Is Dekon’s Share Buyback Program Shaping a New Capital Allocation Narrative for SEHK:2419?

Reviewed by Sasha Jovanovic

- Dekon Food and Agriculture Group announced that it has commenced a share repurchase program, following shareholder approval in April 2025 to buy back up to 12,806,418 shares, representing 3.29% of its issued share capital.

- This move utilizes company funds and reflects adherence to applicable Chinese laws, with the repurchase mandate set to expire at the next Annual General Meeting or upon any revision in a general meeting.

- We’ll examine how Dekon’s decision to initiate a substantial share buyback program shapes the company’s overall investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Dekon Food and Agriculture Group's Investment Narrative?

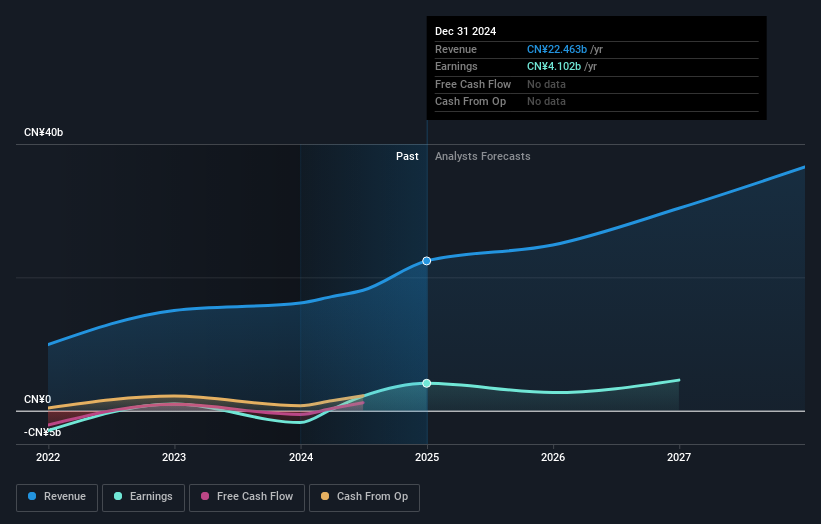

If you’re considering Dekon Food and Agriculture Group, you’ll need confidence in its ability to maintain robust earnings growth and navigate the cyclical pressures of China’s food and agriculture sector. The recent share buyback announcement adds a new dimension, signaling the board’s conviction in Dekon’s underlying value and possibly supporting share price sentiment in the short term. However, it may have only a limited direct impact on the most pressing catalysts: operational efficiency, margin recovery, and regulatory changes, all of which remain vital to Dekon’s story. Risks like management turnover and the concentration of board influence, only a third of directors are independent, should stay on any investor’s radar. Short-term share price volatility and broader sector concerns may outweigh any immediate technical lift from the buyback, judging by recent market moves.

But investors should also keep an eye on governance risks tied to board independence. Despite retreating, Dekon Food and Agriculture Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Dekon Food and Agriculture Group - why the stock might be worth over 2x more than the current price!

Build Your Own Dekon Food and Agriculture Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dekon Food and Agriculture Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dekon Food and Agriculture Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dekon Food and Agriculture Group's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2419

Dekon Food and Agriculture Group

Engages in the livestock and poultry breeding and farming businesses.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026