- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

SEHK Stocks Estimated Below Fair Value In August 2024

Reviewed by Simply Wall St

The Hong Kong market has experienced a notable decline, with the Hang Seng Index retreating by 2.28% amidst broader economic challenges and unexpected rate cuts by the People’s Bank of China. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer significant upside potential once market conditions stabilize. Understanding what makes a stock undervalued involves analyzing factors such as price-to-earnings ratios, book value comparisons, and future growth prospects relative to current valuations. In light of recent market fluctuations and economic indicators, these metrics can help pinpoint stocks trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.27 | HK$4.31 | 47.4% |

| ANTA Sports Products (SEHK:2020) | HK$67.95 | HK$134.17 | 49.4% |

| COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$9.31 | HK$18.27 | 49% |

| Bairong (SEHK:6608) | HK$8.97 | HK$17.47 | 48.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.10 | HK$55.65 | 49.5% |

| FIT Hon Teng (SEHK:6088) | HK$2.69 | HK$4.95 | 45.7% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.31 | HK$4.23 | 45.4% |

| Innovent Biologics (SEHK:1801) | HK$38.70 | HK$71.22 | 45.7% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.74 | HK$1.37 | 46% |

| Chervon Holdings (SEHK:2285) | HK$17.88 | HK$35.64 | 49.8% |

Let's review some notable picks from our screened stocks.

iDreamSky Technology Holdings (SEHK:1119)

Overview: iDreamSky Technology Holdings Limited, with a market cap of HK$3.87 billion, operates a digital entertainment platform that publishes games through mobile apps and websites in the People’s Republic of China.

Operations: The company's revenue segments include Game and Information Services (including SaaS and other related services), which generated CN¥1.92 billion.

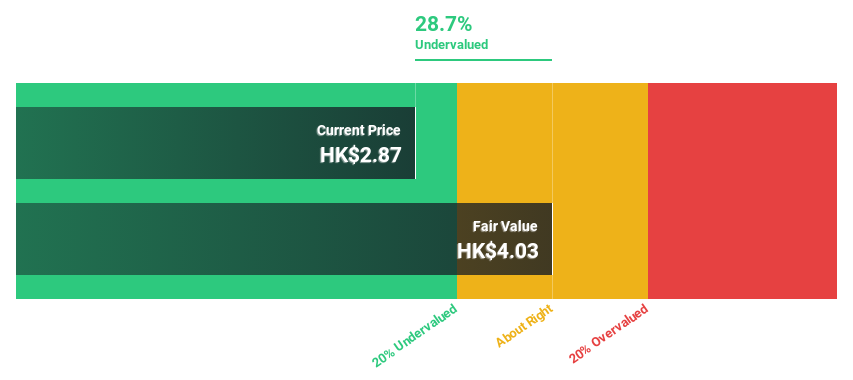

Estimated Discount To Fair Value: 45.4%

iDreamSky Technology Holdings is trading at HK$2.31, significantly below its estimated fair value of HK$4.23, indicating it may be undervalued based on cash flows. Despite a recent follow-on equity offering raising HK$257.68 million, the stock remains 45.4% below fair value estimates. Revenue is forecast to grow at 29.8% per year, outpacing the Hong Kong market's growth rate of 7.4%, with earnings expected to grow by 104.11% annually and profitability anticipated within three years.

- The analysis detailed in our iDreamSky Technology Holdings growth report hints at robust future financial performance.

- Dive into the specifics of iDreamSky Technology Holdings here with our thorough financial health report.

ESR Group (SEHK:1821)

Overview: ESR Group Limited, with a market cap of HK$49.30 billion, engages in logistics real estate development, leasing, and management across Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally.

Operations: The company's revenue segments include Fund Management ($774.64 million) and New Economy Development ($105.48 million).

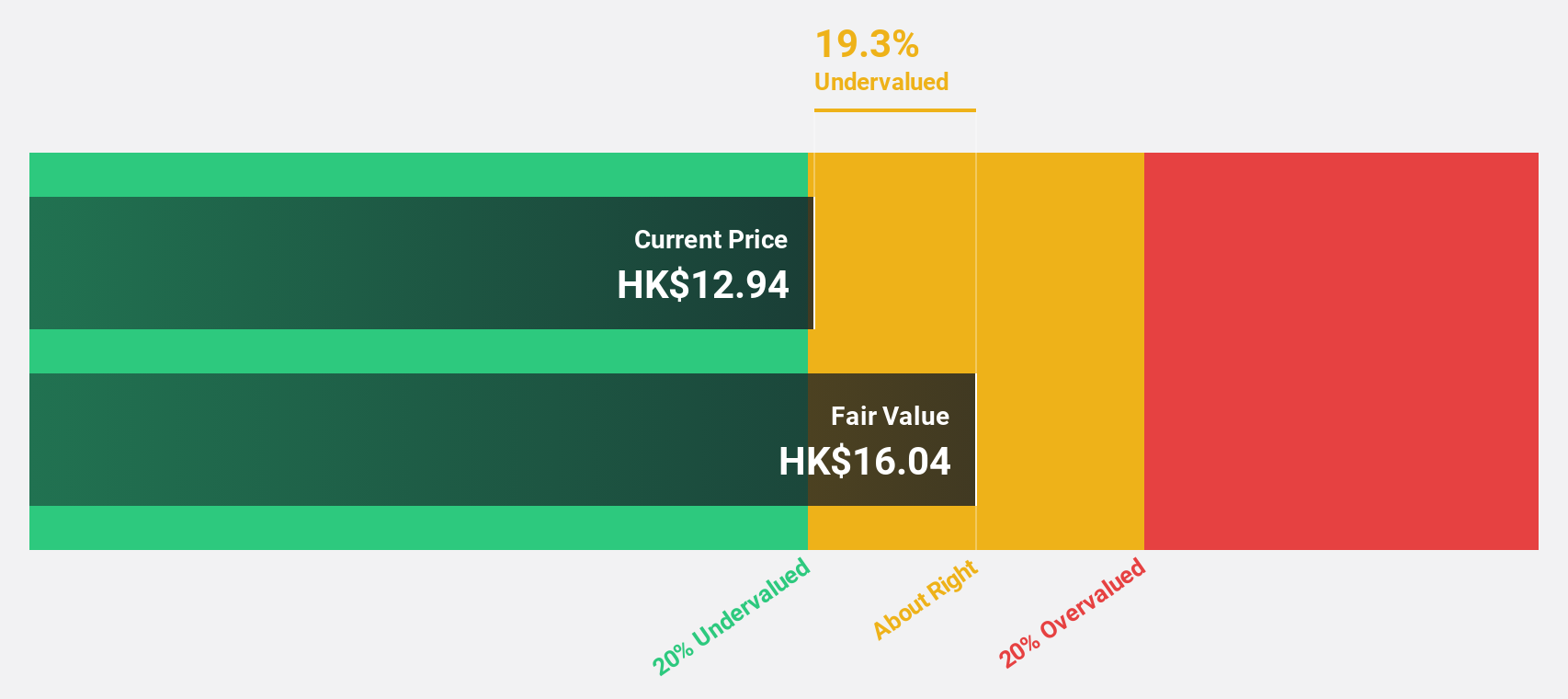

Estimated Discount To Fair Value: 21.6%

ESR Group is trading at HK$11.72, 21.6% below its estimated fair value of HK$14.95, suggesting undervaluation based on cash flows. Despite a forecasted earnings growth of 26.3% per year, the company's return on equity is expected to be low at 7.3%. Profit margins have dropped from 54.8% to 23.9%, and interest payments are not well covered by earnings, indicating potential financial challenges ahead despite promising revenue growth forecasts of 9.6% annually.

- Upon reviewing our latest growth report, ESR Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of ESR Group with our detailed financial health report.

Yeahka (SEHK:9923)

Overview: Yeahka Limited (SEHK:9923) is an investment holding company that offers payment and business services to merchants and consumers in China, with a market cap of HK$4.71 billion.

Operations: The company's revenue segments include Business Services, which generated CN¥3.95 billion.

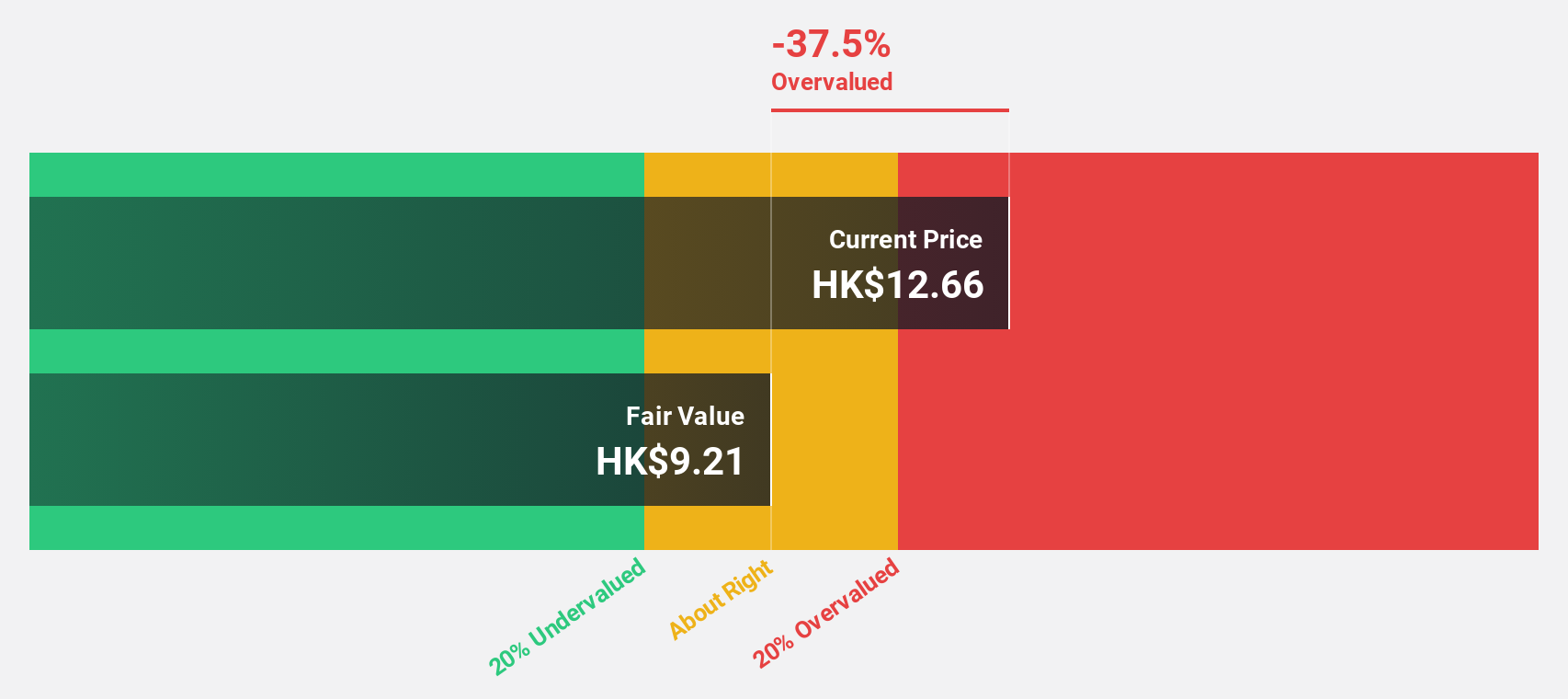

Estimated Discount To Fair Value: 26.9%

Yeahka is trading at HK$11, 26.9% below its estimated fair value of HK$15.06, indicating undervaluation based on cash flows. The company's earnings are forecasted to grow significantly at 51.5% per year, outpacing the Hong Kong market's growth rate of 11.4%. Despite recent executive changes and a dip in profit margins from 4.5% to 0.3%, analysts expect the stock price to rise by 42.9%, reflecting strong growth potential amidst competitive valuation metrics compared to peers and industry standards.

- Insights from our recent growth report point to a promising forecast for Yeahka's business outlook.

- Take a closer look at Yeahka's balance sheet health here in our report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued SEHK Stocks Based On Cash Flows list of 33 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in the logistics real estate development, leasing, and management activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and slightly overvalued.