- Hong Kong

- /

- Oil and Gas

- /

- SEHK:554

Update: Hans Energy (HKG:554) Stock Gained 24% In The Last Three Years

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Hans Energy Company Limited (HKG:554), which is up 24%, over three years, soundly beating the market return of 6.7% (not including dividends).

Check out our latest analysis for Hans Energy

Given that Hans Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

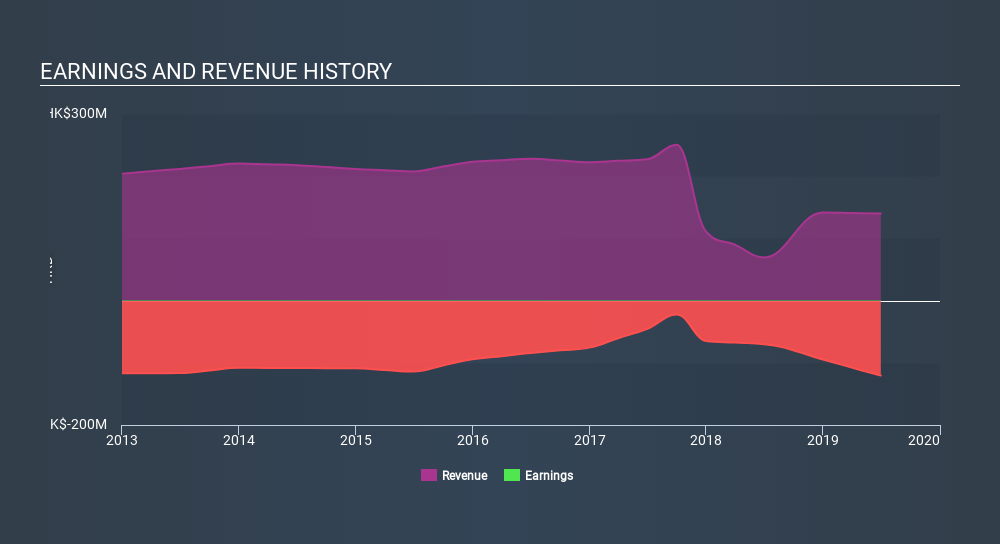

Hans Energy actually saw its revenue drop by 26% per year over three years. Despite the lack of revenue growth, the stock has returned 7.6%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

The graphic below depicts how revenue has changed over time.

Take a more thorough look at Hans Energy's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Hans Energy has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4.1% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:554

Hans Group Holdings

An investment holding company, provides terminal, jetties, storage tanks, and warehousing and logistic services for petroleum, liquid chemical, and gas products in the People’s Republic of China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives