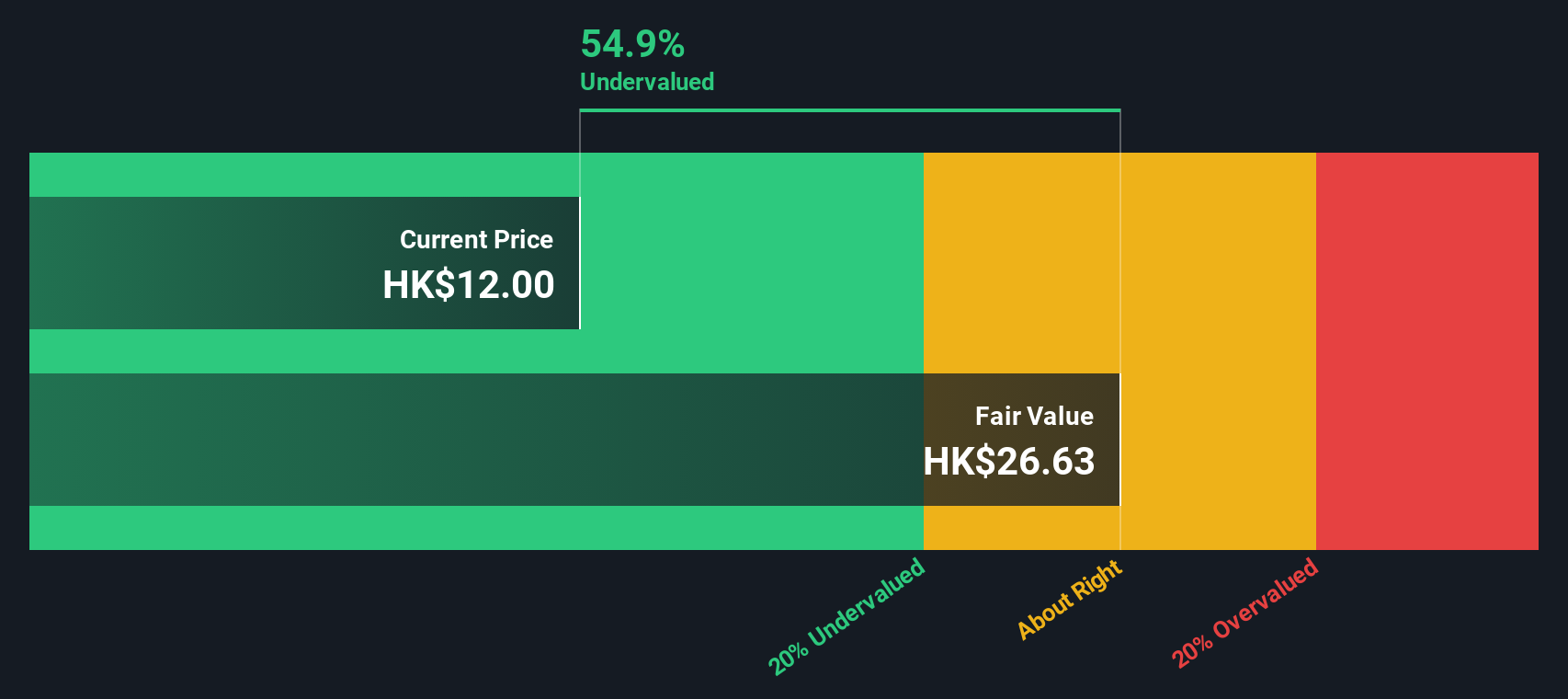

Despite the day-to-day noise, the bigger question is whether Tingyi (Cayman Islands) Holding is currently undervalued, overvalued, or priced just right for its prospects. By running the company through six key valuation checks, Tingyi earns a value score of 4, meaning it comes up undervalued in four out of those six vital areas. But how much does this matter, and what does it really tell us about its long-term potential?

To answer that, it is worth exploring what each valuation method offers. Then it is helpful to take it a step further to uncover the single best way to look at Tingyi's real worth.

Why Tingyi (Cayman Islands) Holding is lagging behind its peersApproach 1: Tingyi (Cayman Islands) Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's value. This helps investors assess whether a stock is trading below or above its estimated true worth, based on the company's ability to generate cash in the future.

For Tingyi (Cayman Islands) Holding, the latest reported Free Cash Flow stands at CN¥4.56 billion. Looking ahead, analysts expect Free Cash Flow to grow, reaching CN¥5.39 billion by 2026 and CN¥5.69 billion by 2027. Beyond that, projections are extrapolated with Simply Wall St estimating the 2035 Free Cash Flow at around CN¥7.40 billion. These figures suggest a steady growth pattern over the coming decade.

Based on this two-stage DCF analysis, the estimated intrinsic value for Tingyi is HK$26.65 per share. This represents a notable intrinsic discount of 57.8% compared to the current share price, signaling the stock appears significantly undervalued according to this approach.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Tingyi (Cayman Islands) Holding.

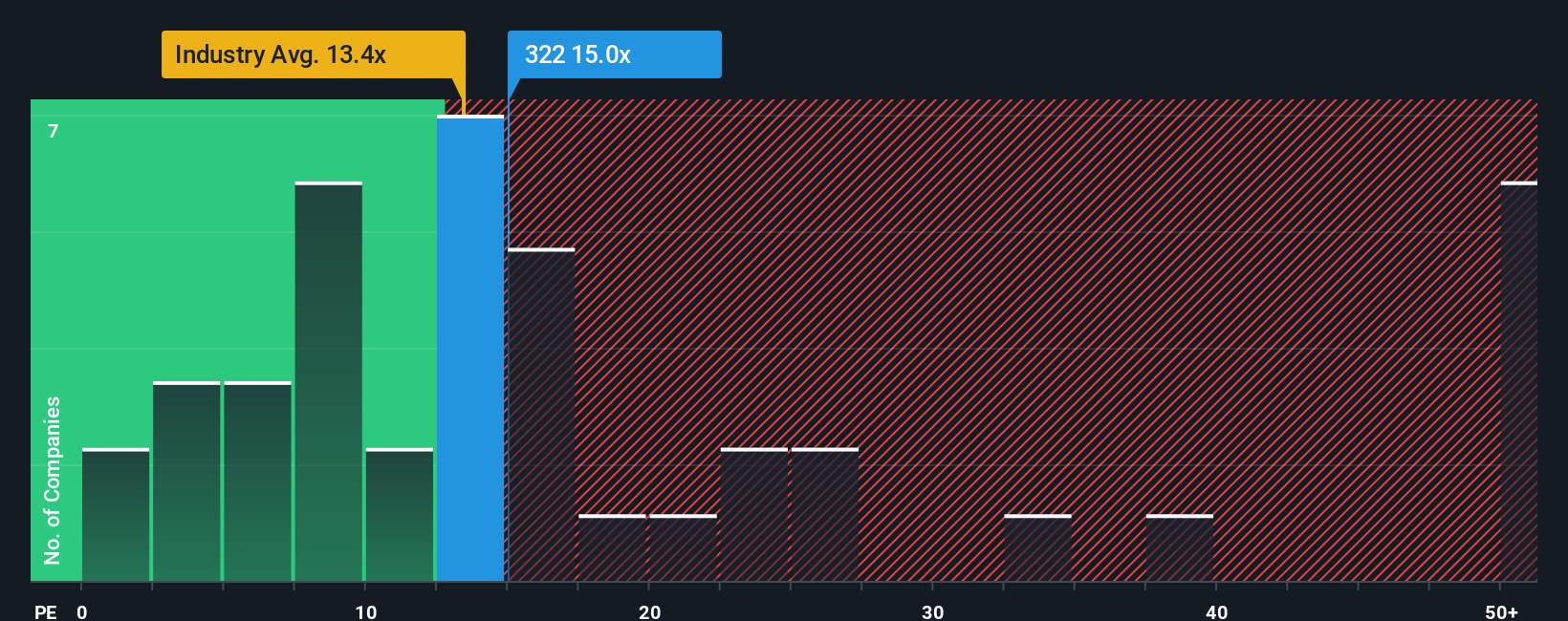

Approach 2: Tingyi (Cayman Islands) Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely favored valuation metric for profitable companies because it captures how much investors are willing to pay for each unit of current earnings. Since Tingyi (Cayman Islands) Holding has consistent profits, the PE ratio gives a quick sense of whether its shares are expensive or cheap compared to the money the company brings in.

Of course, what counts as a "normal" or "fair" PE ratio depends on factors like future earnings growth, stability, and the level of risk. Fast-growing or lower-risk companies often deserve a higher PE. In contrast, slower growth or higher risk might mean a lower PE is appropriate.

Currently, Tingyi trades at a PE ratio of 14.1x. This is just above the peer group average of 13.0x and a touch below the Food industry average of 15.3x. However, comparisons to broad industry data or peer groups can overlook important context, such as Tingyi's specific growth trends, market position, and risk profile.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio (15.5x) is not just an average. It is custom-built for Tingyi, accounting for its profit margins, growth outlook, size, and industry-specific factors. By tailoring the benchmark to the company’s unique situation, the Fair Ratio delivers a more meaningful snapshot of what investors should expect to pay.

Since Tingyi’s actual PE (14.1x) is just under its Fair Ratio (15.5x), the shares look attractively priced when these nuanced factors are taken into account.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Tingyi (Cayman Islands) Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal take on a company; it is the story you build based on your perspective, combining your ideas about Tingyi's future with your own fair value and forecasts for revenue, earnings, and margins. Narratives work by linking the company’s unique story to your financial expectations and ultimately to a calculated fair value, so you see not just what a company is, but where you think it is heading.

On Simply Wall St's Community page, millions of investors write and update Narratives, making it a powerful and easy tool to capture your investment thesis in one place. Narratives help you decide when to buy or sell by directly comparing the Fair Value from your story to the current share price. Plus, they update automatically as new information such as earnings announcements or news becomes available, keeping your perspective relevant and fresh. For Tingyi (Cayman Islands) Holding, some investors believe its fair value is much higher than today’s price, while others see it closer to current levels, all depending on their own Narrative and outlook.

Do you think there's more to the story for Tingyi (Cayman Islands) Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tingyi (Cayman Islands) Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:322

Tingyi (Cayman Islands) Holding

An investment holding company, manufactures and sells instant noodles, beverages, and instant food products in the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives