- Hong Kong

- /

- Energy Services

- /

- SEHK:1251

Returns On Capital Are Showing Encouraging Signs At SPT Energy Group (HKG:1251)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at SPT Energy Group (HKG:1251) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for SPT Energy Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.054 = CN¥70m ÷ (CN¥2.9b - CN¥1.6b) (Based on the trailing twelve months to December 2022).

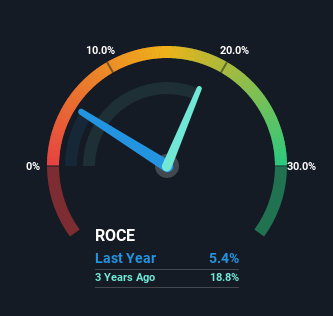

Thus, SPT Energy Group has an ROCE of 5.4%. On its own, that's a low figure but it's around the 6.4% average generated by the Energy Services industry.

See our latest analysis for SPT Energy Group

In the above chart we have measured SPT Energy Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering SPT Energy Group here for free.

SWOT Analysis for SPT Energy Group

- Earnings growth over the past year exceeded its 5-year average.

- Net debt to equity ratio below 40%.

- Earnings growth over the past year underperformed the Energy Services industry.

- Interest payments on debt are not well covered.

- Expensive based on P/E ratio compared to estimated Fair P/E ratio.

- Shareholders have been diluted in the past year.

- Annual earnings are forecast to grow faster than the Hong Kong market.

- Debt is not well covered by operating cash flow.

What Does the ROCE Trend For SPT Energy Group Tell Us?

While in absolute terms it isn't a high ROCE, it's promising to see that it has been moving in the right direction. Over the last five years, returns on capital employed have risen substantially to 5.4%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 29%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a side note, SPT Energy Group's current liabilities are still rather high at 55% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On SPT Energy Group's ROCE

All in all, it's terrific to see that SPT Energy Group is reaping the rewards from prior investments and is growing its capital base. Given the stock has declined 70% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. With that in mind, we believe the promising trends warrant this stock for further investigation.

If you want to continue researching SPT Energy Group, you might be interested to know about the 2 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1251

SPT Energy Group

An investment holding company, provides integrated oilfield services in the People's Republic of China, Kazakhstan, Turkmenistan, Canada, Singapore, Indonesia, the Middle East, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives