- Hong Kong

- /

- Energy Services

- /

- SEHK:1938

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited's (HKG:1938) Shares Leap 81% Yet They're Still Not Telling The Full Story

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited (HKG:1938) shareholders have had their patience rewarded with a 81% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 97%.

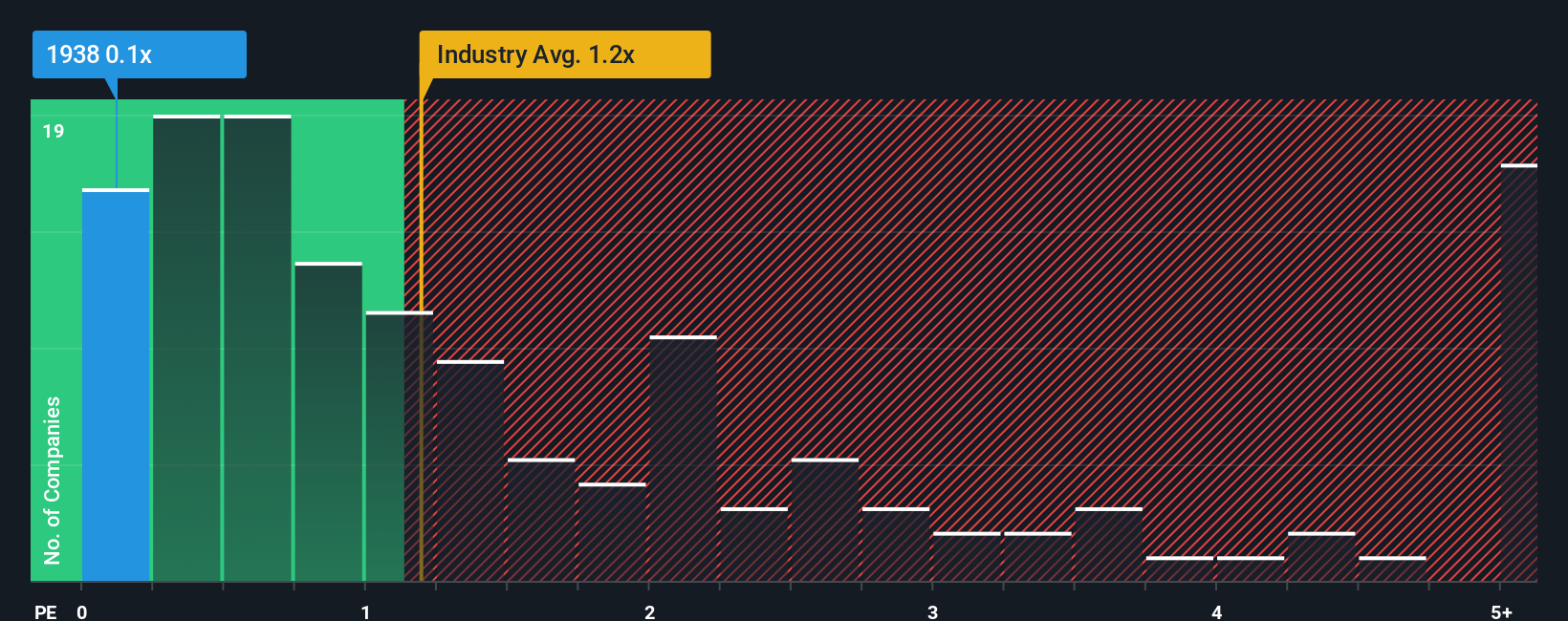

Although its price has surged higher, you could still be forgiven for feeling indifferent about Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in Hong Kong is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

What Does Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' P/S Mean For Shareholders?

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 62% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 9.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Chu Kong Petroleum and Natural Gas Steel Pipe Holdings is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If these risks are making you reconsider your opinion on Chu Kong Petroleum and Natural Gas Steel Pipe Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1938

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

An investment holding company, manufactures and sells longitudinal welded steel pipes in Mainland China, Africa, Europe, the Middle East, rest of Asia, South America, and North America.

Good value with proven track record.

Market Insights

Community Narratives