If You Like EPS Growth Then Check Out Hung Fook Tong Group Holdings (HKG:1446) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Hung Fook Tong Group Holdings (HKG:1446). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Hung Fook Tong Group Holdings

How Fast Is Hung Fook Tong Group Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Hung Fook Tong Group Holdings's stratospheric annual EPS growth of 38%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

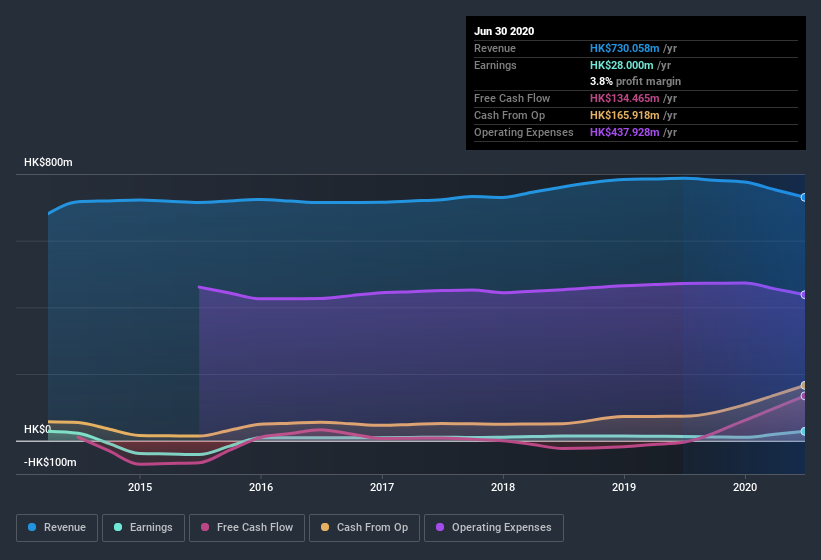

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Hung Fook Tong Group Holdings's revenue dropped 7.2% last year, but the silver lining is that EBIT margins improved from 1.8% to 4.7%. That falls short of ideal.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Hung Fook Tong Group Holdings is no giant, with a market capitalization of HK$354m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Hung Fook Tong Group Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Hung Fook Tong Group Holdings shares, in the last year. With that in mind, it's heartening that Wing Fu Szeto, the Executive Director & CEO of the company, paid HK$351k for shares at around HK$0.35 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Hung Fook Tong Group Holdings insiders own more than a third of the company. In fact, they own 51% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have HK$180m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Hung Fook Tong Group Holdings To Your Watchlist?

Hung Fook Tong Group Holdings's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Hung Fook Tong Group Holdings belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Hung Fook Tong Group Holdings you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hung Fook Tong Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Hung Fook Tong Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hung Fook Tong Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1446

Hung Fook Tong Group Holdings

An investment holding company, together with its subsidiaries, produces, retails, and distributes bottled drinks and other herbal products, soups, and snacks in the People’s Republic of China, Hong Kong, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives