3 SEHK Stocks Estimated To Be Trading At Up To 45.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Hong Kong market has recently seen mixed performance, with the Hang Seng Index experiencing a slight decline amid concerns over weak inflation data and broader economic challenges in China. Despite these headwinds, opportunities remain for discerning investors to identify undervalued stocks trading below their intrinsic value. In this environment, finding stocks that are significantly undervalued can offer potential upside as market conditions stabilize. Here are three SEHK stocks currently estimated to be trading up to 45.6% below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.59 | HK$6.73 | 46.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.40 | HK$56.21 | 49.5% |

| BYD (SEHK:1211) | HK$242.80 | HK$462.23 | 47.5% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.12 | HK$19.83 | 43.9% |

| Jiangxi Rimag Group (SEHK:2522) | HK$27.35 | HK$49.20 | 44.4% |

| Digital China Holdings (SEHK:861) | HK$3.23 | HK$6.08 | 46.9% |

| Akeso (SEHK:9926) | HK$72.20 | HK$132.74 | 45.6% |

| Innovent Biologics (SEHK:1801) | HK$43.80 | HK$79.99 | 45.2% |

| United Company RUSAL International (SEHK:486) | HK$2.33 | HK$4.25 | 45.1% |

| Jinke Smart Services Group (SEHK:9666) | HK$7.01 | HK$13.73 | 48.9% |

Here's a peek at a few of the choices from the screener.

Techtronic Industries (SEHK:669)

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$199.19 billion.

Operations: The company's revenue segments include Power Equipment generating $13.23 billion and Floorcare & Cleaning contributing $965.09 million.

Estimated Discount To Fair Value: 27%

Techtronic Industries appears undervalued based on cash flows, trading at HK$108.7, which is 27% below its estimated fair value of HK$148.99. Recent earnings show a net income increase to US$550.37 million from US$475.78 million a year ago, with revenue rising to US$7.31 billion from US$6.88 billion. Despite moderate revenue growth forecasts (8.5% annually), the company’s earnings are expected to grow faster than the Hong Kong market at 15.3% per year.

- Our comprehensive growth report raises the possibility that Techtronic Industries is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Techtronic Industries.

Yeahka (SEHK:9923)

Overview: Yeahka Limited, an investment holding company with a market cap of HK$4.25 billion, offers payment and business services to merchants and consumers in the People’s Republic of China.

Operations: The company generates revenue from business services amounting to CN¥3.47 billion.

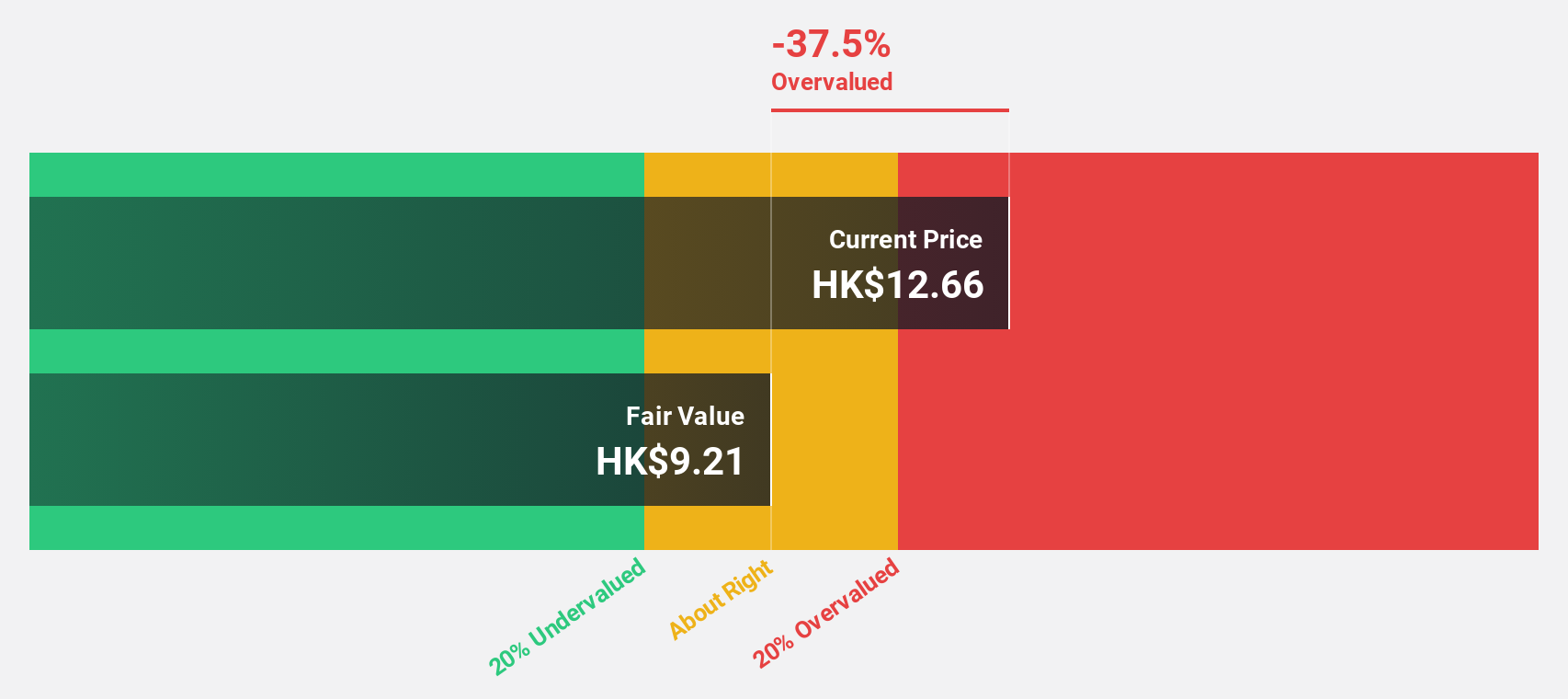

Estimated Discount To Fair Value: 25.9%

Yeahka is trading at HK$9.92, 26% below its estimated fair value of HK$13.4, indicating it may be undervalued based on cash flows. Despite a decline in half-year sales to CNY 1.58 billion from CNY 2.06 billion and net income to CNY 31.63 million from CNY 33.16 million, earnings are forecast to grow significantly at 39.2% annually over the next three years, outpacing the Hong Kong market's expected growth rate of 11.7%.

- According our earnings growth report, there's an indication that Yeahka might be ready to expand.

- Click to explore a detailed breakdown of our findings in Yeahka's balance sheet health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc., a biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$62.51 billion.

Operations: The company's revenue from the research, development, production, and sale of biopharmaceutical products is CN¥1.87 billion.

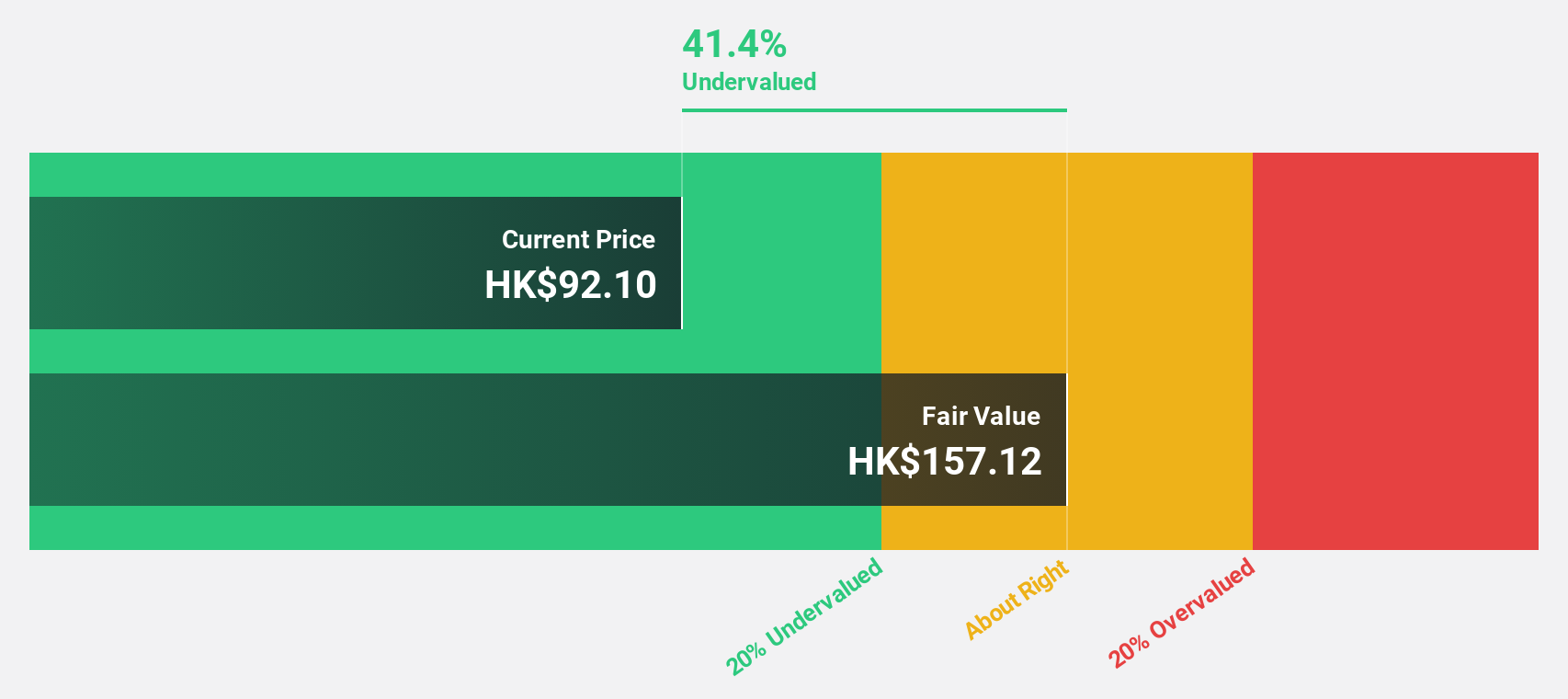

Estimated Discount To Fair Value: 45.6%

Akeso, trading at HK$72.2, is significantly undervalued compared to its estimated fair value of HK$132.74. Earnings are forecast to grow 54.67% annually, and revenue is expected to increase by 33.1% per year, outpacing the Hong Kong market's growth rate of 7.3%. Despite recent shareholder dilution and a volatile share price, Akeso's strong cash flow potential and promising clinical trial results for ivonescimab in treating various cancers underscore its long-term value proposition.

- In light of our recent growth report, it seems possible that Akeso's financial performance will exceed current levels.

- Take a closer look at Akeso's balance sheet health here in our report.

Next Steps

- Get an in-depth perspective on all 29 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.