China Resources Beer (Holdings) (HKG:291) Has A Rock Solid Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies China Resources Beer (Holdings) Company Limited (HKG:291) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for China Resources Beer (Holdings)

What Is China Resources Beer (Holdings)'s Debt?

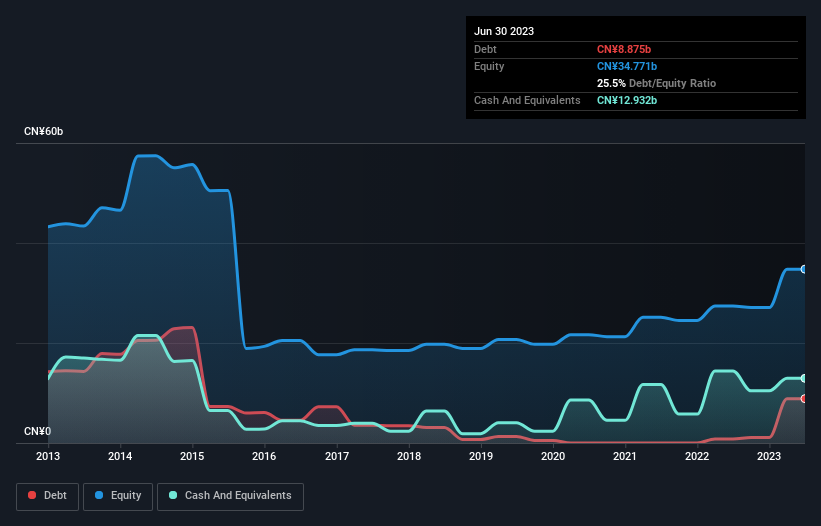

You can click the graphic below for the historical numbers, but it shows that as of June 2023 China Resources Beer (Holdings) had CN¥8.88b of debt, an increase on CN¥800.0m, over one year. However, its balance sheet shows it holds CN¥12.9b in cash, so it actually has CN¥4.06b net cash.

How Strong Is China Resources Beer (Holdings)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Resources Beer (Holdings) had liabilities of CN¥26.5b due within 12 months and liabilities of CN¥15.8b due beyond that. Offsetting this, it had CN¥12.9b in cash and CN¥1.61b in receivables that were due within 12 months. So its liabilities total CN¥27.7b more than the combination of its cash and short-term receivables.

China Resources Beer (Holdings) has a very large market capitalization of CN¥98.5b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Despite its noteworthy liabilities, China Resources Beer (Holdings) boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, China Resources Beer (Holdings) grew its EBIT by 38% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if China Resources Beer (Holdings) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While China Resources Beer (Holdings) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, China Resources Beer (Holdings) recorded free cash flow worth a fulsome 82% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing Up

While China Resources Beer (Holdings) does have more liabilities than liquid assets, it also has net cash of CN¥4.06b. The cherry on top was that in converted 82% of that EBIT to free cash flow, bringing in CN¥3.1b. So we don't think China Resources Beer (Holdings)'s use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of China Resources Beer (Holdings)'s earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:291

China Resources Beer (Holdings)

An investment holding company, manufactures, distributes, and sells beer products in Mainland China.

Excellent balance sheet and good value.