How Investors Are Reacting To Want Want (SEHK:151) Modest Sales Growth and Margin Pressures in Half-Year Results

Reviewed by Sasha Jovanovic

- On November 24, 2025, Want Want China Holdings Limited reported half-year earnings, with sales reaching CNY 11,107.79 million and net income totaling CNY 1,717.43 million, both compared to the previous year's figures for the period ended September 30, 2025.

- While sales saw modest growth, the company's decline in net income and earnings per share highlights margin pressures despite increasing top-line revenue.

- We’ll explore how improving sales alongside shrinking profitability shapes Want Want China Holdings' investment narrative and future positioning.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Want Want China Holdings' Investment Narrative?

To be a shareholder in Want Want China Holdings, you need to believe in the company’s ability to drive consistent revenue growth while navigating ongoing profitability pressures and competitive industry conditions. The recent half-year results showing sales growth to CNY 11.11 billion but lower net income and earnings per share suggest margin challenges remain a pressing short-term issue. For now, this development is material: it raises key questions about cost control, inflation impacts, and whether volume gains can offset thinner profits. Previous analysis highlighted slow revenue and earnings growth as a primary risk, but with the margin dip now confirmed, near-term catalysts like potential share buybacks or dividend adjustments may be overshadowed by persistent cost headwinds. Investors are likely to watch upcoming earnings and governance moves even more closely in light of these recent numbers. But with net profit down despite higher sales, cost pressures are crucial to monitor.

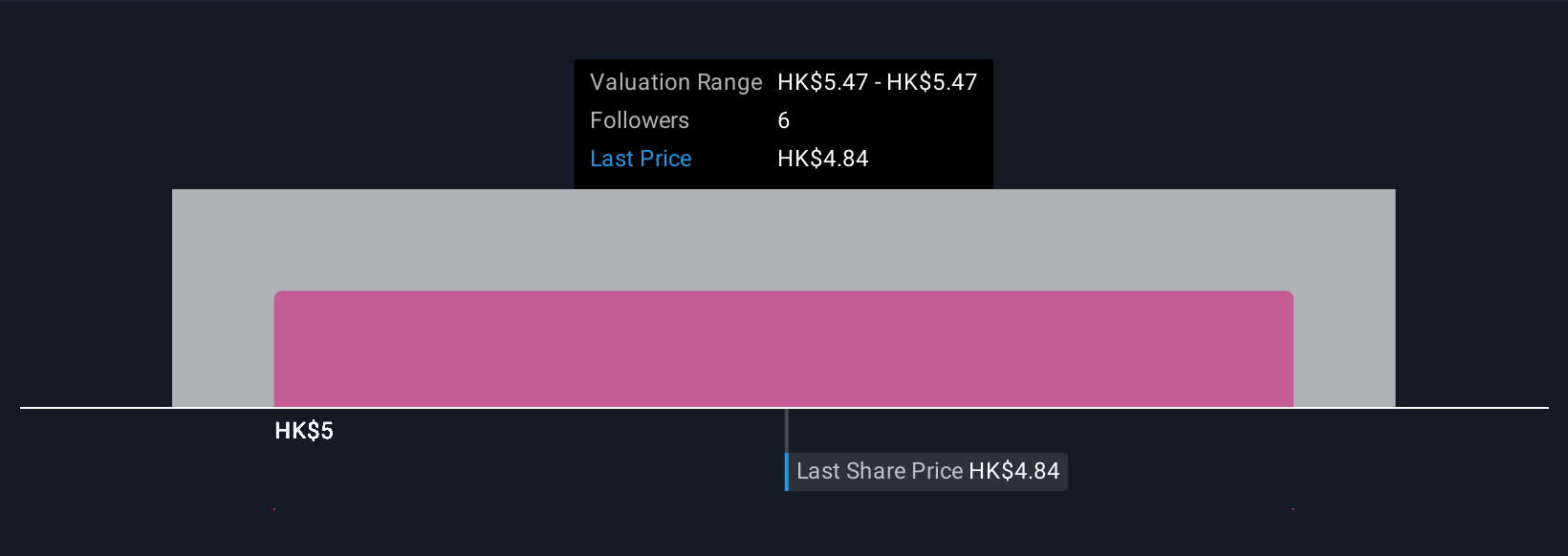

Despite retreating, Want Want China Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Want Want China Holdings - why the stock might be worth just HK$5.48!

Build Your Own Want Want China Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Want Want China Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Want Want China Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Want Want China Holdings' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Want Want China Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:151

Want Want China Holdings

An investment holding company, engages in the manufacture, distribution, and sale of food and beverages.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026