- Hong Kong

- /

- Oil and Gas

- /

- SEHK:689

Take Care Before Jumping Onto EPI (Holdings) Limited (HKG:689) Even Though It's 27% Cheaper

To the annoyance of some shareholders, EPI (Holdings) Limited (HKG:689) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

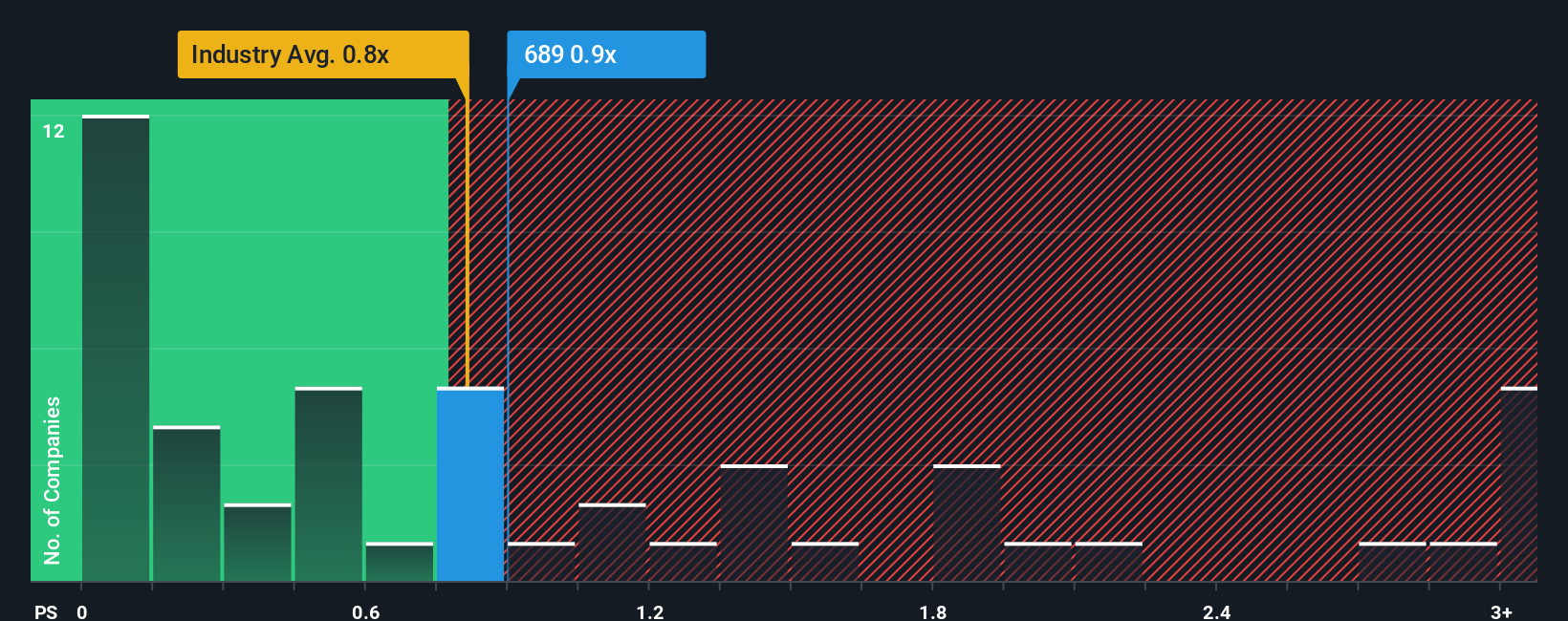

Even after such a large drop in price, there still wouldn't be many who think EPI (Holdings)'s price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in Hong Kong's Oil and Gas industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for EPI (Holdings)

How EPI (Holdings) Has Been Performing

We'd have to say that with no tangible growth over the last year, EPI (Holdings)'s revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on EPI (Holdings)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like EPI (Holdings)'s is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 238% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

In contrast to the company, the rest of the industry is expected to decline by 2.1% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that EPI (Holdings) is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for EPI (Holdings) looks to be in line with the rest of the Oil and Gas industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of EPI (Holdings) revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for EPI (Holdings) (of which 1 is concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if EPI (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:689

EPI (Holdings)

An investment holding company, primarily engages in the exploration and production of petroleum in Canada and Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives