- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

COSCO SHIPPING Energy Transportation (SEHK:1138): Net Margin Edge Reinforces Bullish Case Despite Slower Earnings Growth

Reviewed by Simply Wall St

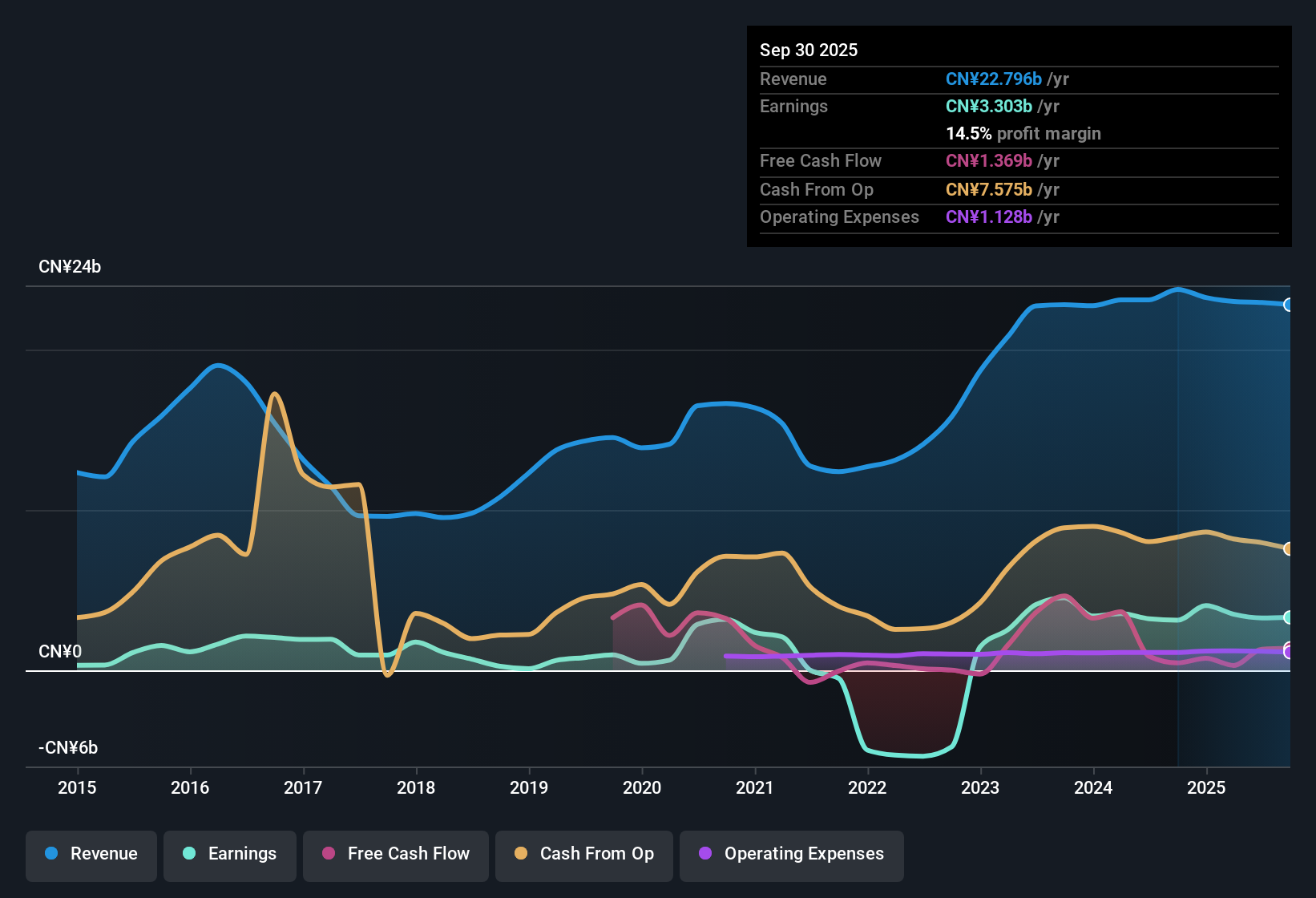

COSCO SHIPPING Energy Transportation (SEHK:1138) reported average annual earnings growth of 31.9% over the past five years, with net profit margins currently at 14.2%, up from 13.9% last year. The most recent year saw earnings growth of 1.7%, and the company is presently trading at a Price-To-Earnings ratio of 16.8x. This valuation appears more attractive than peer averages, although it remains higher than the Hong Kong oil and gas industry benchmark. Looking ahead, forecasts for 11.31% annual earnings growth and 2.8% revenue growth, both below Hong Kong market averages, shape investor sentiment around a steady but moderating performance.

See our full analysis for COSCO SHIPPING Energy Transportation.Next, we will see how these results compare to the key narratives in the market. Some expectations will be confirmed, while others might be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher Despite Slower Growth

- Net profit margins climbed to 14.2%, compared to 13.9% a year ago, showing COSCO SHIPPING Energy Transportation is keeping more of its revenue as profit even as headline growth rates cool.

- What’s interesting is that, while the company’s revenue and earnings growth are forecast to trail broader Hong Kong market averages, operational scale and ongoing investments in efficiency give investors some reassurance about durability of profits.

- Net margins ticked higher even as annual earnings growth slowed to 1.7%, a sign that cost discipline or pricing power is helping the bottom line.

- Forecasted earnings growth of 11.31% per year still points to steady, if not market-leading, momentum supported by the company’s strong track record.

Share Trades Below DCF Fair Value

- With the current share price at HK$11, COSCO SHIPPING Energy Transportation is trading about 31% beneath the DCF fair value estimate of HK$15.94 according to discounted cash flow analysis.

- This gap supports the view that the shares could be underappreciated relative to intrinsic value, especially since the company’s Price-To-Earnings ratio of 16.8x is lower than the peer average of 29x but still higher than the industry average of 9.1x.

- Investors looking for a margin of safety will appreciate the sizable discount to fair value, which is hard to find in shipping stocks with steady profitability.

- Valuation tension in this case creates room for positive re-rating if earnings durability persists and sector risks remain contained.

Financial Position Flags Minor Risk

- COSCO SHIPPING Energy Transportation’s risk profile indicates a minor concern relating to the overall financial position, suggesting investors should keep an eye on leverage and liquidity trends going forward.

- What stands out given the prevailing market view is that, despite high-quality earnings and growth above industry averages, even modest financial stability issues could limit upside if left unchecked.

- While profit margins and earnings have remained robust, the flagged risk reminds investors that industry volatility and regulatory shifts can put strain on financial health unexpectedly.

- Long-term sector trends such as regulatory compliance and shipping rate swings may amplify this minor risk if macro conditions deteriorate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on COSCO SHIPPING Energy Transportation's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid profit margins, COSCO SHIPPING Energy Transportation’s minor balance sheet risk could limit share upside if financial health weakens in tougher markets.

If you want sturdier companies for the next downturn, use our solid balance sheet and fundamentals stocks screener (1984 results) to discover businesses with stronger balance sheets and less financial stress risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the transportation of oil and liquefied natural gas (LNG) in People’s Republic of China and internationally.

Proven track record and fair value.

Market Insights

Community Narratives