- Hong Kong

- /

- Energy Services

- /

- SEHK:1938

If You Had Bought Chu Kong Petroleum and Natural Gas Steel Pipe Holdings (HKG:1938) Stock A Year Ago, You Could Pocket A 153% Gain Today

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited (HKG:1938) share price has soared 153% in the last year. Most would be very happy with that, especially in just one year! It's even up 19% in the last week. Zooming out, the stock is actually down 53% in the last three years.

Check out our latest analysis for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings actually shrunk its revenue over the last year, with a reduction of 37%. So we would not have expected the share price to rise 153%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

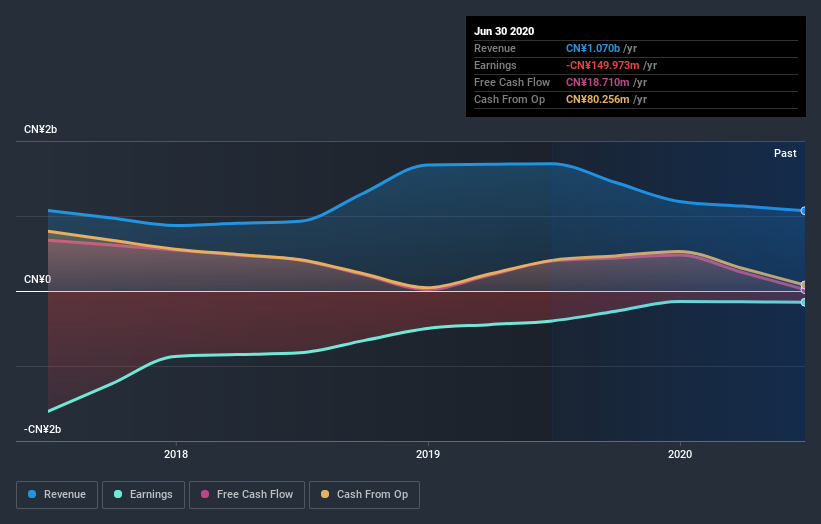

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings shareholders have received a total shareholder return of 153% over the last year. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Chu Kong Petroleum and Natural Gas Steel Pipe Holdings better, we need to consider many other factors. Take risks, for example - Chu Kong Petroleum and Natural Gas Steel Pipe Holdings has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Chu Kong Petroleum and Natural Gas Steel Pipe Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1938

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

An investment holding company, manufactures and sells longitudinal welded steel pipes in Mainland China, Africa, Europe, the Middle East, rest of Asia, South America, and North America.

Good value with proven track record.

Market Insights

Community Narratives