- Hong Kong

- /

- Energy Services

- /

- SEHK:1251

SPT Energy Group's(HKG:1251) Share Price Is Down 49% Over The Past Three Years.

While it may not be enough for some shareholders, we think it is good to see the SPT Energy Group Inc. (HKG:1251) share price up 30% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 49% in the last three years, falling well short of the market return.

Check out our latest analysis for SPT Energy Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

SPT Energy Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 25% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating SPT Energy Group further; while we may be missing something on this analysis, there might also be an opportunity.

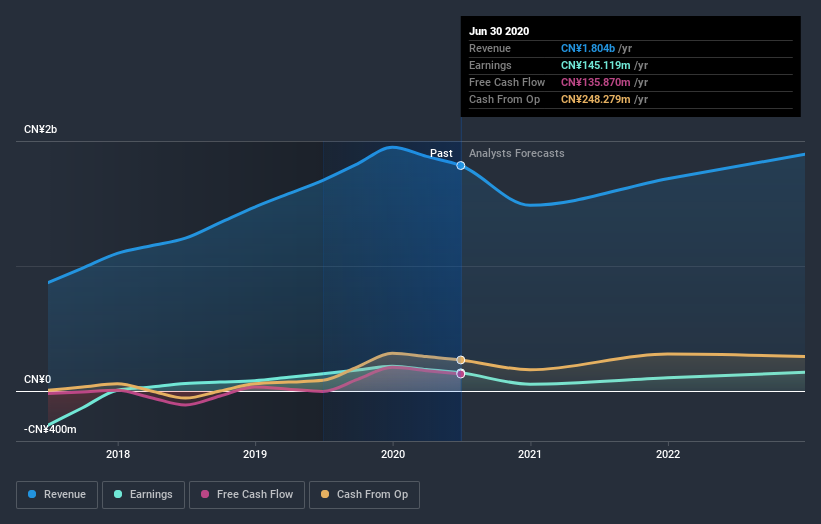

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

SPT Energy Group shareholders are up 5.4% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for SPT Energy Group you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade SPT Energy Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1251

SPT Energy Group

An investment holding company, provides integrated oilfield services in the People's Republic of China, Kazakhstan, Turkmenistan, Canada, Singapore, Indonesia, the Middle East, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives