- New Zealand

- /

- Machinery

- /

- NZSE:SKL

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by uncertainty surrounding the incoming U.S. administration's policies, global markets experienced notable fluctuations, with major indices like the S&P 500 and Russell 2000 seeing declines. As investors navigate these turbulent times, small-cap stocks—often overlooked in favor of larger counterparts—can present unique opportunities due to their potential for growth and agility in adapting to changing economic landscapes. Identifying promising small-cap companies involves assessing their financial health, market position, and ability to capitalize on emerging trends amid broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Intelligent Wave | NA | 7.39% | 15.42% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shenzhen Longtech Smart Control | 3.11% | 18.50% | 15.96% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Skellerup Holdings (NZSE:SKL)

Simply Wall St Value Rating: ★★★★★★

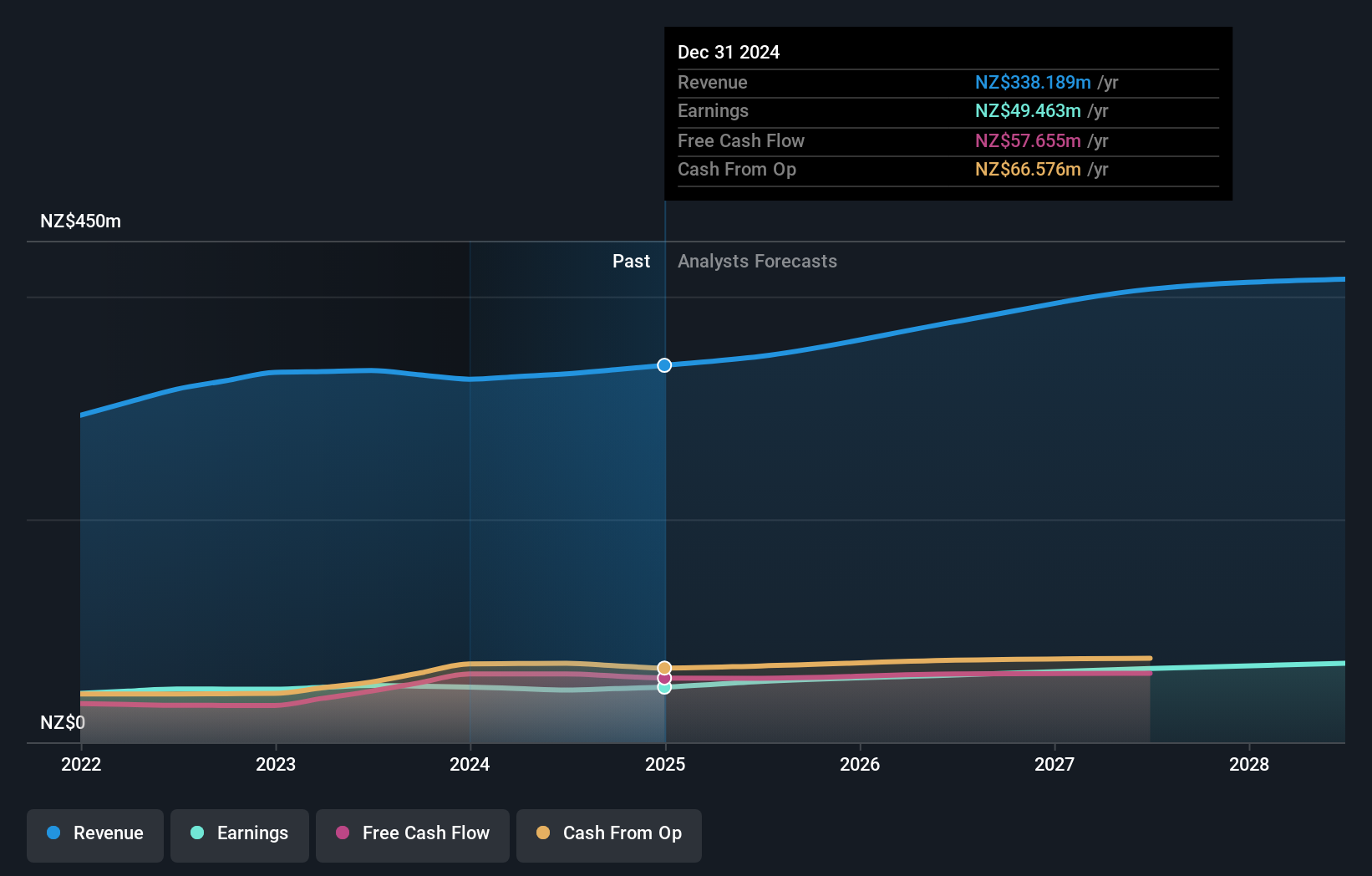

Overview: Skellerup Holdings Limited designs, manufactures, and distributes engineered products for various specialist industrial and agricultural applications with a market cap of NZ$964.67 million.

Operations: Skellerup Holdings generates revenue primarily from its Agri segment, contributing NZ$105.29 million, and its Industrial segment, which brings in NZ$226.22 million. The company has a market cap of NZ$964.67 million.

Skellerup Holdings, a promising name in the industrial sector, trades at 25.2% below its estimated fair value, making it an attractive prospect for those seeking undervalued opportunities. The company's financial health is underlined by a satisfactory net debt to equity ratio of 6.7%, which has decreased from 26% over the past five years. Despite facing negative earnings growth of -7.9% last year, Skellerup's high-quality earnings and robust EBIT coverage of interest payments at 16.8 times suggest resilience and potential for recovery with forecasted annual earnings growth of 9.17%.

- Navigate through the intricacies of Skellerup Holdings with our comprehensive health report here.

Gain insights into Skellerup Holdings' past trends and performance with our Past report.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

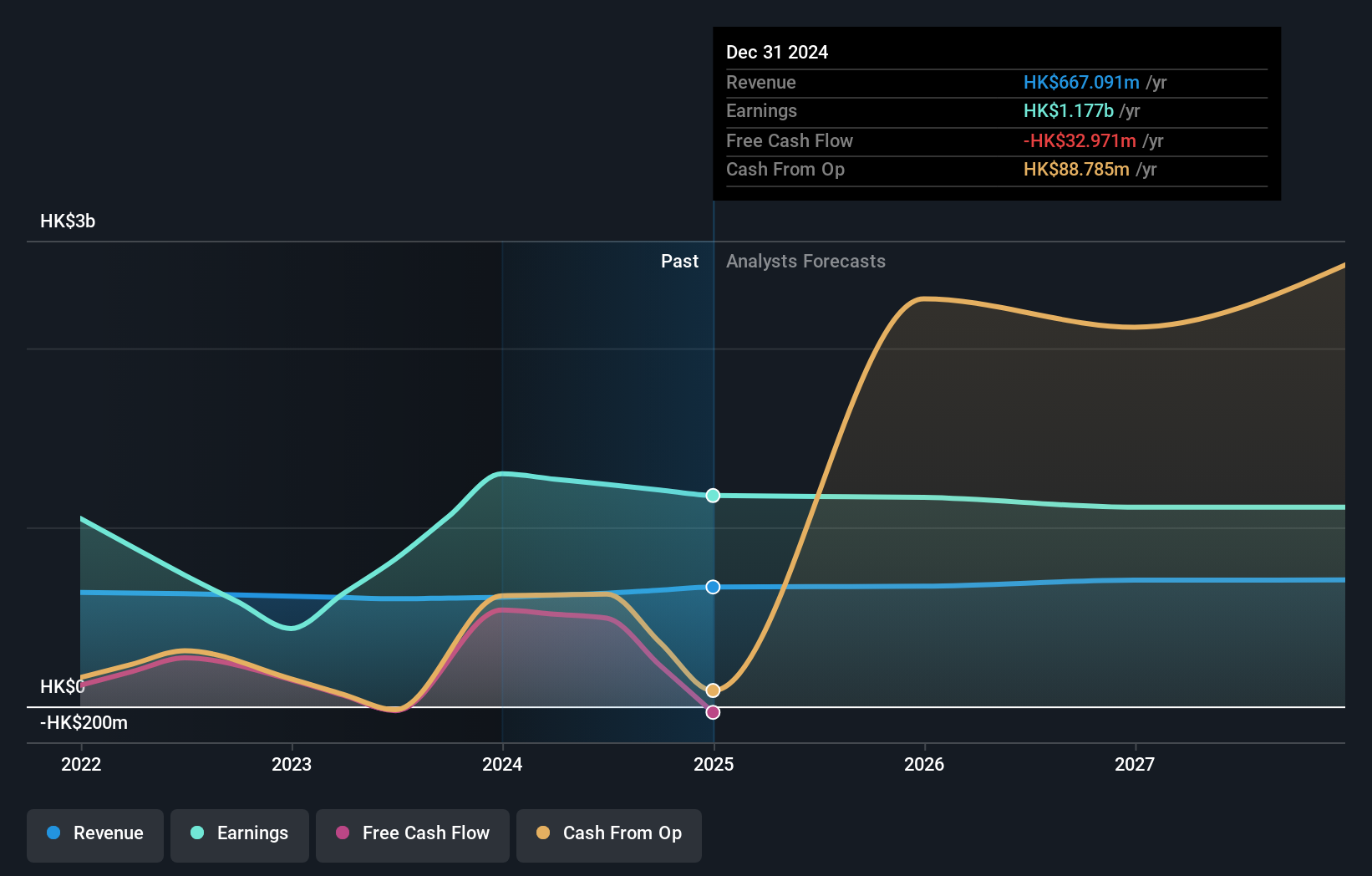

Overview: Sinopec Kantons Holdings Limited is an investment holding company that provides crude oil jetty services, with a market capitalization of HK$10.74 billion.

Operations: Revenue primarily stems from crude oil jetty and storage services, amounting to HK$632.38 million.

Sinopec Kantons Holdings, a smaller player in the energy sector, has shown noteworthy financial resilience. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio stood at 25.5%. Its earnings growth of 50.8% over the past year outpaced the oil and gas industry average of -2.7%, indicating robust performance relative to peers. Trading at 62.4% below estimated fair value suggests potential undervaluation in the market's eyes. Despite reporting net income of HK$685 million for H1 2024, down from HK$744 million last year, it remains profitable with high-quality earnings and positive free cash flow.

- Unlock comprehensive insights into our analysis of Sinopec Kantons Holdings stock in this health report.

Understand Sinopec Kantons Holdings' track record by examining our Past report.

Base (TSE:4481)

Simply Wall St Value Rating: ★★★★★★

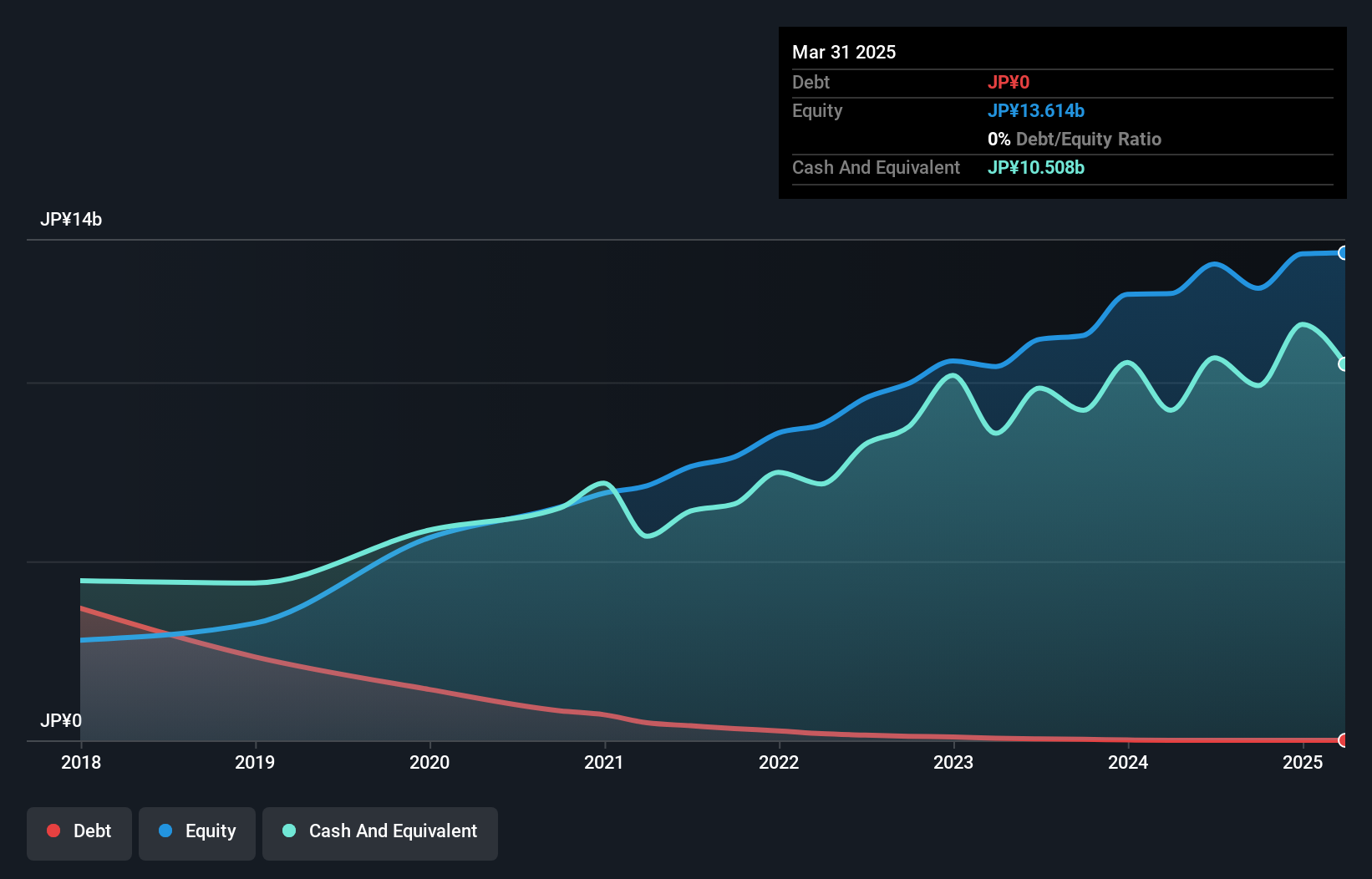

Overview: BASE CO., LTD. specializes in computer software development and related services within Japan, with a market capitalization of ¥59.79 billion.

Operations: The company's revenue is primarily derived from its Contracted Software Development Business, amounting to ¥19.21 billion.

Base, a small cap entity, has been making waves with its robust financial health and strategic moves. Over the past year, earnings surged by 20.3%, outpacing the IT industry's 10.1% growth rate. The company is trading at a value 47.8% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Notably, Base is debt-free now compared to five years ago when it had a debt-to-equity ratio of 42.2%. Recently, it repurchased 196,700 shares for ¥611.74 million between August and September 2024, underscoring confidence in its future prospects without straining financial resources.

- Click here and access our complete health analysis report to understand the dynamics of Base.

Explore historical data to track Base's performance over time in our Past section.

Next Steps

- Navigate through the entire inventory of 4654 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKL

Skellerup Holdings

Designs, manufactures, and distributes engineered products for various specialist industrial and agricultural applications.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives