- Hong Kong

- /

- Electrical

- /

- SEHK:1868

Neo-Neon Holdings And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets react to potential shifts in monetary policy, investors are increasingly looking toward Asia for unique opportunities. Despite the term "penny stock" sounding somewhat antiquated, these stocks continue to offer intriguing prospects for growth, particularly when they involve smaller or newer companies with solid financial foundations. In this article, we explore three Asian penny stocks that exemplify strong balance sheets and promising potential, providing investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.82 | THB3.77B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.89 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.62 | SGD251.28M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.92 | SGD11.49B | ✅ 5 ⚠️ 1 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.70 | THB9.5B | ✅ 3 ⚠️ 3 View Analysis > |

| Skellerup Holdings (NZSE:SKL) | NZ$4.95 | NZ$970.55M | ✅ 3 ⚠️ 1 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.98 | SGD1.09B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 976 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Neo-Neon Holdings (SEHK:1868)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neo-Neon Holdings Limited is an investment holding company involved in the R&D, manufacturing, distribution, and sale of lighting products across North America, Europe, China, and other international markets with a market cap of HK$921.56 million.

Operations: The company's revenue is primarily derived from North America with CN¥715.53 million, followed by Europe at CN¥12.03 million, Asia (excluding the PRC) at CN¥11.78 million, and the People's Republic of China contributing CN¥1.64 million.

Market Cap: HK$921.56M

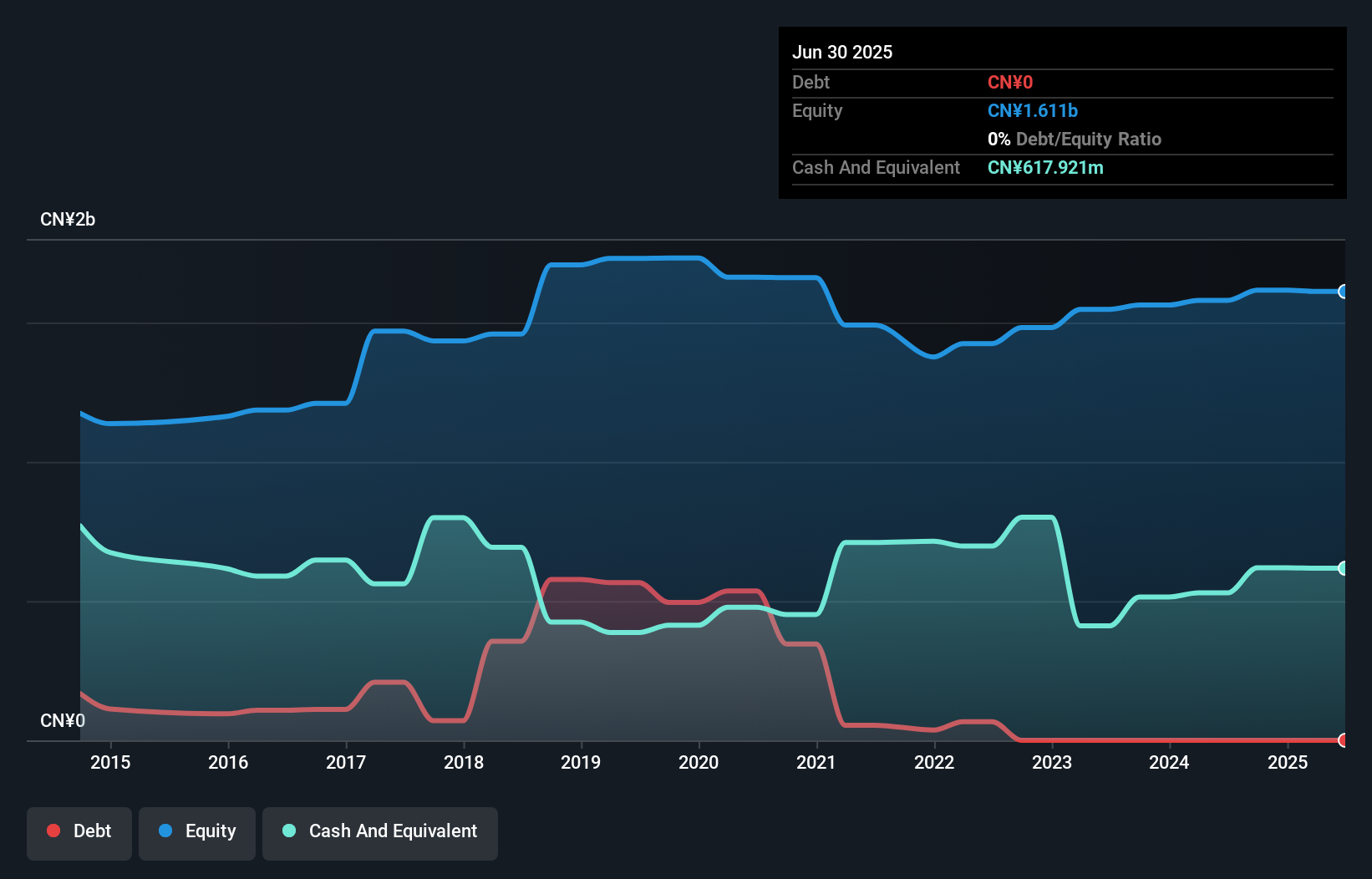

Neo-Neon Holdings Limited, with a market cap of HK$921.56 million, has demonstrated a mixed performance recently. The company reported half-year sales of CN¥290.08 million and net income of CN¥4.95 million, reflecting a decline from the previous year due to increased material costs and distribution expenses driven by inflationary pressures. Despite this, Neo-Neon remains debt-free and its short-term assets significantly exceed both short- and long-term liabilities, indicating financial stability. However, the management team is relatively new with an average tenure of 1.8 years, which may impact strategic continuity in navigating market challenges.

- Click to explore a detailed breakdown of our findings in Neo-Neon Holdings' financial health report.

- Evaluate Neo-Neon Holdings' historical performance by accessing our past performance report.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, clean energy, and energy trading operations across Pakistan, South Asia, the Middle East, and North Africa with a market cap of HK$15.25 billion.

Operations: The company's revenue is derived from two main segments: Trading, which generated HK$7.66 billion, and Exploration and Production, contributing HK$9.86 billion.

Market Cap: HK$15.25B

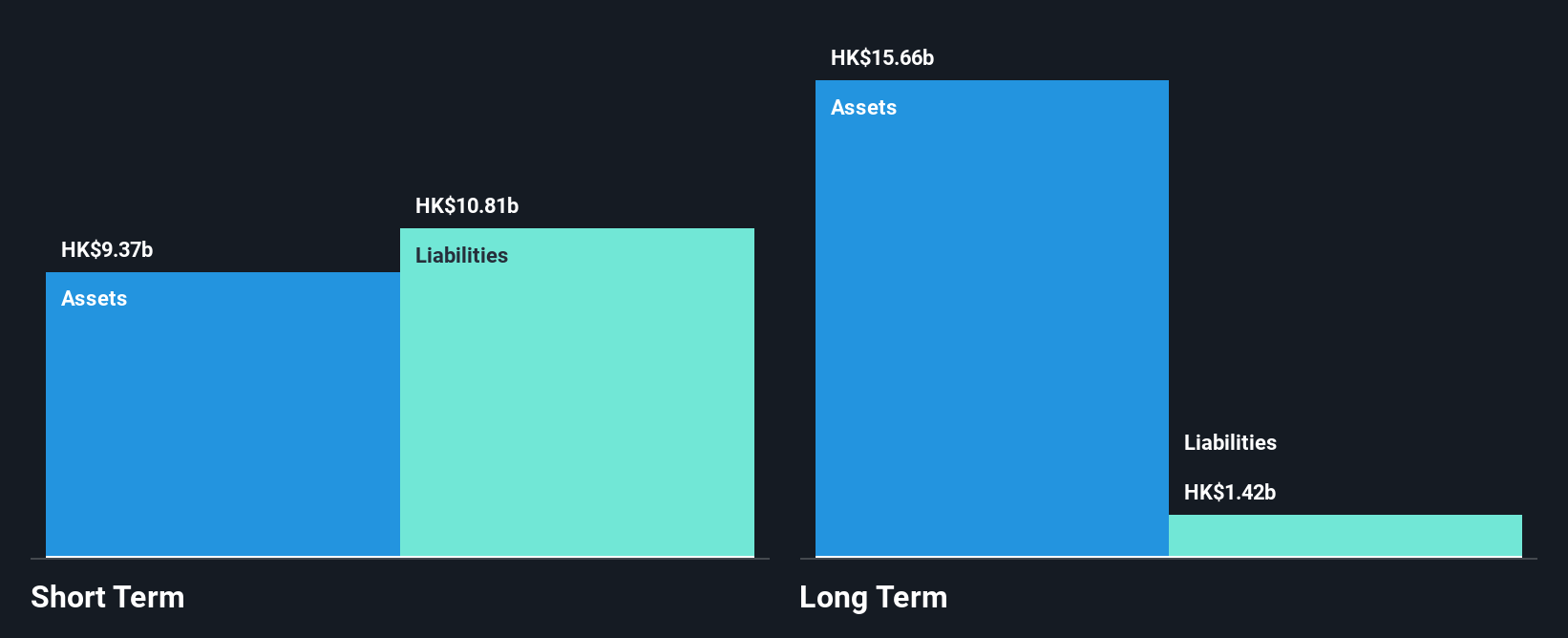

United Energy Group, with a market cap of HK$15.25 billion, has recently turned profitable, complicating comparisons with its historical earnings growth. The company trades significantly below estimated fair value and maintains robust short-term assets exceeding both short- and long-term liabilities. Despite a low return on equity at 11.7%, the company's debt level is well covered by cash flow, indicating financial health. However, recent leadership changes may affect strategic direction as the board lacks seasoned experience with an average tenure of 0.2 years. Volatile share prices and significant insider selling could also pose risks for investors.

- Click here to discover the nuances of United Energy Group with our detailed analytical financial health report.

- Assess United Energy Group's future earnings estimates with our detailed growth reports.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥40.71 billion.

Operations: The company generates revenue of CN¥14.59 billion from its operations in China.

Market Cap: CN¥40.71B

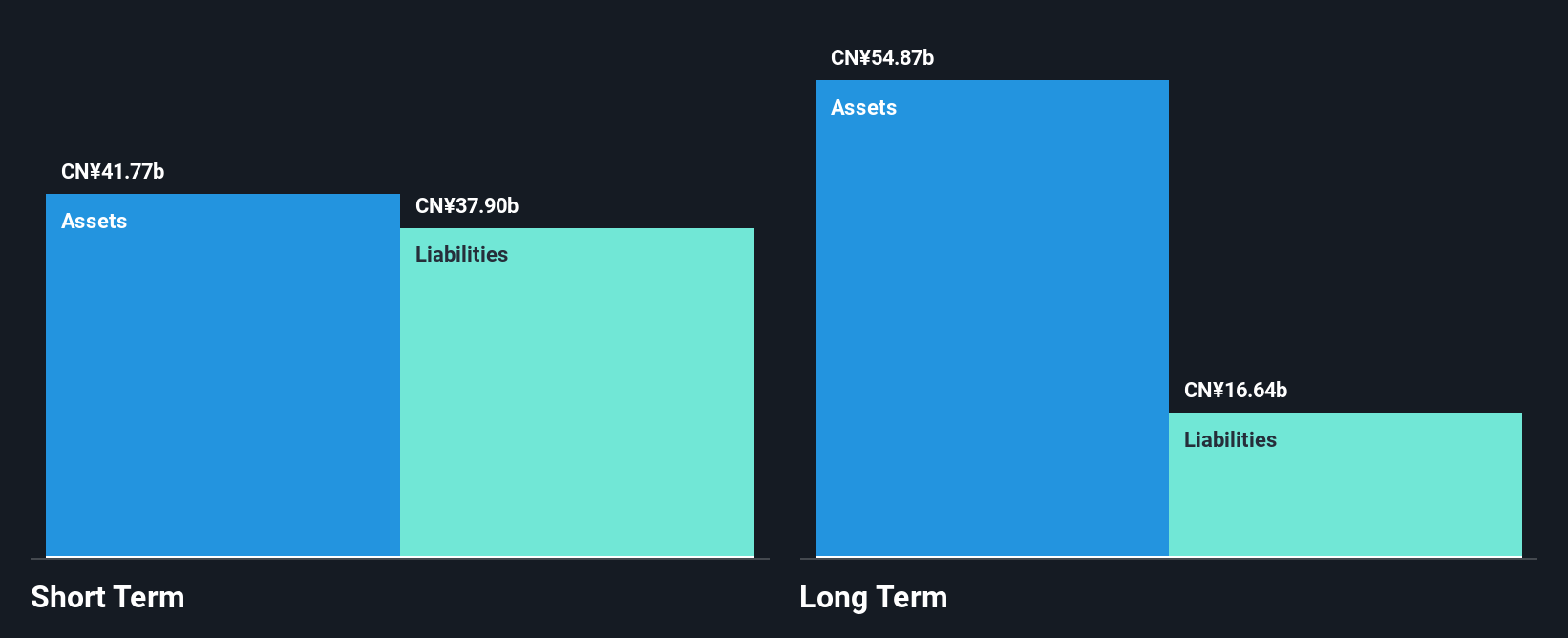

Quzhou Xin'an Development, with a market cap of CN¥40.71 billion, faces challenges as its debt is not well covered by operating cash flow. The company has experienced negative earnings growth over the past year and a decline in earnings over five years. However, it benefits from an experienced management team and board of directors, with average tenures of 15.8 and 5.8 years respectively. Despite high net debt to equity ratio at 66.3%, short-term assets comfortably cover both short- and long-term liabilities, indicating financial resilience amid volatility in share prices and low return on equity at 4.5%.

- Jump into the full analysis health report here for a deeper understanding of Quzhou Xin'an Development.

- Examine Quzhou Xin'an Development's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Click through to start exploring the rest of the 973 Asian Penny Stocks now.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neo-Neon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1868

Neo-Neon Holdings

An investment holding company, engages in the research and development, manufacture, distribution, and sale of lighting products in North America, Europe, the People's Republic of China, the rest of Asia, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives