- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1088

China Shenhua Energy (SEHK:1088): Valuation Insights After Dividend Approval and Nine-Month Earnings Update

Reviewed by Simply Wall St

China Shenhua Energy (SEHK:1088) just approved an interim dividend of RMB 0.98 per share for the first half of 2025, along with reporting a drop in net income over the past nine months. This combination of steady shareholder returns and updated earnings is putting the stock in focus for investors.

See our latest analysis for China Shenhua Energy.

After announcing a substantial interim dividend and new earnings results, China Shenhua Energy’s stock has gathered real momentum, with a 30.88% year-to-date share price return and a 36.5% total shareholder return over the past year. The company’s strong five-year total return of nearly 400% highlights its staying power. At the same time, recent income growth has turned choppy and investors are reassessing both near-term risks and long-term prospects.

If Shenhua’s resilience caught your attention, it’s also worth discovering fast growing stocks with high insider ownership to spot other fast-growing stocks where insiders have skin in the game.

With the stock surging after record returns and major dividend news, the big question is whether shares are now attractively undervalued or if the market has already anticipated all future growth potential.

Price-to-Earnings of 13.9x: Is it justified?

China Shenhua Energy’s current price-to-earnings (P/E) ratio stands at 13.9x, noticeably higher than key industry benchmarks. This suggests the market is paying a premium compared to peers.

The P/E ratio compares a company’s share price to its earnings per share, and is widely used to value established businesses, especially in capital-intensive sectors like energy. A higher P/E can signal strong growth expectations or market confidence. In contrast, a lower P/E can indicate undervaluation or potential challenges.

Currently, China Shenhua Energy’s P/E is more expensive than both the Hong Kong Oil and Gas sector average of 9.8x and its peer group average of 9.7x. It also exceeds the estimated “fair” P/E of 11.8x based on regression analysis. This indicates investors are pricing in a level of performance that is above what comparable companies currently achieve. If sentiment or fundamentals realign with those of the broader sector, there could be movement towards this lower fair multiple.

Explore the SWS fair ratio for China Shenhua Energy

Result: Price-to-Earnings of 13.9x (OVERVALUED)

However, market optimism could shift if earnings growth remains inconsistent or if Shenhua’s valuation premium narrows as sector trends change.

Find out about the key risks to this China Shenhua Energy narrative.

Another View: What Does the SWS DCF Model Say?

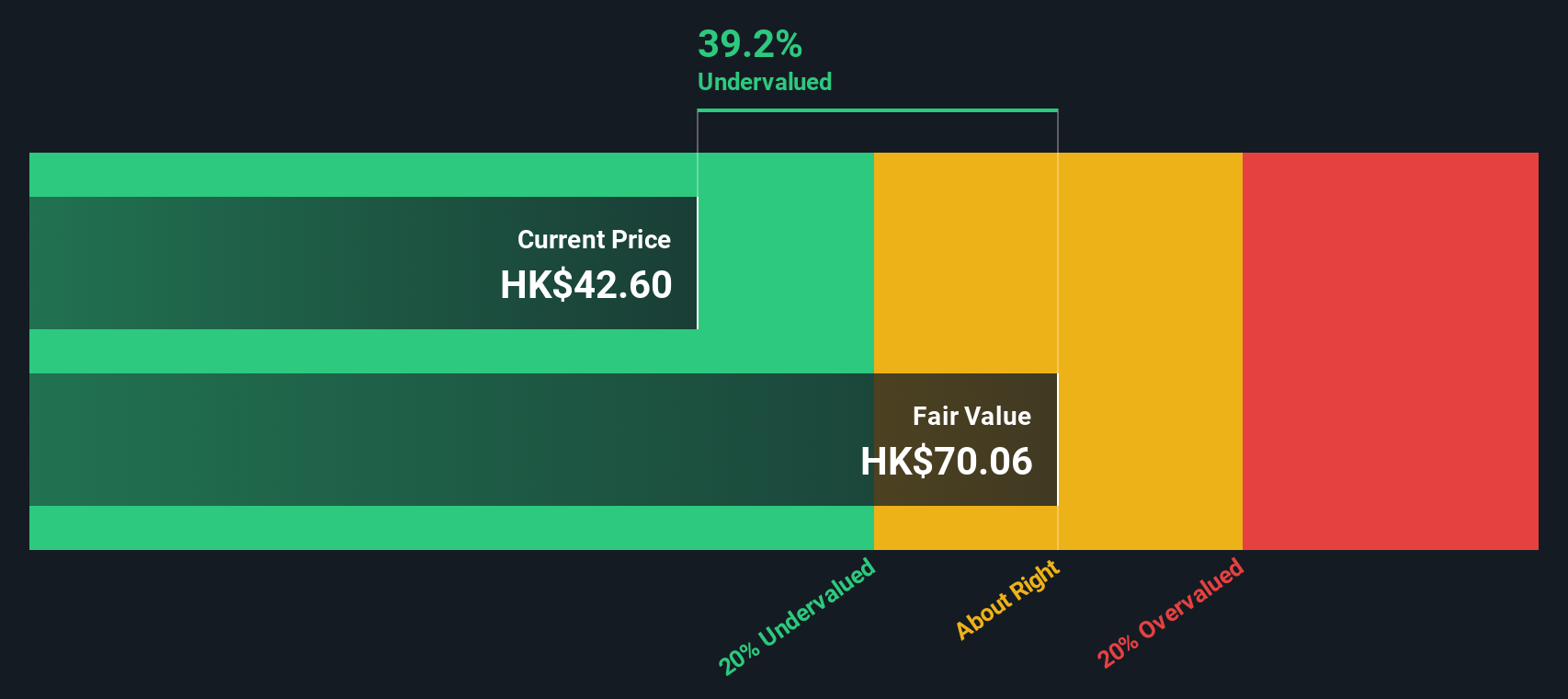

Taking a different approach, the SWS DCF model values China Shenhua Energy shares 39% below their estimated fair value (HK$42.6 vs. HK$70.06). This suggests the stock could be substantially undervalued if all future cash flows unfold as projected. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Shenhua Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Shenhua Energy Narrative

If you want to dig deeper or approach the numbers your own way, it’s easy to form your own perspective in just a few minutes. Do it your way

A great starting point for your China Shenhua Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors broaden their search to spot the next big winner. Use these unique stock lists to uncover standouts you could be missing today.

- Tap into the latest breakthroughs transforming medicine by following these 33 healthcare AI stocks, which is pushing healthcare boundaries with artificial intelligence innovations.

- Unlock hidden value with these 849 undervalued stocks based on cash flows, where strong fundamentals meet attractive price points for those seeking overlooked market opportunities.

- Ride the digital currency wave with these 81 cryptocurrency and blockchain stocks, powering advances in blockchain, payments, and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1088

China Shenhua Energy

Engages in the production and sale of coal and power; railway, port, and shipping transportation; and coal-to-olefins businesses in the People’s Republic of China and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives