- Hong Kong

- /

- Consumer Finance

- /

- SEHK:373

3 Asian Penny Stocks With Market Caps Under US$800M To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions and economic uncertainties, investors are increasingly looking toward smaller-cap opportunities for potential growth. While the term "penny stocks" may seem outdated, it continues to signify the potential of lesser-known companies that can offer substantial value. By focusing on those with solid financial foundations, investors might uncover promising prospects among these stocks.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.103 | SGD43.77M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.23 | HK$776.07M | ✅ 4 ⚠️ 2 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.32 | HK$178.22M | ✅ 2 ⚠️ 4 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.12 | HK$1.77B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.175 | SGD34.86M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.09 | SGD847.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.68 | HK$53.61B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,160 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development, as well as financial services across Hong Kong, the People's Republic of China, the United Kingdom, and Australia, with a market cap of HK$5.69 billion.

Operations: The company's revenue is primarily derived from consumer finance (HK$3.14 billion), healthcare services (HK$1.58 billion), property investment (HK$908.6 million), property management (HK$358.1 million), property development (HK$520.5 million), elderly care services (HK$211 million), and investment and finance activities (HK$839.3 million).

Market Cap: HK$5.69B

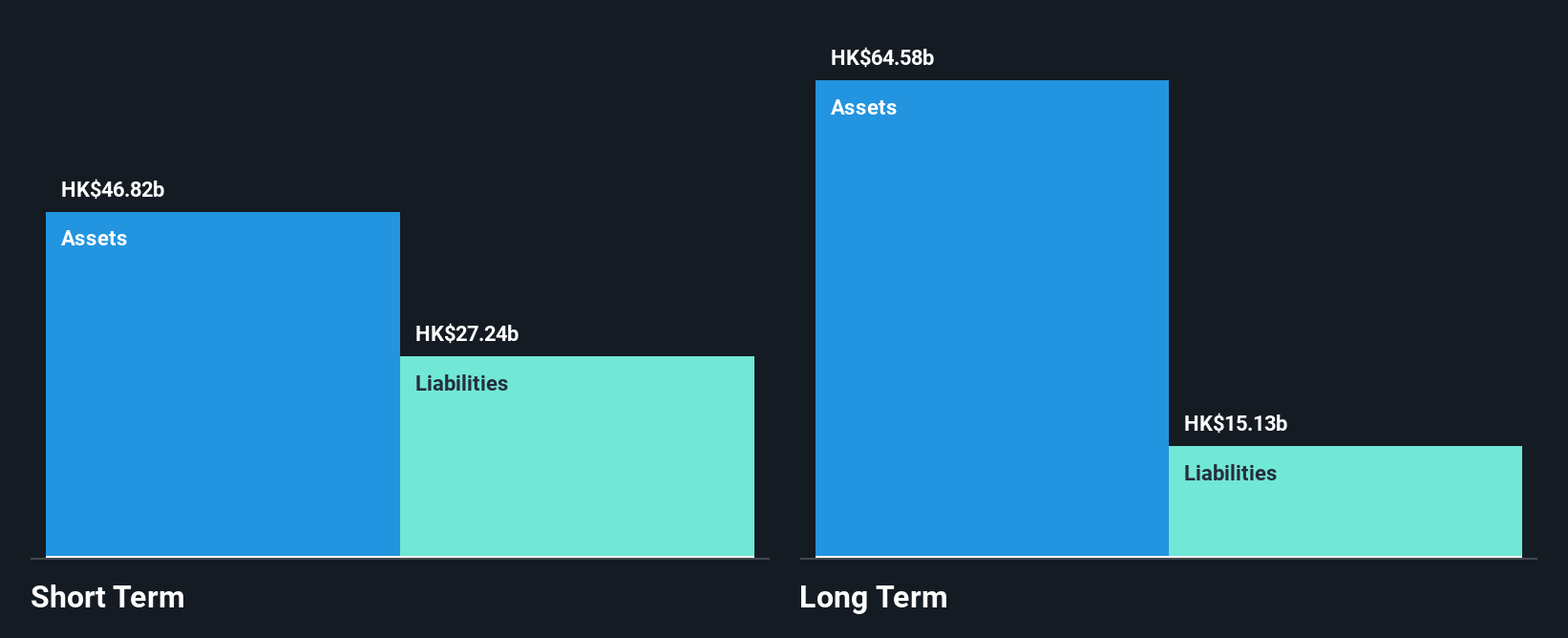

Allied Group Limited, with a market cap of HK$5.69 billion, is navigating challenges as it remains unprofitable despite diverse revenue streams from consumer finance and property investments. Recent financials reveal a net loss of HK$776.7 million for 2024, up from the previous year. The company has reduced its debt to equity ratio over five years but still faces issues with operating cash flow not adequately covering debt obligations. A recent sub-tenancy agreement aligns with market conditions and aims to minimize operational disruptions, reflecting prudent management amidst financial volatility and strategic asset utilization efforts.

- Click to explore a detailed breakdown of our findings in Allied Group's financial health report.

- Review our historical performance report to gain insights into Allied Group's track record.

Chinese People Holdings (SEHK:681)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chinese People Holdings Company Limited is an investment holding company involved in piped gas transmission and distribution, cylinder gas supply, gas distribution, and FMCG and food ingredients supply in China, with a market cap of HK$321.64 million.

Operations: The company's revenue is primarily derived from piped gas transmission and distribution (CN¥1.09 billion), followed by gas distribution (CN¥793.40 million), cylinder gas supply (CN¥677.63 million), and FMCG and food ingredients supply (CN¥71.07 million).

Market Cap: HK$321.64M

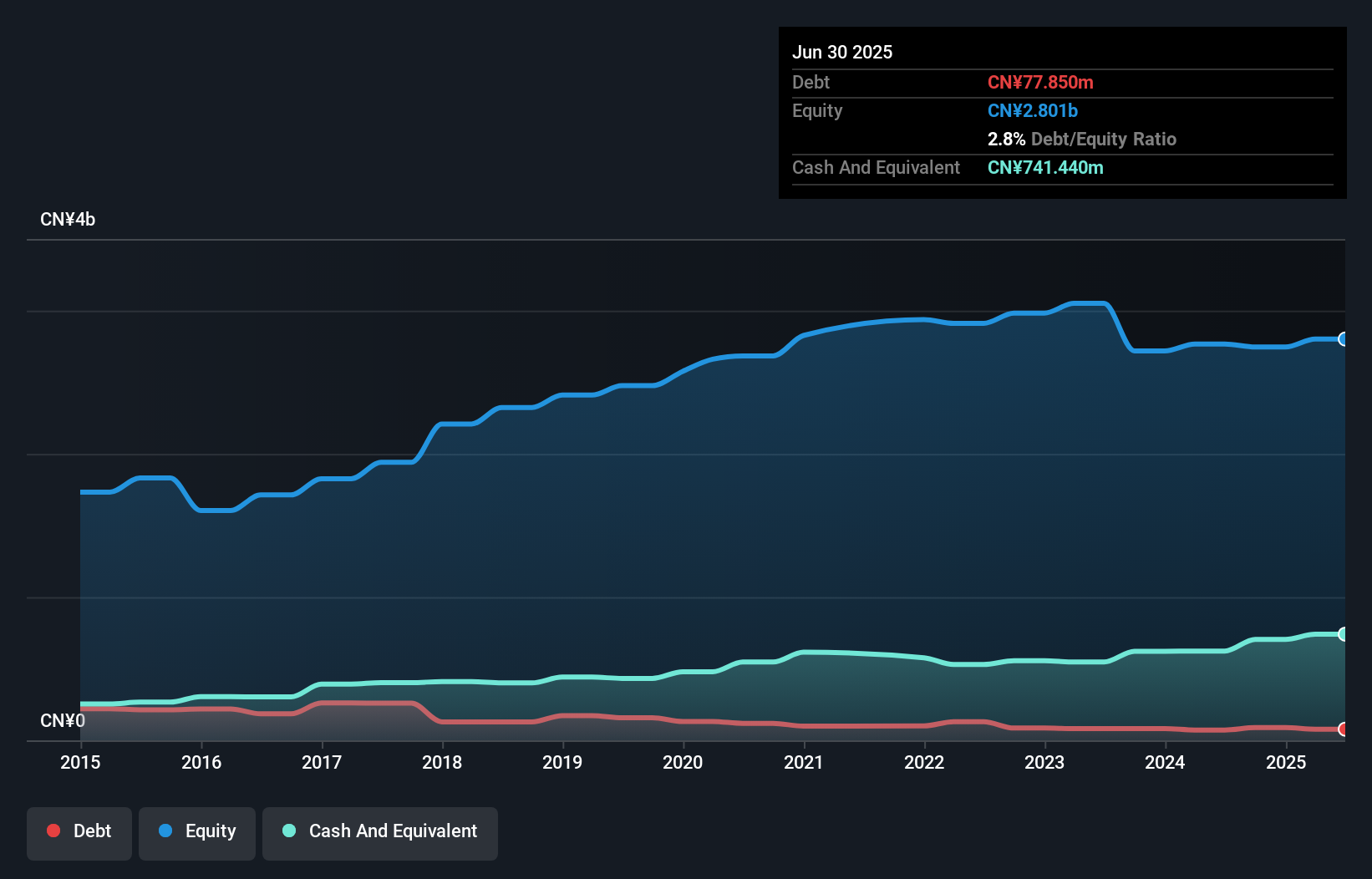

Chinese People Holdings Company Limited, with a market cap of HK$321.64 million, has recently turned profitable, reporting an expected profit of RMB 59 million for 2024 due to improved joint venture performance. Despite past earnings declines and high volatility, the company's financial position is supported by short-term assets exceeding liabilities and operating cash flow well covering debt. However, low return on equity and a large one-off loss impacting recent results remain concerns. The stock trades significantly below estimated fair value, suggesting potential undervaluation amidst these mixed financial signals.

- Get an in-depth perspective on Chinese People Holdings' performance by reading our balance sheet health report here.

- Evaluate Chinese People Holdings' historical performance by accessing our past performance report.

Tongda Group Holdings (SEHK:698)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tongda Group Holdings Limited is an investment holding company that provides high-precision structural parts for smart mobile communications and consumer electronic products globally, with a market cap of HK$817.79 million.

Operations: The company's revenue is primarily derived from Consumer Electronics Structural Components, generating HK$4.54 billion, and Household and Sports Goods, contributing HK$1.05 billion.

Market Cap: HK$817.79M

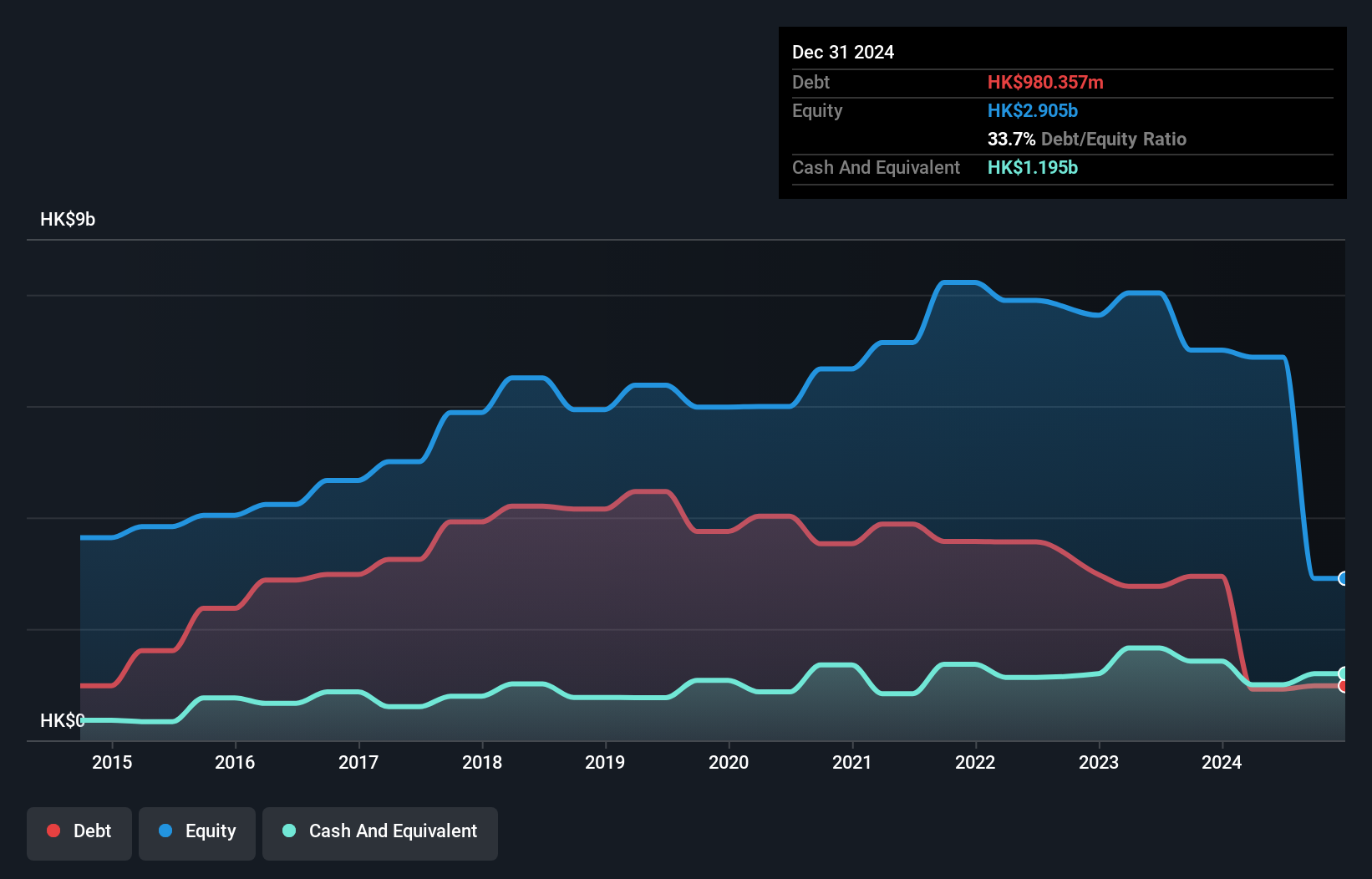

Tongda Group Holdings, with a market cap of HK$817.79 million, remains unprofitable despite generating significant revenue from Consumer Electronics Structural Components and Household and Sports Goods. The company faces challenges with a net loss of HK$3.94 billion in 2024, up from the previous year, alongside negative return on equity. However, it holds more cash than debt and has reduced its debt-to-equity ratio over five years. Trading well below estimated fair value suggests potential undervaluation despite ongoing losses. Management's experience adds stability as they navigate financial hurdles while earnings are forecast to grow substantially annually.

- Dive into the specifics of Tongda Group Holdings here with our thorough balance sheet health report.

- Gain insights into Tongda Group Holdings' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1,160 companies within our Asian Penny Stocks screener.

- Ready For A Different Approach? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:373

Allied Group

An investment holding company, engages in the property investment and development, and financial service businesses in Hong Kong, the People's Republic of China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives