- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1088

What Does China Shenhua Energy's (SEHK:1088) Interim Dividend Reveal About Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On October 24, 2025, China Shenhua Energy approved an interim dividend of RMB 0.98 per share (tax inclusive) totaling approximately RMB 19.47 billion, alongside reporting net income for the first nine months of 2025 of RMB 41.37 billion, down from RMB 47.98 billion a year earlier.

- Despite the earnings decline, the company affirmed shareholder returns and continued profitability, highlighting its approach to balancing income distribution and operational results.

- With the recently approved interim dividend as a major focus, we'll examine how these developments impact China Shenhua Energy's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Shenhua Energy's Investment Narrative?

Being a shareholder in China Shenhua Energy often comes down to confidence in the company’s ability to maintain steady returns even as earnings face some headwinds. The recent approval of a sizable interim dividend, despite a clear drop in net income for the nine months to September 2025, brings both reassurance and caution to the table. This move underlines management’s commitment to rewarding shareholders and may provide near-term support to the share price. However, the payout also highlights persistent risks including slowing earnings growth and questions about the continued sustainability of dividends given softening free cash flows. Meanwhile, recent operational milestones, such as the Jiujiang Phase II project coming online, could help offset some revenue pressures, but overall, the company’s major short-term catalysts and risks remain largely unchanged by the latest announcements. For those paying close attention, dividend coverage and declining profits should still be front of mind.

Still, not all investors may recognize how pressure on free cash flows could impact future dividends.

Exploring Other Perspectives

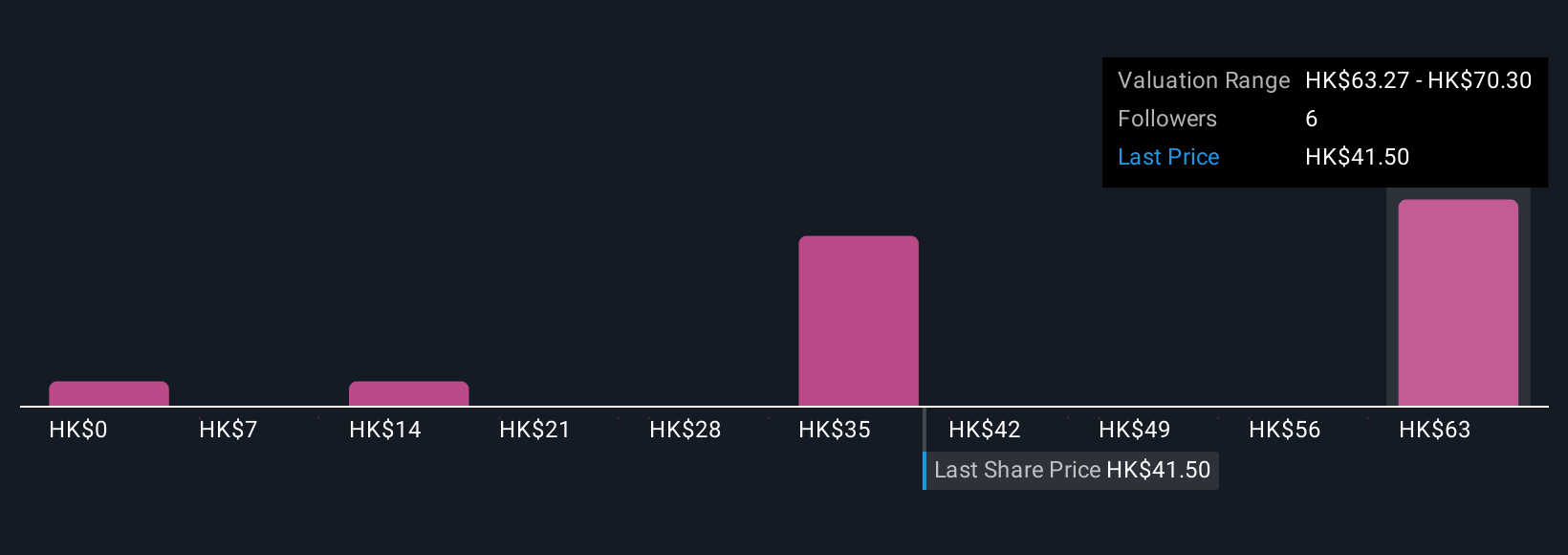

Explore 4 other fair value estimates on China Shenhua Energy - why the stock might be worth less than half the current price!

Build Your Own China Shenhua Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Shenhua Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free China Shenhua Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Shenhua Energy's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1088

China Shenhua Energy

Engages in the production and sale of coal and power; railway, port, and shipping transportation; and coal-to-olefins businesses in the People’s Republic of China and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives