- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

US$17.49 Billion in Global Deals Might Change the Case for Investing in China Petroleum & Chemical (SEHK:386)

Reviewed by Sasha Jovanovic

- China Petroleum & Chemical recently signed 43 procurement agreements with 41 global partners at the China International Import Expo, securing contracts worth US$17.49 billion in total.

- This uptick in international deals highlights resilient global demand and reinforces the company’s position within worldwide supply chains amid evolving market conditions.

- We'll explore how this surge in international procurement agreements shapes China Petroleum & Chemical's investment narrative and long-term growth prospects.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is China Petroleum & Chemical's Investment Narrative?

For investors considering China Petroleum & Chemical, the core thesis often hinges on the company’s role as a vital player in global energy supply chains and a major beneficiary of large-scale procurement agreements. The newly signed US$17.49 billion in global procurement deals adds some positive momentum on the international front, just as recent financial results paint a mixed short-term outlook. Despite improving quarterly net income, revenue and profit margins have trended lower year-on-year, and analyst expectations indicate only moderate annual earnings growth ahead. In this context, while the new import expo agreements may help underpin demand through uncertain cycles, they are unlikely to immediately alter the biggest near-term catalysts: signs of sustained earnings and margin improvement, effective deployment of capital from share buybacks, and progress from recently announced board and management changes. Risks around slower domestic fuel demand, limited board experience, and modest return on equity remain central to the investment case, these should not be overlooked, even amid continued international expansion. On the other hand, the board’s experience and stability remain a concern that investors should watch closely.

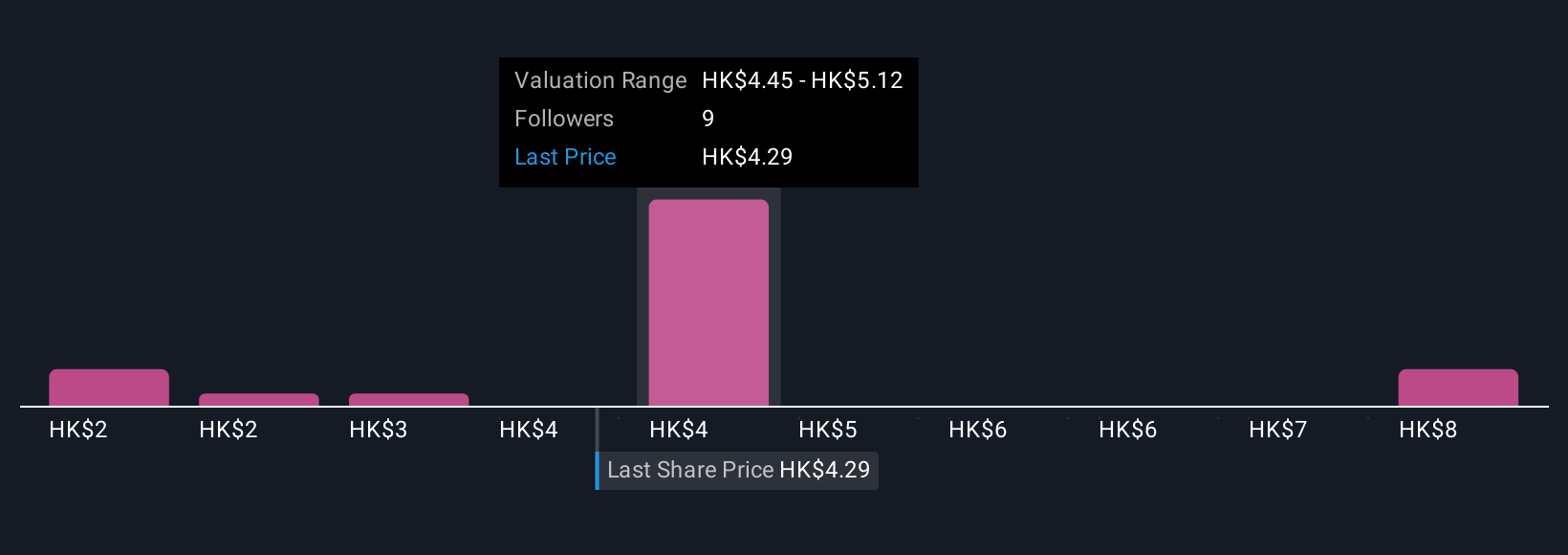

China Petroleum & Chemical's shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on China Petroleum & Chemical - why the stock might be worth less than half the current price!

Build Your Own China Petroleum & Chemical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Petroleum & Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Petroleum & Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Petroleum & Chemical's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives