As global markets react to potential shifts in U.S. monetary policy, Asian stocks have been navigating a complex landscape marked by varying economic indicators and investor sentiment. Penny stocks, though often seen as remnants of past market trends, continue to offer unique opportunities for investors interested in smaller or newer companies with growth potential. By focusing on those with strong financials and a clear growth trajectory, investors can uncover promising prospects within this niche segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.04 | THB3.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.55 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.59 | HK$2.16B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.64 | SGD259.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.22 | HK$2.04B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.72 | THB9.54B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$4.73 billion.

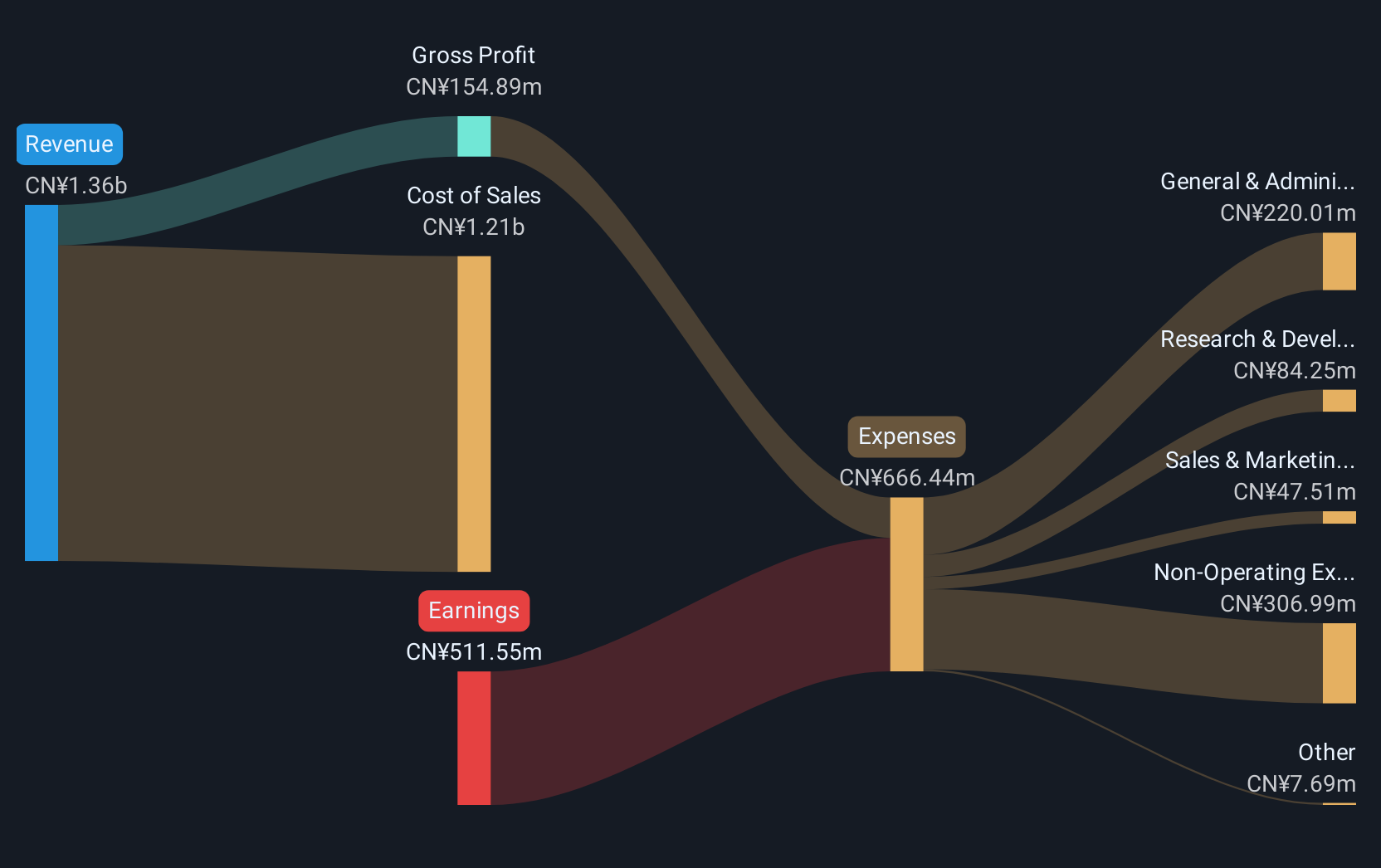

Operations: The company's revenue is primarily derived from Dairy and Related Products, generating CN¥7.10 billion, followed by Nutrition Products at CN¥304.56 million.

Market Cap: HK$4.73B

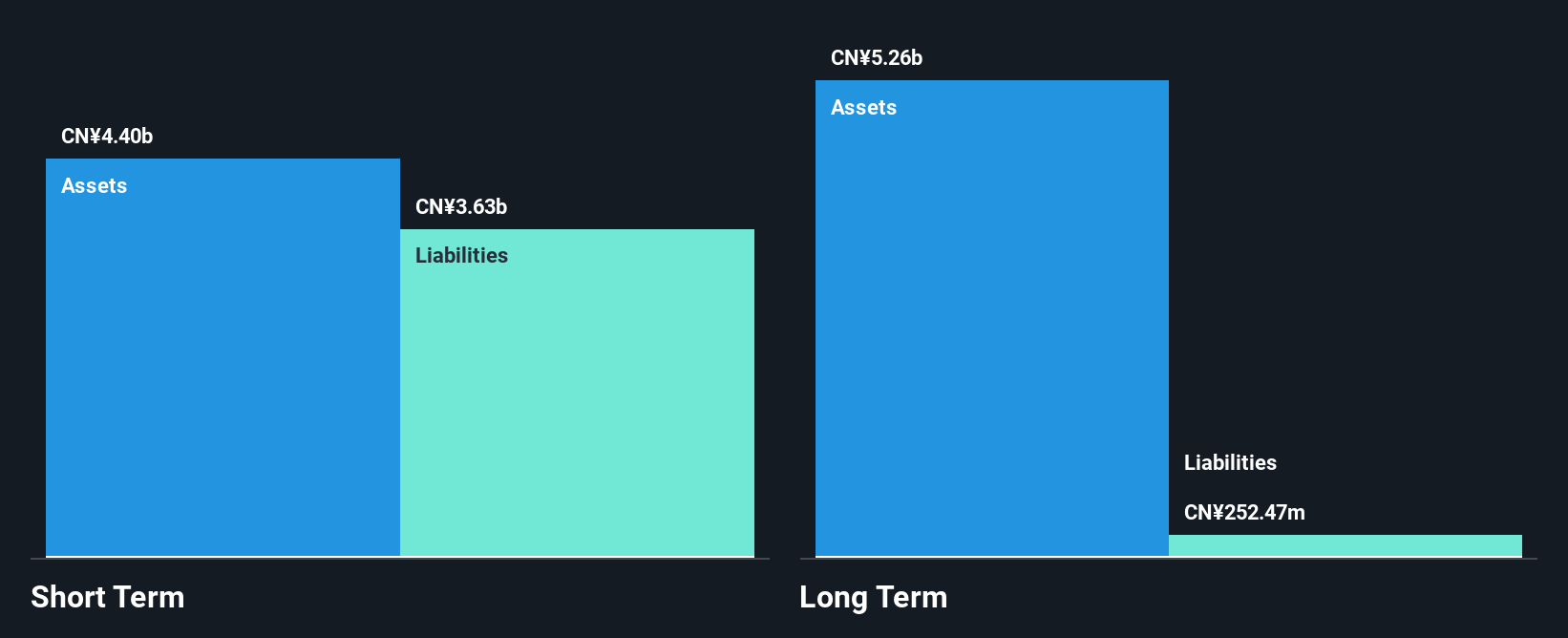

Ausnutria Dairy Corporation Ltd, with a market cap of HK$4.73 billion, has shown significant earnings growth over the past year at 35.3%, surpassing the industry average. Despite this growth, its return on equity remains low at 4.3%. The company's financial stability is supported by short-term assets exceeding both short and long-term liabilities and satisfactory net debt to equity ratio of 12.4%. However, its operating cash flow covers only 14% of its debt, indicating potential liquidity concerns. Recent executive changes include the appointment of Ms. Yang Ruijie as CFO, bringing extensive financial management experience to the team.

- Unlock comprehensive insights into our analysis of Ausnutria Dairy stock in this financial health report.

- Gain insights into Ausnutria Dairy's outlook and expected performance with our report on the company's earnings estimates.

Banyan Tree Holdings (SGX:B58)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Banyan Tree Holdings Limited is a hospitality company based in Singapore that operates across South East Asia, Indian Oceania, the Middle East, North East Asia, and internationally with a market cap of SGD515.81 million.

Operations: The company's revenue is primarily derived from its Hotel Investments segment at SGD202.33 million, followed by Fee-Based services and Residences, contributing SGD123.38 million and SGD121.02 million respectively.

Market Cap: SGD515.81M

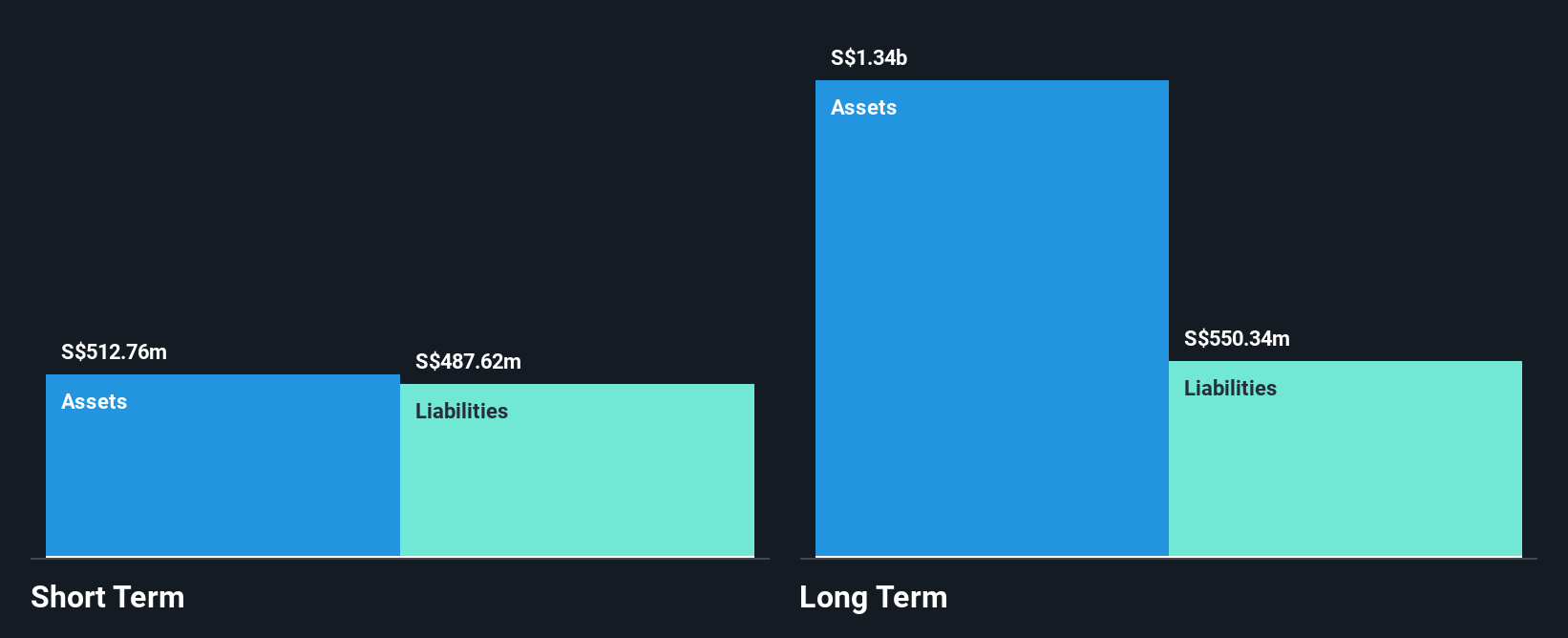

Banyan Tree Holdings Limited, with a market cap of SGD515.81 million, has demonstrated a solid revenue stream primarily from its Hotel Investments segment. Recent earnings results show sales of SGD206.07 million for the half-year ending June 2025, reflecting growth from the previous year. However, while short-term assets cover liabilities effectively, long-term liabilities remain uncovered by short-term assets. The company's net debt to equity ratio is satisfactory at 29.5%, yet interest payments are not well covered by EBIT (2.4x coverage). Despite these challenges, Banyan Tree's strategic expansions and consistent profit growth highlight its resilience in the hospitality sector.

- Take a closer look at Banyan Tree Holdings' potential here in our financial health report.

- Assess Banyan Tree Holdings' previous results with our detailed historical performance reports.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the materials sector and has a market cap of CN¥8.94 billion.

Operations: No specific revenue segments have been reported for Guangdong DFP New Material Group Co., Ltd.

Market Cap: CN¥8.94B

Guangdong DFP New Material Group, with a market cap of CN¥8.94 billion, presents a complex picture in the penny stock landscape. Despite trading significantly below estimated fair value and having reduced its debt-to-equity ratio over five years, the company remains unprofitable with increasing losses. However, its short-term assets of CN¥3.3 billion comfortably cover both short- and long-term liabilities, indicating financial stability despite operational challenges. The recent acquisition of a 29.90% stake by Quzhou entities for CN¥1.9 billion could signal strategic shifts or potential growth opportunities as earnings are forecast to grow substantially at 145.45% annually.

- Click to explore a detailed breakdown of our findings in Guangdong DFP New Material Group's financial health report.

- Examine Guangdong DFP New Material Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Explore the 968 names from our Asian Penny Stocks screener here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1717

Ausnutria Dairy

An investment holding company, primarily engages in the research and development, production, marketing, processing, packaging, and distribution of dairy and related products, and nutrition products.

Good value with proven track record.

Market Insights

Community Narratives